The global messaging business is shifting , and at the heart of this transformation are two platforms — X (formerly Twitter) and Telegram — each pursuing ambitious monetisation strategies designed to leverage AI, subscriptions, and platform extensions in new ways.

The May 28th announcement of a $300 million partnership between Elon Musk’s xAI and Telegram to integrate the Grok AI chatbot into Telegram highlights how messaging platforms are becoming not just communication tools but revenue engines, where AI features are expected to drive user engagement, subscriptions, and new streams of income far beyond traditional advertising or data sales.

The xAI Telegram deal

The deal isan important one for both sides. It gives cash and monetisation opportunities to Telegram. Telegram needs a monetisation strategy, and this deal gives it a major financial boost, just as it pursues a planned $1.5 billion bond issue. For X, the deal gives xAI immediate access to Telegram’s 1 billion+ user base;a fast track to scale bot usage and data collection.

Telegram CEO Pavel Durov announced the landmark partnership: xAI (Elon Musk’s AI startup) will pay $300 million in cash and equity to embed its Grok chatbot within Telegram for one year. Telegram will also receive 50 percent of revenue from xAI subscriptions sold through the platform. “This summer, Telegram users will gain access to the best AI technology on the market,” Durov said, describing the deal as one that “strengthens Telegram’s financial position”.

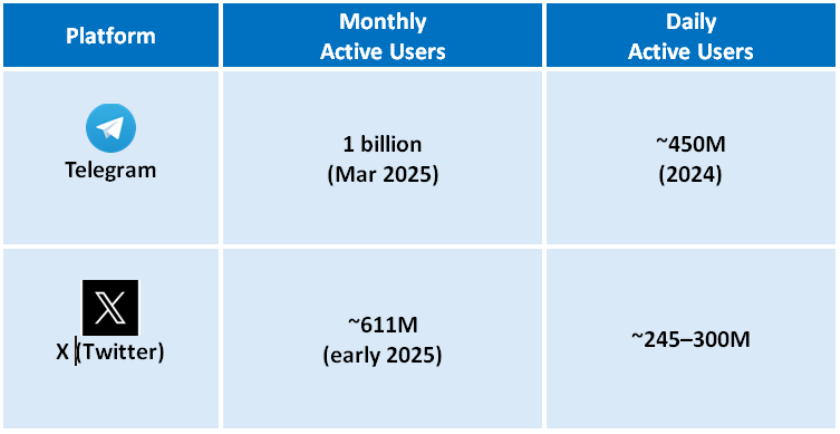

This comes as Telegram claims over 1 billion monthly users (MAUs) and plans to raise at least $1.5 billion via bonds. What they had to offer to the X and xAI team was the reach that the reincarnation of Twitter seems to have lost in terms of users with X sitting outside the top 10 as the 12th largest social platform, with roughly 600 million monthly users.

Elon Musk’s xAI acquired X (formerly known as Twitter) on March 28, 2025 as an all-stock transaction. The deal valued X at $33 billion and xAI at $80 billion. xAI is now cash rich and looking for more users. In the AI race, ChatGPT had 400 million weekly users in February 2025, with plans to hit 1 billion users by the end of 2025. xAI needs to scale X reach fast.

In a confirmation of xAI’s interest in messaging, X has announced that it will support person-to-person messaging again, in its newest version Xchat.

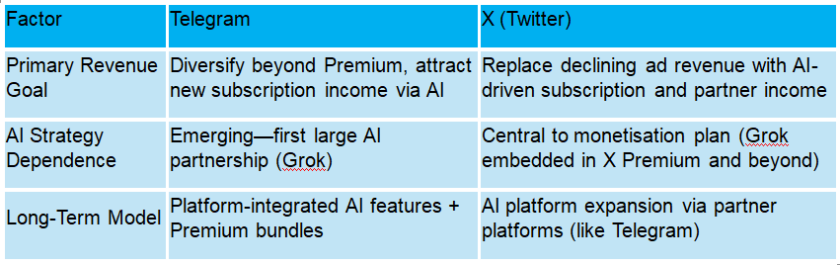

Telegram’s monetisation strategy: a shift toward AI-driven subscriptions

Telegram has historically positioned itself as an ad-free, privacy-first alternative to WhatsApp and other global messaging platforms. Unlike Meta or Google, Telegram has largely resisted monetisation via advertising, relying instead on its Telegram Premium subscription service (priced at around $4.99/month) and donations to fund development.

