Oracle, via its acquisition of Tekelec and Acme Packet, is leading the diameter signalling control (DSC) market in 2013, followed very closely by F5 and Huawei, said Infonetics Research.

Ericsson and Huawei have made significant pushes into the Diameter space and should be viewed as formidable threats.

“As exploding traffic from mobile devices, smartphones, and machines vexes mobile operators, we expect competition in the Diameter signaling controller market to intensify in 2014,” said Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research.

Infonetics Research says expected strong growth in the diameter signalling controller market is attracting vendors from varying backgrounds, from telecom hardware and software vendors such as Alcatel-Lucent, Ericsson, Huawei, and Oracle, to traditional signalling vendors (Ulticom), pure play vendors (Diametriq), IP experts (F5), and vendors in the policy and control space (Amdocs, Comptel, Openet).

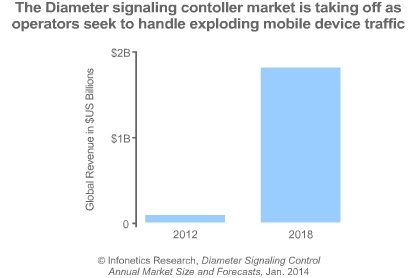

The diameter signaling control market is still relatively new, but in 2013 it matured through the success of a range of vendors and strong growth worldwide, with revenue more than doubling over the previous year. The vendor landscape continues to shift with acquisitions and new entrants.

Infonetics forecasts global diameter signalling controller revenue to grow at a 54 percent compound annual growth rate (CAGR) through 2018.

The primary use case for diameter signalling control remains centralized routing, but roaming via Diameter Edge Agent (DEA) is close behind, and policy and charging rules function (PCRF) binding continues to see significant activity.

Key areas of diameter signalling controller product development in 2014 include virtualization and a more widespread integration of interworking function (IWF).

North America controlled nearly 80 percent of the Diameter signaling controller market back in 2011, but Asia Pacific quickly caught up in 2012 and EMEA came close to parity by 2013 due to the significant ramping of LTE in these regions; Latin America is starting to show more activity as LTE expands there.