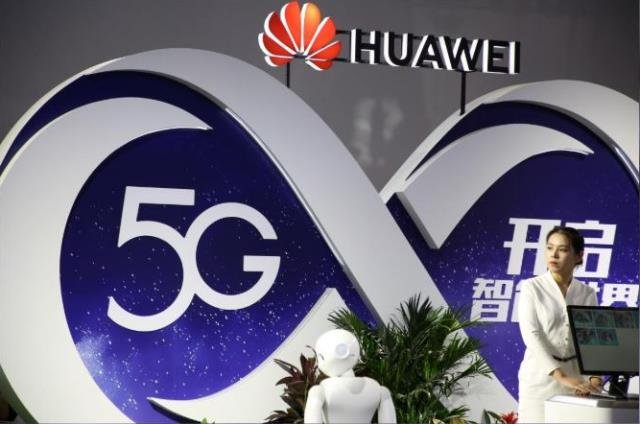

China’s Huawei Technologies seems to be facing a challenging phase in the 5G network business considering the recent 5G equipment deals bagged by rivals such as Nokia and Ericsson.

Huawei Technologies, which reported 296.7 billion yuan revenue in 2019 from its telecom network business, did not announce big 5G network deals during the first quarter of 2020.

Huawei Technologies, which reported 296.7 billion yuan revenue in 2019 from its telecom network business, did not announce big 5G network deals during the first quarter of 2020.

Huawei’s telecom network business contributes 34.5 percent sales to its total revenue. Huawei has already lost considerable business in the United States in the wake of supply related restrictions.

Huawei Technologies earlier said its full-year revenue would likely jump 18 percent in 2019 to 850 billion yuan or $121.72 billion. China accounts for 59 percent of its total revenue. Americas contributed 52.5 percent of its total revenue.

Earlier, Huawei revealed that the coronavirus outbreak would not affect the supply of 5G telecoms equipment to its customers after its factories resumed production.

Research firm Dell’Oro Group says Huawei lost telecom equipment share that touched 28 percent in the first quarter of 2020 as compared with 29 percent in the full year of 2019. But Huawei was not the only vendor to miss share. Nokia, Cisco and ZTE, have also lost telecom network share in Q1 2020.

5G deals

Nokia, the second largest telecom equipment maker and Ericsson, the third largest mobile network supplier, bagged important 5G equipment deals.

Bell Canada and Telus, two of Canada’s largest telecoms firms, selected Sweden’s Ericsson and Finland’s Nokia to build 5G telecoms networks, ditching China’s Huawei Technologies for the project.

Bell Canada and Telus did not select Huawei. Analysts said the decision to drop Huawei from 5G roll outs, would ease the Canadian government’s thorny decision on whether to allow the company into Canada’s 5G network.

Bell, Canada’s second-largest cellphone provider by wireless revenue, announced it would partner with Ericsson for its core 5G network. Previously, Bell said Nokia would provide other parts of its 5G tech.

Telus picked Ericsson and Nokia as its equipment suppliers.

Rogers Communications, the other dominant telecoms operator in Canada, has partnered with Ericsson.

Though Huawei has contracts with smaller companies, and continues to provide some tech for Bell’s network, the two companies are substantial contracts and it’s a nice piece of business for whoever gets it,” Lawrence Surtees, lead research analyst on communications at IDC Canada, said.

Huawei said it supports Bell’s strategy of selecting multiple equipment suppliers, referring to the Canadian telecom firm’s relationship with Huawei to supply other network components.

Telecoms companies were in a bind due to the government’s indecision.

“There is now equipment certainty and the use of multiple suppliers is an excellent strategy to help stimulate innovation and discipline pricing,” Mark Goldberg, a telecoms industry consultant, said.

Telefonica Deutschland earlier picked Ericsson to build its 5G core mobile network in Germany, saying the choice would safeguard the security of its next-generation services.

Meanwhile, British officials have discussed supplies of 5G networking equipment with companies in South Korea and Japan as part of a bid to develop alternatives to China’s Huawei Technologies, Bloomberg reported.

Initial talks with Japan’s NEC and South Korea’s Samsung, are part of a government plan announced last year to diversify Britain’s range of 5G suppliers.

Britain designated Huawei a “high-risk vendor” in January, capping its 5G involvement at 35 percent and excluding it from the data-heavy core of the network.

London is now looking at the possibility of phasing Huawei out of its 5G network completely by 2023, pushing forward with plans to develop a range of alternative suppliers.

Huawei currently mainly relies on telecom operators in China to build its 5G business.

Baburajan K