The Australian Competition and Consumer Commission (ACCC) has released its report on the Regional Mobile Infrastructure Inquiry, revealing significant changes in the mobile telecommunications industry in Australia.

The report points out that the sale of mobile towers by the country’s three major mobile network operators — Telstra, Optus, and TPG Telecom — to specialist telecom tower companies has altered the industry’s structure and rendered the regulatory framework for tower access obsolete.

The report points out that the sale of mobile towers by the country’s three major mobile network operators — Telstra, Optus, and TPG Telecom — to specialist telecom tower companies has altered the industry’s structure and rendered the regulatory framework for tower access obsolete.

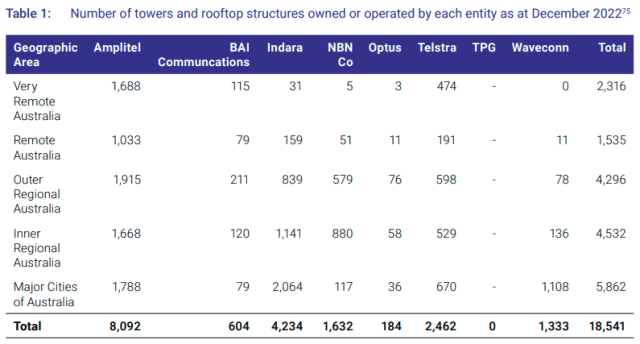

In 2021, Telstra transferred over 8,000 of its physical towers, mast, large pole and antenna mount structures to Amplitel.

Singtel, parent company of Optus, formed the business Australia Tower Network (ATN) to hold its telecommunications infrastructure.

Singtel then sold 70 percent of ATN to AustralianSuper in late 2021, with Singtel retaining access to the sites through long-term leasing arrangements.

In May 2022, AustralianSuper and Singtel purchased Axicom, which increased the AustralianSuper investment in ATN to 82 percent and reduced Singtel’s investment to 18 percent.

The combined portfolio is more than 4,300 tower and rooftop sites and is now known as Indara Digital Infrastructure (Indara).

Axicom, formerly Crown Castle Australia, acquired 712 mobile tower sites from Optus Group in 2000.

The following year, Crown Castle acquired 669 of Vodafone Hutchison Australia’s towers.

In 2007 and 2008, Crown Castle acquired 190 mobile tower sites from Vodafone Hutchison Australia.

In May 2022, TPG Telecom sold its mobile towers to Canadian public pension fund OMERS related entity, Waveconn.

The ACCC was tasked by the Australian Government to investigate access to towers and other infrastructure utilized for providing mobile services in regional areas. The inquiry examined various factors influencing the incentives for mobile network operators, including Telstra, Optus, and TPG Telecom, to invest in expanding or enhancing mobile coverage.

The ACCC was tasked by the Australian Government to investigate access to towers and other infrastructure utilized for providing mobile services in regional areas. The inquiry examined various factors influencing the incentives for mobile network operators, including Telstra, Optus, and TPG Telecom, to invest in expanding or enhancing mobile coverage.

The final report outlines 20 key findings on topics related to tower access, the regulatory framework, consumer experiences, and the feasibility of temporary mobile roaming during natural disasters.

One of the key observations is that expanding mobile coverage typically necessitates mobile network operators to either construct new towers or share existing ones through a practice known as co-location. Co-location is usually more cost-effective for mobile network operators than building entirely new towers.

However, despite the potential advantages of independent tower companies, existing commercial arrangements seem to constrain the expansion of co-location.

“Telstra, Optus, and TPG Telecom continue to have a significant influence on communications investment decisions in regional, rural, and remote Australia. The tower companies only build new towers when they have commitments from network operators to use them,” ACCC Commissioner Anna Brakey said.

Each of the three major mobile network operators sold their tower portfolios to separate tower companies, creating strong contractual relationships between the old and new owners. These relationships may limit infrastructure sharing options and their impact on future mobile coverage expansion remains uncertain.

The change in mobile tower ownership has rendered the existing regulatory regime, including the Facilities Access Code administered by the ACCC, no longer suitable since it does not cover all the major companies that now own towers.

The ACCC’s inquiry found that competition is vital for expanding regional mobile coverage. Telstra’s enduring competitive advantage in regional areas and lower population density pose challenges for Optus and TPG Telecom to extend their networks.

The report underlines the concerns of regional, rural, and remote consumers who report lower quality mobile services. These issues include patchy coverage, difficulty interpreting coverage maps, and concerns about network congestion, especially as data demand continues to rise.

The report also explores the technical feasibility of temporary mobile roaming during natural disasters or emergencies. While it’s technically possible, implementing temporary mobile roaming would require changes to business processes, network systems, and protocols involving government agencies and the mobile network operators.

The ACCC’s findings shed light on the complexities of Australia’s evolving mobile telecommunications landscape and the challenges faced in ensuring widespread, high-quality mobile coverage, particularly in regional and remote areas.