The latest consultation from Indian telecom regulator TRAI indicates that mobile operators will need to introduce product specific – voice / SMS / data and their combinations tariff offerings in addition to present tariff offerings.

TRAI Chairman Anil Kumar Lahoti and his team believe that mobile consumer preferences in India have changed. In fact, the latest consumer survey — commissioned by TRAI — indicates tariff offers available in market are broadly bundled tariff offerings having mix of voice, Data, SMS and OTT services etc. which may not fulfill the requirements of large number of subscribers as all services may not be required by all subscribers.

The survey indicates that there is a perception that subscribers are forced to pay for services that are not required by them. There is also a perception among consumers that the bundled offerings of telecom services act as a constraint on the choice of subscription of telecom tariff offers by the subscribers.

India has 1059.73 million mobile phone customers at the end of May 2024. Another TRAI report shows the number of outgoing SMS per subscriber per month is 10.94 during January-March, registering 8.19 percent decrease from January-March 2023.

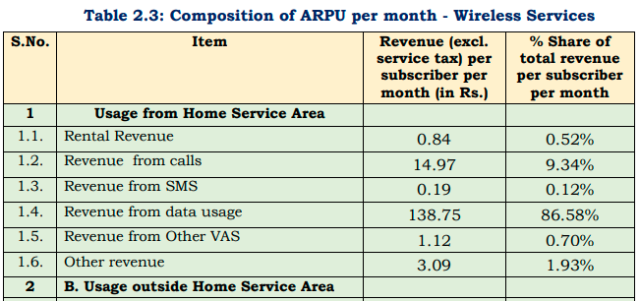

SMS revenue of Rs 0.19 represents 0.12 percent of the total revenue for Indian telecom operators.

Revenue from calls is Rs 14.97 per subscriber per month, representing 9.34 percent of its total monthly subscriber.

India has 913.34 million mobile data customers during January-March 2024. Indian mobile phone users consumed 52,636 PB of data during the January-March quarter of 2024. Average mobile data usage per wireless data subscriber per month was 20.27 GB. Average revenue realization per GB for mobile data usage was Rs 8.74.

Revenue from data usage is Rs 138.75, representing 86.58 percent of mobile ARPU in India.

TRAI’s latest consultation has taken reference from several countries.

In United states, a survey found that 96 percent of those aged 18 to 29 own a smartphone compared with 61% of those 65 and older, reflecting a 35-percentage point difference. The trend could be similar in India. Introducing voice and SMS only tariff plans in the market could provide more options tailored to the needs of similar consumers, TRAI said.

INTERNATIONAL PRACTICES

Banglalink Bangladesh offers voice-only and SMS only packs for their subscribers.

Grameenphone Bangladesh offers voice-only and SMS only packs for different validity periods.

Tello United States offers a tariff plan with custom choice of minute units and free SMS packs for their subscribers.

Telenor Pakistan offers voice-only and SMS-only packs.

Ufone Pakistan offers tariffs for voice-only services, and combination of voice and SMS services.

NowMobile United Kingdom offers a combination of voice and SMS services.

GOMO by Singtel, a telecom service provider in Singapore, offers additional packs for talk time and SMS11. These add-on packs are designed for customers who need more call minutes or text messages after their main plan’s allowance is used up.

TRAI indicates flexible offers from Indian telecoms – BSNL, Bharti Airtel, Vodafone Idea and Reliance Jio — allows users to customize their service based on their individual needs, without overpaying for features they don’t use.

Baburajan Kizhakedath