America Movil has reported revenue of 232.04 billion pesos during January–March 2025, marking a 14 percent year-on-year increase, with service revenue growing 15.8 percent and adjusted EBITDA rising 13.3 percent.

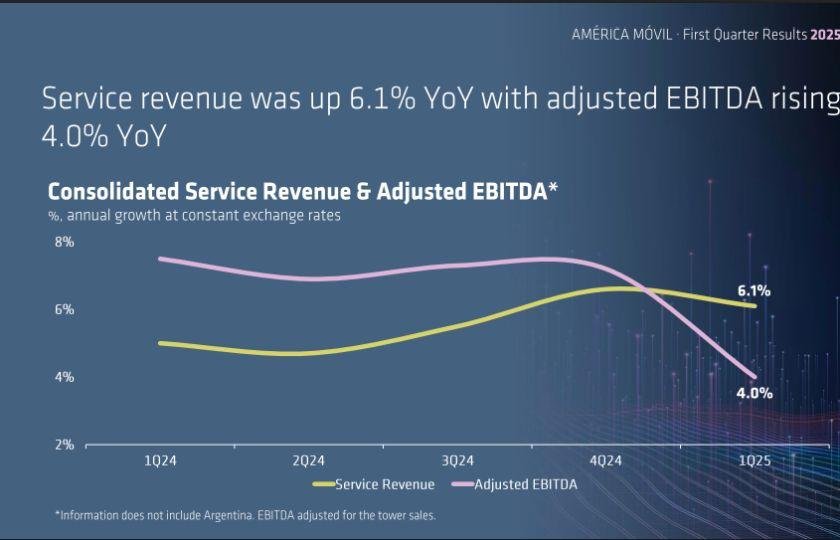

America Movil’s service revenue was up 6.1 percent and adjusted EBITDA 4.0 percent. Mobile service revenue grew 5.7 percent, driven by an 8.8 percent rise in postpaid revenue, while fixed-line service revenue rose 6.7 percent.

Broadband revenue increased 9.8 percent and PayTV 8.7 percent, the strongest growth in several quarters.

Operating profit reached 44.8 billion pesos, up 10 percent, reflecting improved performance and higher depreciation and amortization, partly due to the incorporation of the Chilean operation.

Net profit jumped 39 percent to 18.7 billion pesos, helped by the increase in operating income and a slight decrease in financing costs.

In Q1 2025, the company added 2.4 million postpaid subscribers, with Brazil contributing 987 thousand, Colombia 163 thousand, and Mexico 133 thousand.

The prepaid segment saw a net loss of 1 million subscribers, mostly from Brazil and Mexico.

In Q1 2025, America Movil had 87,587 thousand wireless subscribers in Brazil, up from 87,145 thousand in Q4 2024. Central America had 17,386 thousand subscribers, compared to 17,241 thousand previously.

The Caribbean saw an increase to 8,000 thousand from 7,910 thousand. In Colombia, subscribers rose to 41,250 thousand from 40,953 thousand. Ecuador had 9,949 thousand, up slightly from 9,862 thousand.

Austria & Eastern Europe had 27,588 thousand, increasing from 27,122 thousand. In Mexico, there was a slight drop to 83,925 thousand from 84,613 thousand.

Peru’s subscribers increased to 12,749 thousand from 12,686 thousand. The Southern Cone had 35,486 thousand, up from 35,060 thousand. Total wireless lines rose to 323,920 thousand in March 2025 from 322,593 thousand in December 2024.

In fixed-line services, America Movil added 446 thousand broadband accesses, led by Mexico with 165 thousand, Brazil with 98 thousand, and Central America with 52 thousand.

However, the company experienced a loss of 130 thousand voice lines and 32 thousand PayTV units.

As of March 2025, America Movil had 402 million access lines, including 324 million wireless subscribers — of which 134 million were postpaid — and 78 million fixed-line RGUs comprising 35 million broadband accesses, 14 million PayTV units, and 29 million landlines. Postpaid mobile and fixed broadband were key growth areas, expanding by 6.1 percent and 4.3 percent, respectively.

America Movil announced a capital expenditure plan of $6.7 billion for 2025, down from $7.1 billion in 2024, citing the economic slowdown as a reason for the reduced investment.

The company’s finance chief Carlos Garcia noted the decision was made to manage expenditures amid slowing economies, adding that the company might save some capex for future years without affecting the guidance for 2026.

America Movil is also closely monitoring a proposed telecommunications law by President Claudia Sheinbaum, which aims to block foreign propaganda broadcasts but has raised concerns about increased state control. The company has been engaging with lawmakers to provide its views on the bill.

Baburajan Kizhakedath