The global smart audio devices market is poised for substantial growth, with shipments projected to exceed 500 million units by 2025, Canalys report said.

The growth in smart audio devices market is driven by innovation, cross-brand collaborations, and a shift towards enhancing user experiences rather than adding isolated features. Key players are focusing on technological advancements in acoustics, chips, and AI-driven algorithms while strengthening their ecosystem partnerships to stay competitive.

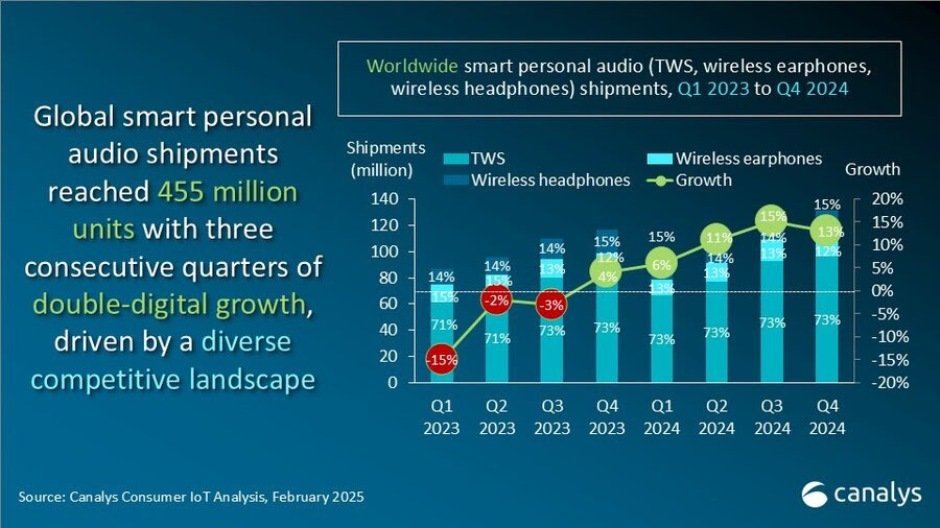

Data from Canalys, now part of Omdia, indicates that smart personal audio devices shipments, including true wireless stereo (TWS) earbuds, wireless headphones, and wireless earphones, reached 455 million units in 2024, reflecting an 11.2 percent annual increase. Growth was observed across all product categories, with China and emerging markets in Asia-Pacific, Latin America, the Middle East, and Africa driving demand.

Market leaders such as Apple continue to solidify their dominance through seamless hardware-software integration, leveraging proprietary chipsets to enhance connectivity and deliver immersive audio experiences.

Brands like Xiaomi and Huawei are capitalizing on their IoT ecosystems to create interconnected user experiences. The premium audio segment, led by Sony, Bose, and Edifier, remains focused on high-end consumers, offering advanced audio technologies, Hi-Res certifications, and strategic partnerships with streaming platforms.

Emerging brands are also making notable strides by targeting niche segments. Companies like Shokz and Cleer Audio are gaining traction in the sports and health categories with innovative open-form designs, while Oladance has sparked industry-wide interest in AI-driven translation technology. These brands are tailoring pricing and product strategies to regional markets, fueling rapid expansion.

Regionally, Greater China led with 22 percent growth, followed by Asia-Pacific (19 percent), EMEA (10 percent), and Latin America (7 percent), underscoring the broad-based momentum in the smart audio market, Canalys Research Analyst Jack Leathem said.

Smart personal audio market

Apple maintained its position as the market leader in smart personal audio shipments in 2024, shipping 81.8 million units and capturing an 18.0 percent market share. However, this marked a decline from 87.2 million units and a 21.3 percent share in 2023, reflecting a 6.1 percent decrease.

Samsung shipped 37.9 million units, securing an 8.3 percent market share and achieving 8.5 percent annual growth.

Indian brand boAt demonstrated strong momentum, increasing shipments by 25 percent to reach 28.0 million units, with its market share rising to 6.2 percent.

Xiaomi saw the most significant growth among the top brands, surging by 54.9 percent to ship 26.8 million units and capturing a 5.9 percent share.

Sony also experienced steady growth, with a 14.6 percent increase in shipments, reaching 18.4 million units and holding a 4.0 percent market share.

The Others category, comprising various smaller brands, collectively accounted for 261.6 million units, representing 57.5 percent of the market and growing by 13.3 percent.

TWS market

Apple remained the dominant brand in the TWS market in 2024, shipping 76.5 million units and holding a 23.1 percent market share, despite a 6.5 percent decline from the previous year’s 81.8 million units and 27.8 percent share.

Samsung secured the second spot with 28.2 million shipments, maintaining an 8.5 percent share and growing by 12.6 percent. Xiaomi experienced substantial growth, surging by 57.7 percent to 26.0 million units and expanding its market share to 7.9 percent from 5.6 percent in 2023.

boAt continued its strong presence, shipping 19.8 million units, marking an 18.2 percent increase and capturing 6.0 percent of the market.

Huawei registered the highest annual growth among the top brands at 59.2 percent, reaching 14.8 million shipments and increasing its market share from 3.2 percent to 4.5 percent.

The Others category, which includes various smaller brands, accounted for 166.2 million shipments, representing 50.1 percent of the market and growing 15.9 percent year-over-year. The overall TWS market grew by 12.6 percent in 2024, with total shipments reaching 331.6 million units.

Baburajan Kizhakedath