TrendForce maintains its optimistic outlook for the DRAM industry, forecasting that high-bandwidth memory (HBM) will account for 10 percent of total DRAM bit output in 2025, doubling its 2024 share. HBM’s market revenue contribution is expected to exceed 30 percent, driven by its higher average selling price (ASP).

By 2025, over 80 percent of total HBM bit demand is projected to be for next-gen HBM3e, with the 12-Hi models making up more than half of the demand. These models, expected to become mainstream for AI platforms, are projected to surpass older-generation products like HBM2e and HBM3.

Despite the growth prospects, concerns linger over potential oversupply in 2025. Senior VP of Research at TrendForce, Avril Wu, highlights the uncertainty surrounding whether manufacturers can scale HBM3e production as planned, given the steep learning curve in achieving stable yields, particularly for the 12-Hi versions.

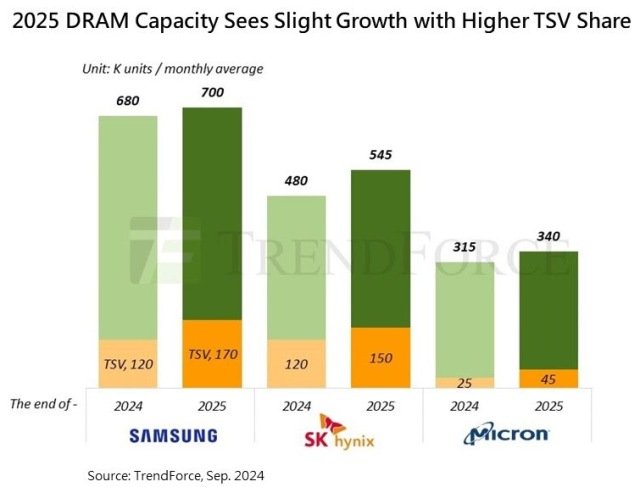

Samsung, SK Hynix, and Micron have already submitted samples of HBM3e 12-Hi, with SK Hynix and Micron expected to complete validation by year-end. Capacity expansion in through-silicon via (TSV) processes is underway, with Samsung planning to increase its TSV production by 40 percent by the end of 2025, and SK Hynix aiming for a 25 percent increase.

However, the challenges in mass production for 12-Hi models, which are integral to key products like NVIDIA’s B200 and AMD’s MI325, may complicate supply stability.