TrendForce’s latest report reveals a promising future for the memory industry, forecasting significant revenue increases for both DRAM and NAND Flash.

In 2024, DRAM revenue is expected to surge by 75 percent, reaching $90.7 billion, while NAND Flash revenue is projected to climb 77 percent, reaching $67.4 billion. This growth is driven by increased bit demand, improved supply-demand dynamics, and the rise of high-value products such as High Bandwidth Memory (HBM).

DRAM Revenue Boosted by HBM

TrendForce attributes the expected 75 percent increase in DRAM revenue in 2024 to several factors, including the adoption of HBM, which is set to contribute 5 percent of DRAM bit shipments and 20 percent of revenue.

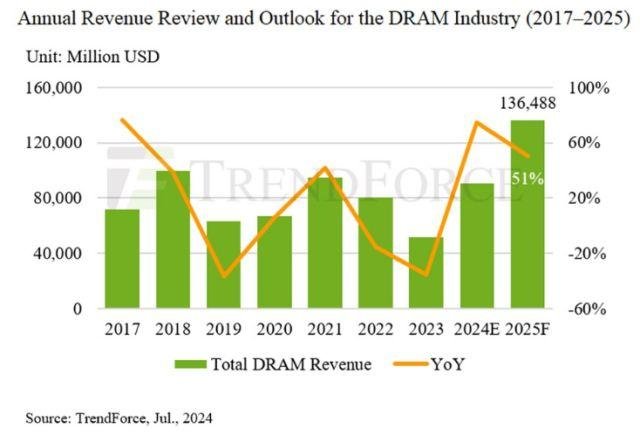

Additionally, the generational evolution of general DRAM products, controlled capital expenditures by manufacturers, and a recovery in server demand are pivotal. The average DRAM price is anticipated to rise by 53 percent in 2024 and by 35 percent in 2025, pushing revenues to $136.5 billion in 2025 — a 51 percent year-over-year increase.

High-value products like DDR5 and LPDDR5/5X are also expected to drive up average prices, with DDR5 projected to account for 40 percent of server DRAM bit shipments in 2024 and 60-65 percent in 2025. Similarly, LPDDR5/5X is expected to make up 50 percent of mobile DRAM bit shipments in 2024, increasing to 60 percent in 2025.

Record NAND Flash Revenue Driven by QLC SSDs and UFS

NAND Flash revenue is set to reach $67.4 billion in 2024, a 77 percent year-over-year increase, with further growth to $87 billion expected in 2025. This growth is fueled by the adoption of high-capacity QLC enterprise SSDs and the integration of QLC UFS in smartphones.

North American cloud service providers (CSPs) are already extensively adopting QLC enterprise SSDs in AI servers. QLC is projected to account for 20 percent of NAND Flash bit shipments in 2024, with a further increase anticipated in 2025.

In the smartphone sector, QLC is expected to gradually penetrate the UFS market, with some Chinese manufacturers planning to adopt QLC UFS solutions by late 2024. Apple is expected to start incorporating QLC into iPhones by 2026.

Impact on the Industry Ecosystem

The anticipated revenue growth will provide manufacturers with the cash flow needed to accelerate investments. Capital expenditures in the DRAM and NAND Flash industries are projected to rise by 25 percent and 10 percent, respectively, in 2025. This expansion will boost demand for upstream raw materials like silicon wafers and chemicals.

However, the increase in memory prices will also raise the cost of electronic products, squeezing profit margins for ODM/OEM companies and potentially dampening end-user sales. This cost pressure could lead to a decline in demand, despite the booming revenues.