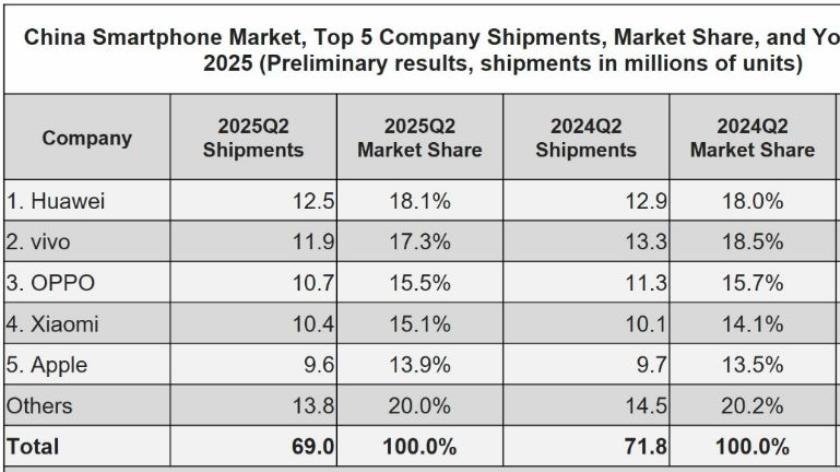

Smartphone spending in China declined in the second quarter of 2025, with shipments falling to 69.0 million units — a 4.0 percent drop year-on-year, according to IDC data.

This marks the first contraction in six quarters, as macroeconomic uncertainties and underwhelming stimulus from government subsidies restrained consumer demand. The traditionally strong “618” online shopping festival served primarily as a channel inventory correction opportunity rather than a catalyst for new demand.

Despite the market’s cooling momentum, Huawei reclaimed the top position for the first time in over four years, highlighting its renewed strength in brand loyalty and efficient shipment strategies.

“Huawei returned to the top spot after more than four years, underscoring its strong brand appeal and effective shipment management,” said Will Wong, senior research manager for Client Devices at IDC Asia Pacific.

Xiaomi emerged as the only Top 5 vendor to register growth, driven by sustained traction in the budget and value segments.

Apple, though experiencing a decline, managed to soften the impact through targeted price cuts, making select iPhone 16 and 16 Pro models eligible for government subsidies.

Smartphone share

Huawei led the market in Q2 2025 with an 18.1 percent share, up slightly from 18.0 percent in Q2 2024, despite a dip in shipments from 12.9 million to 12.5 million units.

Vivo followed closely with a 17.3 percent share, down from 18.5 percent a year earlier, as shipments fell from 13.3 million to 11.9 million units.

OPPO held the third position with a 15.5 percent share, almost stable compared to 15.7 percent in Q2 2024, despite a modest drop in shipments from 11.3 million to 10.7 million.

Xiaomi saw a gain in market share, rising from 14.1 percent to 15.1 percent, with shipments increasing from 10.1 million to 10.4 million.

Apple also improved its share, moving up from 13.5 percent to 13.9 percent, though shipments slightly declined from 9.7 million to 9.6 million units.

The “Others” category saw a marginal decrease in both shipments and share, from 14.5 million units and 20.2 percent in Q2 2024 to 13.8 million and 20.0 percent in Q2 2025.

The disruption in the government’s subsidy rollout and persistent economic headwinds have dampened consumer sentiment, making a rapid recovery in smartphone spending unlikely in the near term. Analysts expect a more cautious and complex market trajectory through the second half of 2025, with vendors focusing on managing inventory and selectively capturing demand through pricing and promotions.

Baburajan Kizhakedath