Smartphone shipments grew by 5 percent year-on-year in Q3 2024, marking the fourth consecutive quarter of growth, according to the latest Canalys research. This surge is driven by resilient demand in emerging markets and the beginning of a replacement cycle in North America, China, and Europe.

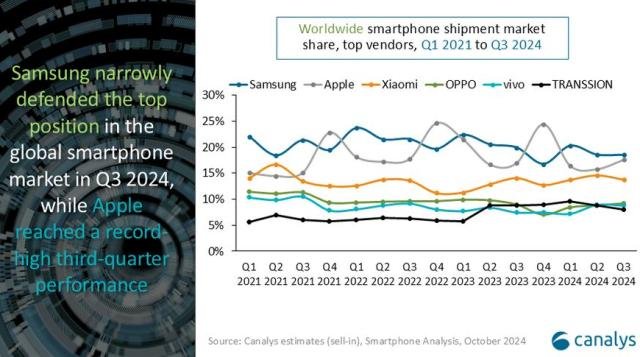

Apple reached a significant milestone this quarter, increasing its market share to 18 percent, up from 17 percent in Q3 2023. This growth places Apple on par with Samsung, which saw its market share decline from 21 percent to 18 percent. Apple’s strong performance is attributed to the iPhone 15 series and its legacy models, making Q3 2024 its highest third-quarter volume to date, according to Canalys.

Apple has shipped 56 million iPhones in the third quarter of 2024, marking a 3.5 percent increase compared to the 54.1 million units shipped during the same period in 2023, according to a new report by IDC. Despite this growth, Apple’s global smartphone market share remained relatively steady at 17.7 percent, compared to 17.8 percent last year.

IDC report said the increase in shipments was driven largely by strong demand in emerging markets, along with the successful launch of the iPhone 16 lineup. According to Nabila Popal, IDC’s research director for Worldwide Client Devices, older models, particularly the iPhone 15, performed exceptionally well due to significant promotions and marketing campaigns centered around the new Apple Intelligence feature.

Though Apple Intelligence’s rollout outside the U.S. has been staggered, the company is poised for further growth during the upcoming holiday season. Many customers are expected to upgrade from earlier models, such as the iPhone 12 and iPhone 13, to the AI-enabled iPhone 16, as they seek to future-proof their devices for the long term.

Canalys report said Samsung has 18 percent share in the smartphone market in Q3 2024 vs 21 percent in Q3 2023.

Apple also has 18 percent share in the smartphone market in Q3 2024 vs 17 percent in Q3 2023.

Xiaomi has 14 percent share in the smartphone market in Q3 2024 vs 13 percent in Q3 2023.

Oppo has 9 percent share in the smartphone market in Q3 2024 vs 10 percent in Q3 2023.

Apple’s success is driven by a market shift towards premium devices and the refresh cycle of devices purchased during the pandemic. In regions like North America and Europe, Apple continues to dominate, with the iPhone 16 expected to fuel further momentum in H1 2025. Apple’s diversification strategy, which has helped reduce lead times, combined with its expanding Apple Intelligence services, has strengthened its position.

“The gap between the top vendors has narrowed,” said Le Xuan Chiew, an analyst at Canalys, highlighting the intensifying competition. As the holiday season approaches, vendors are gearing up for major shopping events like 11.11 and Black Friday, aiming to capture the attention of consumers waiting for deals.

While other manufacturers like Xiaomi, Oppo, and Vivo also saw slight gains or stability in market share, Apple is closer than ever to leading the global smartphone market during a Q3.

Baburajan Kizhakedath