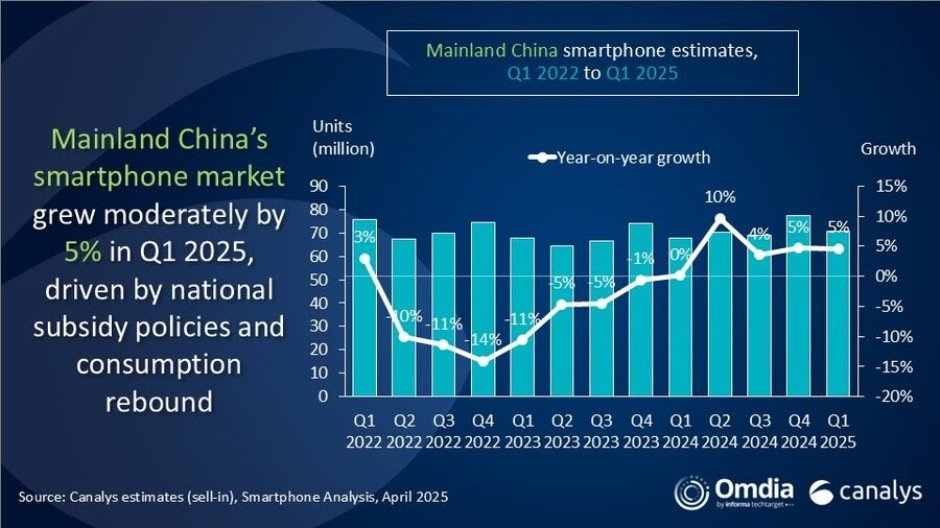

The size of China’s smartphone market rose 5 percent in Q1 2025 to 70.9 million units fueled by subsidy policies and a rebound in consumer sentiment.

“The device subsidy program implemented in January 2025 provided moderate support to the market,” said Amber Liu, Research Manager at Canalys (now part of Omdia).

“While the policy brought forward some replacement demand, it was more about a temporary pull-in rather than generating organic growth. Vendors maintained rational inventory management and overall channel stock levels remained healthy,” Amber Liu said.

The report said smartphone vendors, as part of their long-term strategies, are increasing investments in brand store expansion, in-store experience optimization, and channel partnerships.

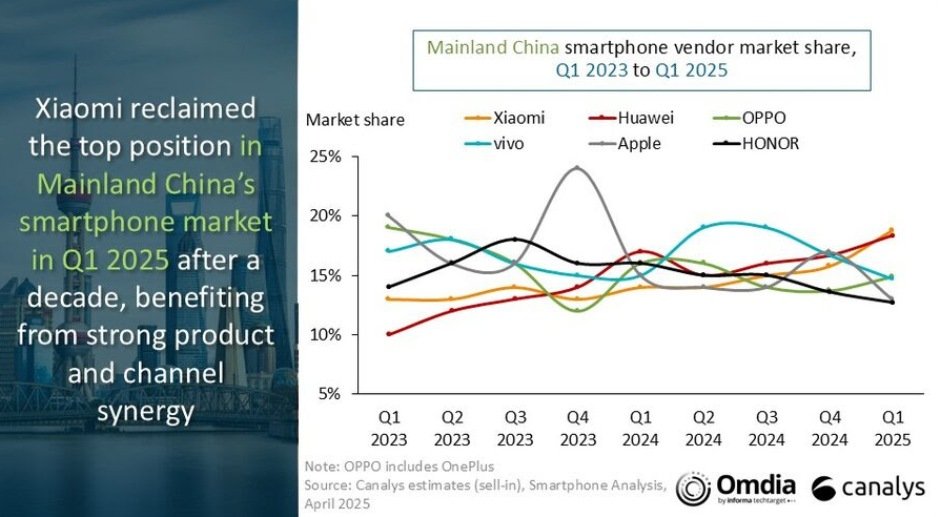

The highlight of the report is the growth of Xiaomi that has regained the top position in China’s smartphone market for the first time in a decade. Meanwhile, Apple dropped to the fifth position.

Xiaomi

Xiaomi shipped 13.3 million smartphones in Q1 2025, up from 9.5 million in Q1 2024, increasing its market share from 14 percent to 19 percent. Xiaomi benefited from the synergies across its smartphone, AIoT and mobility ecosystem, as well as strong execution under the national subsidy scheme.

“Xiaomi’s strong Q1 performance, which propelled it back to the top of the market, was driven by the effective synergy between its product ecosystem and channel strategy,” said Toby Zhu, Principal Analyst at Canalys (now part of Omdia).

Huawei

Huawei has shipped 13 million units compared to 11.7 million a year earlier, with its market share rising from 17 percent to 18 percent. Huawei has achieved double-digit growth through robust channel management.

Huawei is accelerating its HarmonyOS Next ecosystem rollout — including bringing the upgrade to the Nova 12 and 13 series — which is set to reshape the domestic operating system and strengthen its competitive moat. HarmonyOS Next is expected to account for 3 percent of China’s smartphone install base by 2025.

OPPO

OPPO’s shipments slightly declined from 10.9 million in Q1 2024 to 10.6 million in Q1 2025, and its market share dropped from 16 percent to 15 percent.

Vivo

Vivo’s shipments remained fairly stable, moving from 10.3 million to 10.4 million, while maintaining a 15 percent market share.

Apple

Apple saw a decline, with shipments falling from 10.0 million to 9.2 million, and its market share slipping from 15 percent to 13 percent.

AI

AI-capable smartphones in China is projected to exceed 40 percent in 2025 from 22 percent in 2024.

Baburajan Kizhakedath