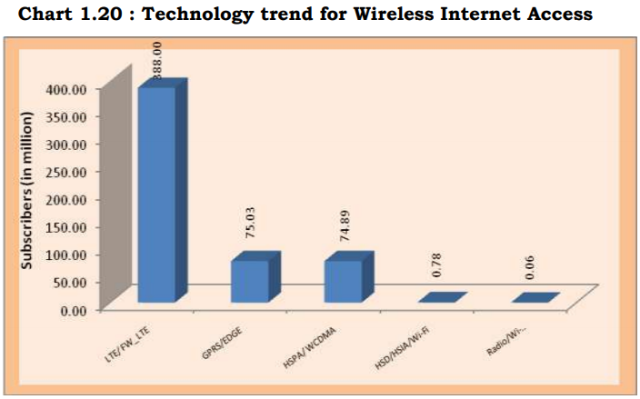

Indian telecom market has 388 million 4G LTE subscribers in the September quarter of 2018, according to the latest TRAI report.

India has 75.03 million 2G data subscribers and 74.89 million 3G data subscribers for using mobile Internet. 3G market has its number two position as telecoms have started shifting their network to 4G from 3G.

India has 75.03 million 2G data subscribers and 74.89 million 3G data subscribers for using mobile Internet. 3G market has its number two position as telecoms have started shifting their network to 4G from 3G.

The TRAI report said wireless data usage rose from 10,418,076 terabytes in the June quarter to 15,549,891 terabytes during September quarter of 2018.

TRAI said Indian mobile phone users’ 2G data usage was 113,445 terabytes, 3G data usage was 1,461,827 terabyte and 4G data usage was 10,914,498 terabytes.

India has Internet subscriber base of 560.01 million (+9.3 percent) including 481.7 million broadband subscribers. India has 538.76 million wireless Internet subscribers and 21.25 million wired Internet subscribers.

India’s Internet penetration was 42.87.

India has 365.94 million Internet subscribers in urban locations and 194.07 million in rural areas.

Reliance Jio has 252.25 million 4G subscribers on its LTE network across the country. Jio is the largest 4G operator in India. The latest TRAI does not have 4G subscriber data base of Vodafone Idea and Airtel.

Top five service areas in terms of internet subscriptions (wired+ wireless) are Maharashtra with 46.11 million, Andhra Pradesh with 43.78 million, Tamil Nadu including Chennai with 40.71 million, UP East with 38.18 million and Gujarat with 35.91 million subscribers in the July-August-September quarter.

Mobile phone users

India has 1,169.29 million (+1.99 percent) wireless subscribers including 647.70 million in urban areas and 521.59 million in rural areas.

Bharti Airtel has 347.52 million (–1 million) subscribers as compared with Vodafone Idea’s 435.22 million (–8.35 million), Reliance Jio’s 252.25 million (+37 million) and BSNL with 124.69 million (–0.31 million).

Vodafone Idea has 230.56 million subscribers in rural India against with Airtel’s 171.33 million, Reliance Jio’s 80.83 million and BSNL’s 38.79 million.

Reliance Jio has 45.04 percent share in Indian ISP market as compared with Vodafone Idea’s 25.02 percent, Airtel’s 22.67 percent and BSNL’s 5.11 percent.

Atria Convergence has 1,363,593 broadband subscribers for 0.24 share, while Hathway Cable & Datacom has 766,220 subscribers for 0.14 share.

India has 1,169.29 million subscribers at the end of September 2018, registering 1.99 percent increase over the previous quarter and 1.66 percent drop year on year.

Baburajan K