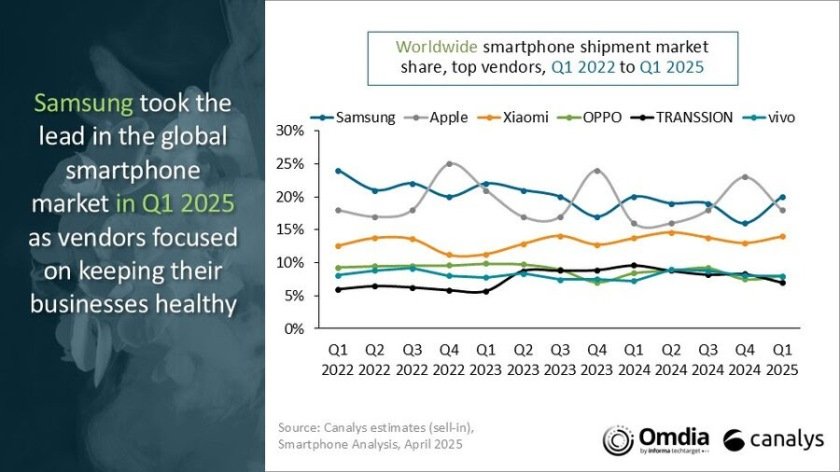

The latest Canalys report has highlighted the share of leading smartphone vendors during the first-quarter of 2025.

Samsung led the global smartphone market with a 20 percent share, reclaiming the top position through strong channel strategies.

Apple followed closely with an 18 percent share in the global smartphone market, reflecting a slight dip amid weakening demand in key markets, particularly in the United States.

Xiaomi secured third place with a stable 14 percent share in the global smartphone market, maintaining its position from the same quarter a year ago.

Vivo and OPPO each captured an 8 percent share in the global smartphone market, ranking fourth and fifth respectively, as both brands continued to focus on selective market investments and pricing flexibility to stay competitive.

The global smartphone market grew by 1 percent year on year in Q1 2025, signaling a cautious recovery amid ongoing macroeconomic headwinds and restrained consumer sentiment. The modest growth came despite slower-than-expected sell-through and persistent challenges around channel inventory digestion.

The performance of smartphone vendors in Q1 reflected a more fragile recovery compared to the post-pandemic surge in 2024, said Amber Liu, Research Manager at Canalys. While vendors pushed high inventory volumes into channels to secure early-year momentum, slower sales extended inventory cycles and weighed on sell-in performance.

This softness in the global smartphone market was exacerbated by cautious consumer behavior in key markets and underwhelming seasonal boosts, such as those expected during Ramadan, said Sanyam Chaurasia, Senior Analyst at Canalys.

In response, smartphone vendors shifted focus from volume to profitability, implementing dynamic channel incentives, flexible pricing models, and expanded financing options — particularly in emerging markets — to drive demand and sustain margins.

Adding to the complexity, escalating global trade tensions have introduced new uncertainties. Vendors like Apple, Samsung, and Lenovo are already facing weaker demand in the US, along with concerns over potential cost increases tied to impending tariffs. Apple responded by front-loading shipments into early April, attempting to get ahead of possible Q2 disruptions.

Globally, the looming threat of higher component costs and softening export demand has prompted companies to accelerate diversification strategies. These include relocating production bases, reconfiguring sourcing models, and optimizing logistics. As a result, vendors are bracing for continued disruptions to profitability and extended planning cycles throughout the rest of 2025.

Baburajan Kizhakedath