Communication service providers (CSPs) have witnessed a remarkable 5.5 percent increase in their spending on Operational Support Systems (OSS) and Business Support Systems (BSS) software and services in 2022, Analysys Mason report said recently.

This surge reflects ongoing investments in 5G infrastructure and the adoption of cloud-native solutions across the telecommunications landscape.

This surge reflects ongoing investments in 5G infrastructure and the adoption of cloud-native solutions across the telecommunications landscape.

The 5G infrastructure market will be valued at $12.08 billion in 2023 and is expected to grow at a CAGR of 33.6 percent over the forecast period of 2023-2030, GlobalData report said.

Alex Bilyi, an analyst at Analysys Mason, predicts that there will be a gradual slowdown in the growth of OSS and BSS industry during the forecast period. The maturation of 5G technology coupled with persisting challenges in monetizing 5G services will likely contribute to this deceleration.

Despite this, CSPs are expected to persist in modernizing their OSS/BSS systems, particularly in the early stages of the forecast period, to facilitate advanced automation and improved customer experiences imperative for the 5G era. Furthermore, the latter part of the forecast will witness a shift towards increased cloud-related expenditure as CSPs expand their service portfolios beyond the traditional CSP domain.

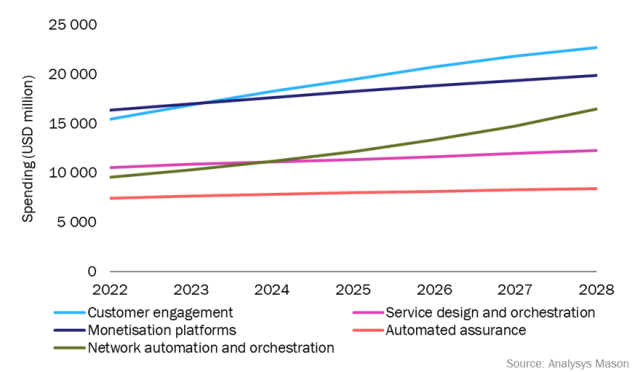

Projections indicate a steady growth trajectory with CSPs’ spending on OSS/BSS software and services anticipated to achieve a Compound Annual Growth Rate (CAGR) of 5.0 percent, culminating in a value of USD80 billion between 2022 and 2028, the report said.

OSS needs to evolve to unlock the value of network across different domains, technologies, and vendors to support digital services and network slicing cost-efficiently and at scale, Nokia report said.

A change from technology focus to business focus is required and automation needs to be based on business-intent and contracted SLAs.

A recent Gartner report identified Ericsson and Amdocs as two of the top BSS vendors for the telecom industry.

Figures outlined by the Analysys Mason report highlight the breakdown of CSPs’ expenditure in 2022 and the projected spending spanning 2023 to 2028 across five key segments: Automated Assurance (AA), Customer Engagement (CE), Monetization Platforms (MP), Network Automation and Orchestration (NAO), and Service Design and Orchestration (SDO).

Notably, CSPs across regions like North America (NA), Latin America (LATAM), Sub-Saharan Africa (SSA), the Middle East and North Africa (MENA), and emerging Asia–Pacific (EMAP) are poised to outpace the global average in spending.

EMAP, in particular, is expected to witness rapid expenditure growth across all five OSS/BSS segments, whereas LATAM and SSA will predominantly see market-driving spending in the OSS domain.

In comparison, NA and Western Europe (WE) are projected to lead in spending, with NA experiencing a more robust growth rate due to increased investments in 5G standalone networks. However, WE might face a slower growth rate due to the lingering effects of the energy crisis following geopolitical events like Russia’s invasion of Ukraine.

The special report underscores that the surge in CSPs’ OSS/BSS spending will be fueled by the advancement of 5G technology, Software as a Service (SaaS) adoption, and cloudification.

The 5G revolution has propelled CSPs beyond mere discussions about its adoption, focusing now on generating new revenue streams. While initial spending on 5G-related initiatives is expected to surge within the first 1–3 years of the forecast, a subsequent slowdown is foreseen as the technology matures. Simultaneously, investments in cloud-based solutions will witness substantial growth, driven by the need for orchestrated automation and virtualization of new services in CSP domains.

The report further emphasizes pivotal decisions faced by CSPs in updating their OSS and BSS systems, with expected investments of USD31 billion by 2028. The emergence of 5G SA networks brings new challenges in managing complex services, operational efficiencies, and scaling systems to accommodate increased service volumes. Consolidation of OSS stacks through vendor mergers and acquisitions is reducing the number of providers, propelling CSPs towards larger platform-based solutions supporting multi-domain systems.

Additionally, the forecast anticipates a rapid growth rate of 18.4 percent for SaaS-based solutions within the OSS/BSS market. CSPs are gradually shifting their perception towards SaaS, especially in BSS, envisioning it as the preferred model for customer engagement solutions.

Cloudification, marked by significant spending reaching USD18.9 billion by 2028, is expected to reshape CSPs’ approach to network orchestration, APIs, DevOps, and AI/ML technologies, heralding a transformational period for the telecom industry.

Baburajan Kizhakedath