TrendForce’s latest research shows that the global smartphone industry gained strong momentum in the third quarter of 2025 as new product launches lifted production. Global smartphone output reached 328 million units in 3Q25, marking 9 percent quarter-on-quarter growth and a 7 percent increase compared to last year. This reflects the traditional seasonal upswing in the second half of the year.

TrendForce expects fourth-quarter demand to benefit from new flagship devices and heavy inventory preparation for global e-commerce sales. However, constrained memory supply and rising component prices are putting pressure on profit margins, especially for entry-level devices. The research firm currently forecasts smartphone production to grow 1.6 percent year over year in 2025, but warns that persistent memory shortages could trigger a downward revision.

China remained the world’s largest smartphone market in 2025 with a 23 percent share. Early-year subsidy programs boosted demand, though their impact has tapered off. Full-year sales are still expected to rise 2 percent. India holds the second position with a 13 percent market share, supported by recovering consumer sentiment and an expected 2 percent annual sales increase. North America, the third-largest market with an 11 percent share, saw weaker demand after front-loaded inventory purchases related to tariff concerns, resulting in a projected 1 percent annual decline.

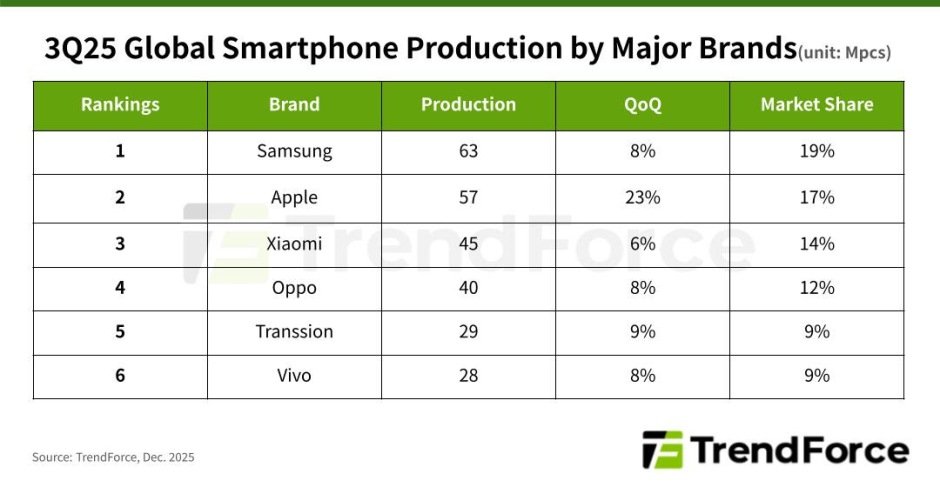

Samsung held its lead in global production with nearly 63 million units in the third quarter, an 8 percent increase quarter on quarter, giving it a 19 percent market share. Strong sales of the Galaxy A series and positive reception for its refreshed foldable models helped strengthen both volume and high-end shipments.

Apple followed closely with 57 million units, its highest third-quarter production on record. Keeping the iPhone 17 base-model prices unchanged while offering higher storage proved effective, and the improved design differentiation in the Pro series sustained momentum in the premium segment.

Xiaomi, including Redmi and POCO, ranked third with close to 45 million units, up 6 percent quarter on quarter. The company benefited from fresh product introductions and holiday-focused inventory buildup. OPPO, including OnePlus and Realme, secured fourth place with around 40 million units, posting an 8 percent increase supported by stronger demand in India, Southeast Asia, and Latin America.

Transsion brands TECNO, Infinix, and itel continued to see robust demand in emerging markets across Africa and Asia. The company produced more than 29 million units in the third quarter, up 9 percent, ranking fifth globally. Vivo, including iQOO, followed closely with about 28 million units. Its share was less than half a percentage point behind Transsion. Strong sales of mid-to-high-end iQOO models and active festival-season stocking drove Vivo’s quarterly growth of more than 8 percent.

Baburajan Kizhakedath