Vodafone Group has announced a 2.3 percent decrease in its revenue for the October-December 2023 quarter, falling from €11.638 billion to €11.372 billion. The service revenue also experienced a 1.4 percent decline, dropping from €9.52 billion to €9.383 billion during the same period.

Germany – Mixed Performance Amidst Commercial Trends

In Germany, Vodafone noted a 0.3 percent increase in service revenue, a positive shift from the 1.1 percent growth in the previous quarter. This improvement was attributed to higher broadband Average Revenue Per User (ARPU), partially offset by broadband customer losses and reduced regulated rates for terminating mobile calls. The third quarter saw a decline in the customer base, attributed to fixed broadband disconnections following communicated price increases. Despite this, the converged customer base increased by 45,000 to 2.4 million. The company is strategically navigating changes in German TV laws, anticipating new regulations effective from July 2024, impacting bulk TV contracting in multi-dwelling unit (MDU) apartment complexes.

United Kingdom – Robust Growth Across Segments

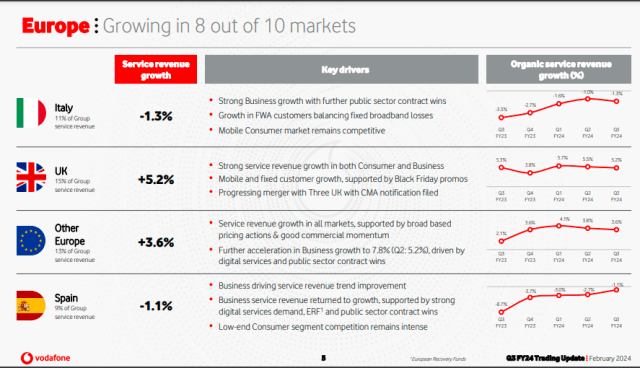

In the UK, Vodafone experienced a 5.2 percent growth in service revenue, propelled by strong performance in both Consumer and Business segments, though partially offset by lower fixed wholesale revenue. Mobile contract customer base increased by 18,000, with the digital sub-brand ‘VOXI’ adding 26,000 customers in the quarter. The fixed segment witnessed a positive trend with 39,000 new broadband customers added during Q3, reaching a total of 1.3 million. Vodafone’s partnerships with CityFibre and Openreach allow them to extend full-fibre broadband services to over 14.5 million households, surpassing other providers in the UK.

Italy – Challenges in Mobile Value Segment

In Italy, service revenue declined by 1.3 percent due to sustained price pressure in the mobile value segment. However, there was a notable demand for fixed line connectivity and digital services in the Business segment. The Consumer prepaid active customer base decreased quarter-on-quarter, reflecting repricing actions. The digital sub-brand ‘ho.’ continued to grow, adding 36,000 net new customers. Vodafone extended its wholesale MVNO agreement with PostePay until the end of 2028.

Spain – Headwinds in Consumer Value Segment

Vodafone Spain faced challenges with a decline in service revenue, attributed to continued price competition in the Consumer value segment, reduced customer base, and lower mobile termination rates. Positive contributions from inflation-linked price increases and higher Business revenue partially offset the decline. Vodafone Spain will be reported as discontinued operations in the consolidated financial statements for the year ending March 31, 2024.

Other Europe – Broad Growth Across Markets

In other European markets, Vodafone reported a 3.6 percent growth in service revenue, with positive trends in Portugal, Ireland, and Greece. Portugal witnessed growth in both Consumer and Business segments, driven by inflation-linked contractual price increases. Ireland experienced service revenue growth driven by mobile customer base expansion. Greece saw growth in Business fixed segments supported by public sector demand. Vodacom, Vodafone’s subsidiary, exhibited an 8.8 percent growth in service revenue, with strong performances in South Africa, Egypt, and international markets.

Turkey – Resilient Growth Despite Economic Challenges

Despite economic challenges and hyperinflationary conditions, Vodafone Turkey demonstrated strong service revenue growth, increasing by 90.4 percent. This growth was driven by continued customer base management and repricing actions to counteract the high inflationary environment. The company maintained commercial momentum, adding 352,000 mobile contract customers during the quarter. Notably, Turkey was designated as a hyperinflationary economy in April 2022.