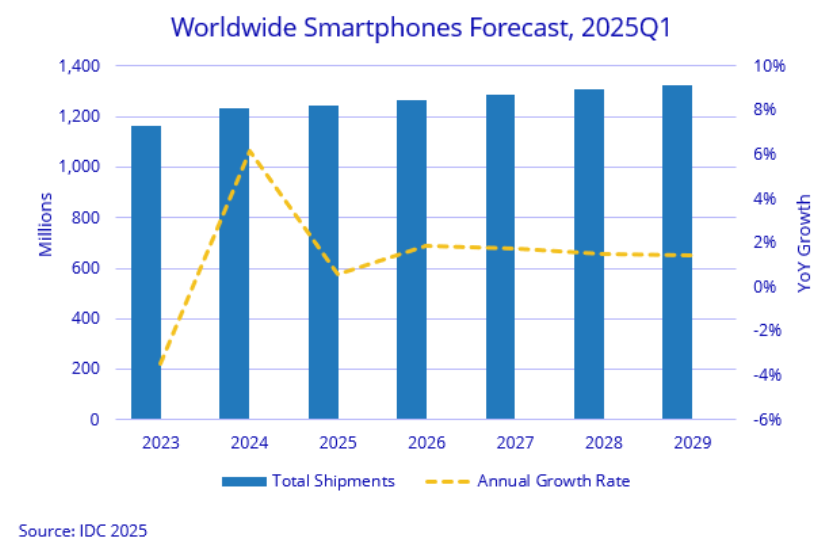

Worldwide smartphone shipments are forecast to grow 0.6 percent in 2025 to 1.24 billion units, down from an earlier forecast of 2.3 percent. This slowdown reflects the impact of high uncertainty, tariff volatility due to Donald Trump tariffs, inflation, unemployment, and weakening consumer spending across many regions.

Growth in the global smartphone market is expected to remain in low single digits over the forecast period, with a five-year CAGR of 1.4 percent, driven by rising smartphone penetration, lengthening upgrade cycles, and cannibalization from the growing used smartphone market, Anthony Scarsella (research director) and Nabila Popal (senior research director( with IDC’s Worldwide Quarterly Mobile Phone Tracker, said in the report.

Despite global challenges, the US and China are driving the 0.6 percent growth in 2025. In China, a 3 percent growth is expected due to government subsidies boosting Android demand.

Apple, however, is forecasted to decline by 1.9 percent in 2025, impacted by competition from Huawei, macroeconomic pressures, and subsidy limits for devices priced above 6,000 Yuan. Heavy discounting during the 618 shopping festival and the anticipated launch of the iPhone 17 with major hardware upgrades may partially offset this decline.

In the US, growth is forecast at 1.9 percent, down from 3.3 percent due to uncertainty from the US-China trade war and potential tariff-related price increases. However, the unique US market structure, where the majority of devices are sold through carriers, helps mitigate price sensitivity by offering robust trade-in deals and interest-free financing programs. The anticipated 4 percent rise in average selling prices is expected to have limited impact on consumers, especially with new premium devices launching in the second half of the year.

The industry faces significant challenges from geopolitical tensions, particularly around potential US tariffs on smartphones manufactured outside the US. These tariffs, if implemented at 20-30 percent, could severely impact the US market outlook.

Smartphone OEMs are navigating this uncertainty while accelerating supply chain diversification efforts, with India and Vietnam emerging as key alternatives to China for smartphone production. The combination of economic pressures, trade risks, and evolving production strategies underscores the complex environment the smartphone industry must navigate in the coming years.

Meanwhile, the global PC market is poised for growth in 2025, driven by several key strategies and underlying factors. A major growth driver is the Windows 11 migration, which is generating sustained commercial demand across global markets.

PC manufacturers are capitalizing on temporary tariff exemptions and a 90-day pause on tariffs to accelerate shipments, particularly in the US, seizing the opportunity before potential economic headwinds set in.

In parallel, tablet markets are influenced by factors like hybrid work trends, content consumption needs, and enterprise mobility, though IDC does not expect tablets to see the same robust growth trajectory as traditional PCs.

TelecomLead.com News Desk