As Europe seeks to bolster its digital infrastructure and competitiveness, the debate over telecom market consolidation has intensified, says Ookla report.

Advocates argue that fewer players in the telecom market in Europe could lead to better network performance and investment, but critics warn of potential downsides for affordability and innovation.

EU companies lack the scale required to provide citizens with ubiquitous access to fiber and 5G broadband and to equip businesses with advanced platforms for innovation.

Telecom market in EU has 34 mobile network operators (MNOs) and 351 virtual operators (MVNOs), compared with three MNOs in the US (plus 70 MVNOs) and four MNOs in China (plus 16 MVNOs), European Commission said in a report in September 2024.

Here’s a look at the evidence and insights shaping the discussion:

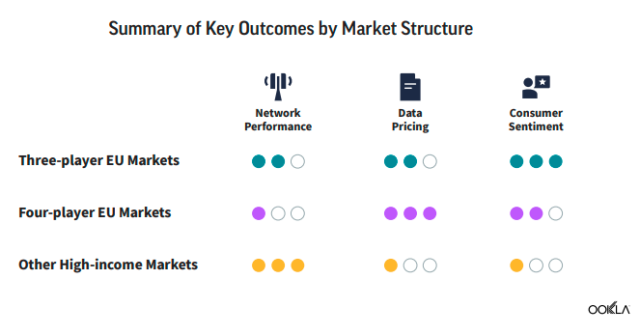

Three-Player Markets Show Superior Network Performance

Data from Speedtest Intelligence for Q2-Q3 2024 reveals that three-player mobile markets in Europe consistently deliver better network performance. Among the top ten European countries ranked by median download speed, seven are three-player markets. These markets recorded median download speeds 56 percent higher than their four-player counterparts.

Countries like Denmark, Sweden, and France, which have four-player markets, achieved competitive performance by engaging in extensive network-sharing agreements. These include shared spectrum usage, site infrastructure, and even multi-operator core networks, demonstrating that collaboration can partially offset the disadvantages of greater market fragmentation.

5G Coverage: A Complex Equation

Market concentration alone does not predict 5G coverage outcomes. Instead, socio-economic factors — such as urbanization levels and economic development — play a more significant role. Wealthier, more urbanized nations benefit from conditions that attract greater investment in service coverage and network availability.

In four-player markets, disparities in network quality between operators are often more pronounced. This suggests that more fragmented markets may struggle to deliver consistent performance across providers.

Pricing vs. Investment: A Double-Edged Sword

One of the key benefits of four-player markets is lower consumer costs. These markets exhibit intense price-based competition, leading to median consumer costs per gigabyte nearly five times lower than in concentrated three-player markets.

But this affordability comes at a cost: lower average revenue per user (ARPU) and constrained reinvestment capabilities in some markets. Conversely, in concentrated markets outside the EU, operators with reduced competition often show lower capital intensity, suggesting fewer incentives to invest in network upgrades.

A One-Size-Fits-All Solution Doesn’t Exist

The findings highlight that telecom consolidation is not a panacea for Europe’s digital competitiveness. Exceptional examples, such as Denmark (a four-player market with high speeds) and the Netherlands (a three-player market with high speeds and concentration), suggest that local contexts matter significantly.

Policy Implications

Policymakers aiming to enhance Europe’s digital infrastructure should adopt a targeted approach, leveraging a mix of strategies:

Network Sharing: Encouraging collaboration between operators in spectrum and infrastructure.

Incentives for Investment: Designing frameworks that stimulate reinvestment without compromising affordability.

Tailored Regulation: Recognizing the diversity of market contexts across Europe, from urbanized economies to rural regions.

Rather than relying solely on consolidation, Europe’s telecom strategy must balance competition, innovation, and consumer protection to achieve sustainable digital growth.