However, the scale of Telegram’s operationsrequires substantial investment, especially as the platform builds out services like cloud storage, large file sharing, and secure communications infrastructure. Telegram is currently raising $1.5 billion via bond issuance — a move signalling both capital need and market confidence in its monetisation potential.

The partnership with xAI serves several monetisation purposes for Telegram:

Immediate cash injection:

xAI’s $300 million payment strengthens Telegram’s financial position, supporting its operational costs and easing reliance on debt financing. This upfront capital is critical as Telegram scales both its infrastructure and feature set.

Recurring subscription revenue:

Telegram will receive 50 percent of revenue generated from xAI’s Grok subscriptions sold on the platform, establishing a new, long-term revenue stream. This reduces reliance on its Premium subscription model alone and opens a potential pathway to bundle AI services with Premium for increased value.

Enhanced user engagement:

Integrating Grok AI into Telegram chats is designed to increase time spent in-app, daily active users (DAUs), and user stickiness — making Telegram’s ecosystem more attractive to both consumers and potential future advertisers or service partners.

Product differentiation in a crowded market:

By embedding Grok AI, Telegram distinguishes itself from WhatsApp (still gradually rolling out Meta AI) and other secure messaging apps like Signal, which are unlikely to embrace AI features due to their strict privacy policies.

This strategy marks Telegram’s first serious step into AI monetisation — aligning with global trends that see generative AI as a key driver of platform revenue growth.

X’s monetisation strategy: diversification and dependency reduction

X (formerly Twitter), under Elon Musk’s ownership, has been aggressively reshaping its revenue model. Historically dependent on digital advertising (which made up more than 90 percent of its revenue pre-Musk), X has seen a sharp decline in ad income amid concerns about brand safety, content moderation, and Musk’s own controversial public positions.

In response, Musk has launched a subscription-heavy model, pushing features like X Premium (formerly Twitter Blue), paid verification, and now integration with Grok—the generative AI chatbot developed by xAI. This multi-faceted approach serves several key monetisation goals:

Subscription revenue growth:

X aims to convert as many users as possible to paying subscribers via X Premium, bundling benefits such as longer posts, fewer ads, and now, access to Grok AI. The success of Grok is seen as critical to justify this monthly subscription fee and create perceived value for users.

xAI monetisation beyond X:

The Telegram deal represents xAI’s first major foray outside the X ecosystem—an essential move as Musk seeks to monetise Grok independently of X’s core platform. This reduces risk by spreading revenue potential across different platforms and user bases.

Data diversification for AI training:

Integrating Grok with Telegram also provides xAI (and by extension, X Corp) with a broader conversational data set, crucial for training and improving its AI models. This AI-driven data economy may become a long-term revenue foundation, enabling the development of enterprise AI services or licensing deals.

New revenue-sharing ecosystem:

The 50 percent revenue share with Telegram suggests Musk’s willingness to create a partner-based ecosystem for Grok—potentially expanding to other platforms and apps globally. This could mimic the app store model or cloud marketplace frameworks, where X and xAI collect revenue from multiple front-end providers.

Long-term AI infrastructure monetisation:

With recent investments such as the Colossus AI supercomputer project in Memphis, xAI is building the capacity to offer large-scale AI services. Expanding Grok’s reach into Telegram helps justify this infrastructure spend by growing the user base that these AI systems serve.

Comparative monetisation pressures and risks

While both companies seek to leverage AI for growth, their underlying risks and market dynamics differ:

A symbiotic AI monetisation experiment

This $300 million partnership represents a mutually beneficial experiment for both X and Telegram. For the mobile ecosystem — including both telcos and A2P messaging providers—the move signals a broader industry shift: AI-powered monetisation will soon be integral to all major messaging platforms, which will blur the lines between communication, commerce, and content.

Therefore, companies within the telecoms space must prepare for this AI-driven messaging future — where bots, subscriptions, and platform partnerships reshape user engagement and revenue models.

By Dario Betti, CEO, MEF

ABOUT THE AUTHOR

Dario Betti is CEO of MEF (Mobile Ecosystem Forum) a global trade body established in 2000 and headquartered in the UK with members across the world. As the voice of the mobile ecosystem, it focuses on cross-industry best practices, anti-fraud and monetisation. The Forum, which celebrates its 25th anniversary in 2025, provides its members with global and cross-sector platforms for networking, collaboration and advancing industry solutions.

Web: https://mobileecosystemforum.com/

Twitter: https://x.com/mef

LinkedIn: https://www.linkedin.com/company/mobile-ecosystem-forum

Facebook: https://www.facebook.com/MobileEcosystemForum/