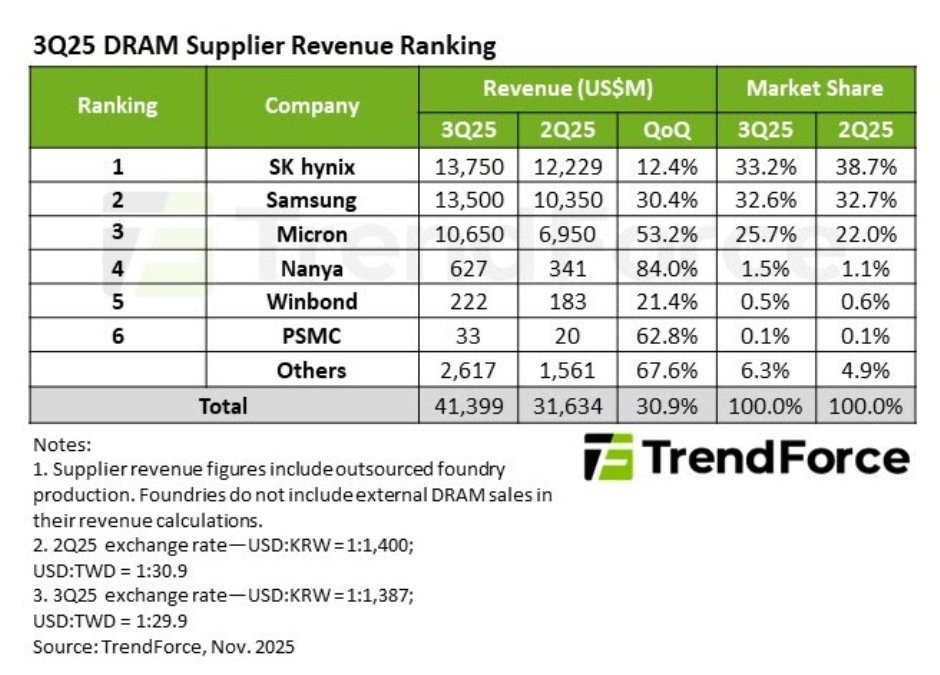

The global DRAM market recorded exceptional momentum in the third-quarter of 2025, with revenue rising to $41.4 billion due to strong growth in conventional DRAM pricing, increased bit shipments, and expanding HBM demand. TrendForce data shows that suppliers benefited from tight inventories and robust procurement activity, pushing overall industry revenue up by a solid thirty point nine percent quarter over quarter.

As the DRAM industry enters the final quarter of 2025, DRAM suppliers are approaching near zero inventory levels, causing a steep drop in the growth of bit shipments. Cloud service providers remain flexible with procurement budgets, which influences pricing across all major applications. As a result, contract prices for advanced and legacy nodes are expected to see rapid gains. TrendForce estimates that conventional DRAM contract prices will increase by 45-50 percent quarter over quarter, while overall contract pricing for DRAM and HBM combined will rise by 50-55 percent.

SK Hynix held the leading spot in the global DRAM market in 3Q25 with revenue of $13.75 billion, supported by higher seasonal ASPs and strong shipment volumes. However, its market share declined slightly to 33.2 percent due to intensified competition.

Samsung exceeded expectations with significant growth in bit shipments, achieving $13.5 billion in quarterly revenue, a rise of 30.4 percent, and securing a 32.6 percent share.

Micron followed with impressive increases in both ASPs and shipments, bringing its revenue to $10.65 billion and raising its market share to 25.7 percent.

Taiwanese suppliers continued their upward trajectory, each reporting more than 20 percent quarter over quarter growth. Mature node DRAM from these vendors helped meet demand gaps created by the rapid node migration of the top three global players.

Nanya delivered the strongest growth, with revenue rising 84 percent to $630 million. Winbond posted a 21.4 percent increase to $220 million, while PSMC achieved $33 million in DRAM revenue from its consumer products, aided by customer restocking and inventory clearance. Including its foundry operations, PSMC recorded a total growth rate of 36 percent.

The global DRAM market is now entering a phase of accelerated pricing, constrained supply, and rising demand for both conventional DRAM and HBM, setting the stage for another strong performance as 2025 concludes.

Shefana Fazal