Spending on telecom services and Pay TV services will grow by 0.6 percent — in constant dollar terms — to $1.65 trillion in 2018, according to a IDC report.

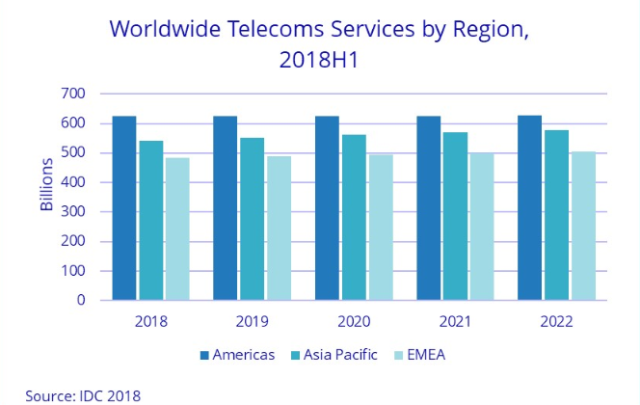

Americas will be the largest telecom and Pay TV services market with $624 billion revenue in 2018.

Americas will be the largest telecom and Pay TV services market with $624 billion revenue in 2018.

The report said telecom services and Pay TV services in Asia Pacific will clock revenue of $541 billion this year.

EMEA will have revenues of $483 billion from telecom services and Pay TV services. Asia Pacific and EMEA regions will grow much faster than the Americas, mainly driven by the emerging country markets of South Asia and Africa.

Reasons for de-growth

The global telecom and Pay TV services market had achieved 1.2 percent growth in 2017. The drop in revenue of telecom and Pay TV services business of mobile operators is mostly due to the consequence of new accounting rules introduced since the start of this year.

Mobile operators are now obliged to completely exclude their handset sales revenues from service revenues.

The overall effect is neutral as handset sales would have gone up. “Growth rate will recover as soon as next year,” Kresimir Alic, senior program manager, IDC Worldwide Telecom Services Database, said.

The global telecom and Pay TV services market is expected to remain in a positive mood, growing at a compound annual growth rate (CAGR) of 0.8 percent over of the 2017-2022 forecast period.

Who’s growing

Mobile share is expected to reach 52 percent of the total market in 2018. The mobile market is set to grow at five-year CAGR of 1.2 percent, driven by mobile data usage and expanding M2M applications.

There will be declines in spending on mobile voice and messaging services.

The fixed data services segment is expected to represent 22 percent of total spending in 2018 and is set to grow at a 4 percent CAGR through 2022, largely driven by the need for higher bandwidth services.

Spending on fixed voice services will decline at -5 percent CAGR and will represent less than 9 percent of the total market by 2022.

“Developed and mature markets will show marginal gains, driven by technology migration and bandwidth needs,” said Eric Owen, group vice president, EMEA Telecommunications & Networking.

Most telecom operators are now looking to invest in 5G and are struggling with the return on investment given the mature nature of the markets.