The GSMA Intelligence report reveals significant improvements in mobile Quality of Service (QoS) in the Asia Pacific region over the past decade, driven by technological advancements and growing consumer demand for better connectivity.

QoS improved

Globally, mobile download speeds increased from 4 Mbps in 2014 to 26 Mbps in 2023, while upload speeds grew eight-fold to 10 Mbps. Latency also saw a substantial decline, dropping from 155 ms in 2014 to 39 ms in 2023. Similar positive trends were observed in Asia Pacific, where median download speeds reached 26 Mbps in 2023, upload speeds hit 11 Mbps, and latency improved to a median of 36 ms.

However, significant differences persist between high-income countries (HICs) and low-and-middle-income countries (LMICs) in the region. In 2023, HICs reported median download speeds of 129 Mbps, six times faster than LMICs and five times the global average. Upload speeds in HICs were double those of LMICs, and latencies were 20 percent lower. These disparities highlight the unequal distribution of network performance capabilities within the region.

Mobile voice services have also evolved significantly. While traditional mobile voice services remain essential, alternative app-based voice services, such as WhatsApp and Teams, have become increasingly popular. A 2023 consumer survey showed that 86 percent of mobile internet users in Asia Pacific made or received calls via online platforms in the last three months, with 45 percent using such services daily.

Despite this shift, traditional voice QoS has seen marked improvements, with the ratio of unsuccessful calls halving from 1.3 percent in 2013 to 0.6 percent in 2022 and the dropped call ratio decreasing from 0.8 percent to 0.4 percent during the same period.

QoS concerns

The advancements in QoS reflect large-scale investments in network infrastructure and the growing demand for advanced digital services. Nevertheless, the differences in QoS between HICs and LMICs underscore the need for continued efforts to bridge the connectivity gap in the region. While traditional QoS metrics have improved, limited data on app-based services indicates a potential area for further study as consumer preferences continue to shift.

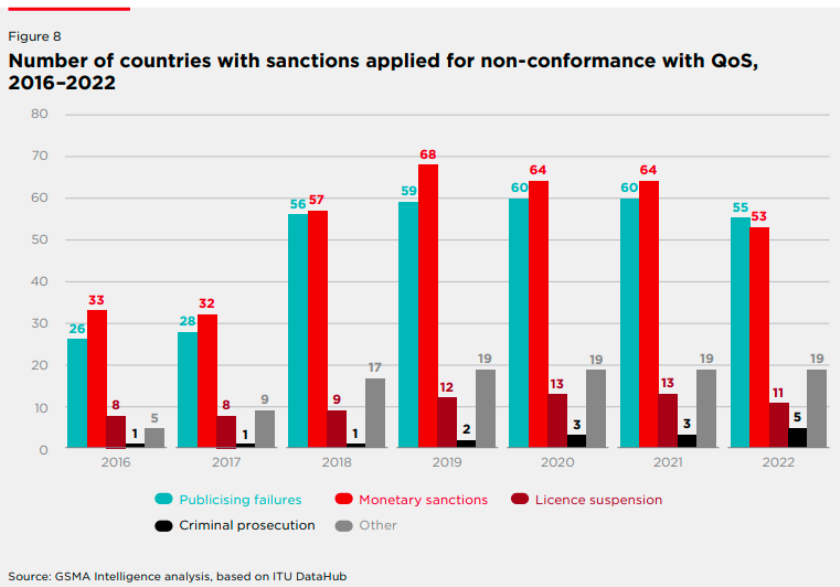

Regulators and mobile operators differ on reasons for QoS failures. Regulators cite insufficient network upgrades, while operators highlight external factors such as limited spectrum access, bureaucratic right-of-way (RoW) procedures, and local restrictions on site development.

Additional challenges include interference from illegal jammers, vandalism, adverse weather impacting microwave links, theft of network equipment, and infrastructure damage due to road and utility works. In remote areas, unreliable power sources and restrictions on diesel generator use exacerbate issues.

Strict EMF policies, municipal-level site sealing, and restrictions near airports due to 5G interference concerns further hinder network expansion. Difficult terrain conditions like mountains create signal barriers, leading to poor coverage and reduced data speeds in affected areas. These challenges highlight the complexities of achieving consistent QoS across the region despite the overall advancements.

The report is prepared by Harry Fernando Aquije Ballon (Economist), Pau Castells (Head of Economic Analysis) Kenechi Okeleke (Senior Director) with contributions from Natasha Nayak (Senior Policy Manager) and Jeanette Whyte (Head of Policy & External Affairs, APAC) at GSMA Intelligence.

Baburajan Kizhakedath