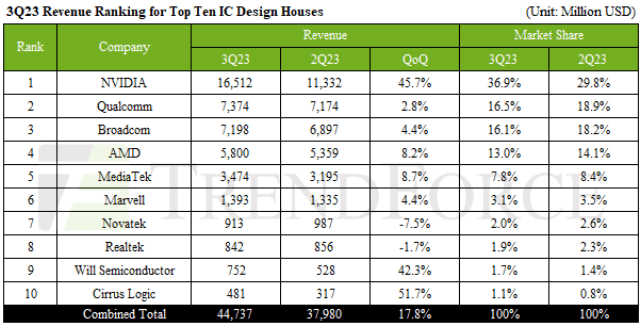

The world’s top Integrated Circuit (IC) design houses have achieved 17.8 percent increase in revenue to an all-time high of $44.7 billion for the third quarter of 2023, TrendForce said.

This remarkable growth trajectory, as per TrendForce’s analysis, was propelled by a confluence of factors. A robust season of stockpiling for smartphones and laptops, combined with an accelerated shipment of generative AI chips and components, served as the primary drivers behind this historic achievement.

This remarkable growth trajectory, as per TrendForce’s analysis, was propelled by a confluence of factors. A robust season of stockpiling for smartphones and laptops, combined with an accelerated shipment of generative AI chips and components, served as the primary drivers behind this historic achievement.

NVIDIA, Qualcomm, Broadcom, AMD, MediaTek, Marvell, Novatek, Realtek, Will Semiconductor and Cirrus Logic are the top 10 IC design companies in the world, according to the report.

Performance of top IC design firms

NVIDIA, seizing the opportunities presented by the AI boom, emerged as the unequivocal leader in revenue and market share. The company’s revenue skyrocketed by an impressive 45.7 percent to a staggering $16.5 billion during the third quarter. This remarkable surge was predominantly fueled by sustained demand for generative AI and LLMs (Large Language Models). Notably, NVIDIA’s data center business, which accounted for nearly 80 percent of its revenue, played a pivotal role in driving this exceptional growth.

In a noteworthy development, analog IC supplier Cirrus Logic made a significant leap, overtaking US PMIC manufacturer MPS to claim the coveted tenth spot. Cirrus Logic’s ascent was propelled by robust demand for smartphone stockpiling, solidifying its position in the industry.

Qualcomm, leveraging the success of its flagship AP Snapdragon 8 Gen 3 and the introduction of new Android smartphones, witnessed a 2.8 percent quarter-on-quarter revenue climb to approximately $7.4 billion. However, NVIDIA’s meteoric growth had an impact on Qualcomm’s market share, which declined to 16.5 percent.

Similarly, Marvell experienced substantial growth, with third-quarter revenue reaching $1.4 billion, a 4.4 percent increase quarter-on-quarter. The surge was attributed to heightened demand for generative AI from cloud clients and the expansion of its data center business, offsetting declines in other sectors.

Despite these monumental successes, certain sectors faced uncertainties. Companies like Novatek and Realtek witnessed declines in revenues by 7.5 percent and 1.7 percent, respectively. However, Will Semiconductor and Cirrus Logic saw impressive growth, benefitting from the demand for Android smartphone components.

Looking ahead, TrendForce projects sustained growth for the top ten IC design houses in the upcoming fourth quarter. The forecast is underpinned by expectations of a gradual normalization of inventory levels and a modest seasonal rebound in the smartphone and notebook markets. The global surge in LLMs, extending its influence beyond major corporations to regional markets and small-to-medium enterprises, is poised to further bolster this positive revenue trend.