DRAM (dynamic random-access memory) suppliers have yet to achieve optimal levels despite efforts to balance inventories, TrendForce said.

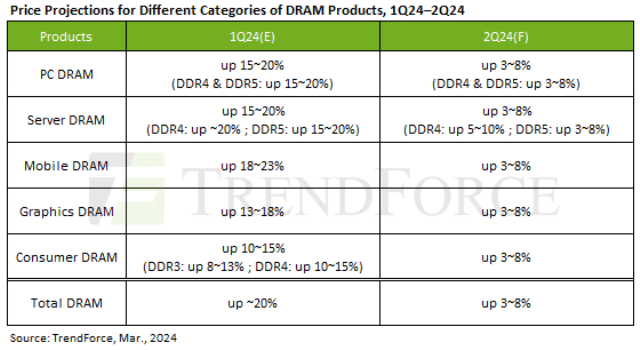

With a focus on enhancing capacity utilization rates, DRAM suppliers aim to navigate through a tepid demand outlook for the year. However, the substantial price increases witnessed since the fourth quarter of 2023 are expected to exert a dampening effect on inventory restocking momentum. Consequently, TrendForce projects a moderate increase of 3–8 percent in DRAM contract prices for the second quarter.

With a focus on enhancing capacity utilization rates, DRAM suppliers aim to navigate through a tepid demand outlook for the year. However, the substantial price increases witnessed since the fourth quarter of 2023 are expected to exert a dampening effect on inventory restocking momentum. Consequently, TrendForce projects a moderate increase of 3–8 percent in DRAM contract prices for the second quarter.

The shift toward DDR5-compatible CPUs is poised to stimulate demand for PC DRAM in the upcoming quarter. Manufacturers are gearing up for this transition by adopting more advanced and cost-efficient production processes for DDR5, thereby anticipating improved profitability.

This anticipation of higher DRAM prices in the first half of 2024 has emboldened suppliers to target a 3–8 percent hike in PC DRAM contract prices for Q2. Despite a notable rise in DDR5 prices in Q1, expected AI PC demand may mitigate further increases in DDR5 prices during Q2.

In the server DRAM sector, there is sustained interest in accumulating DDR5 inventory, although its market penetration has not met initial expectations. To address this, manufacturers are ramping up DDR5 production and employing volume bundling strategies to enhance profitability. This strategy, coupled with capacity constraints in DDR4, is expected to result in a more pronounced rise in DDR4 contract prices compared to DDR5 in the second quarter, effectively narrowing the price gap between the two.

The mobile DRAM market reflects a balanced buyer inventory but lacks a significant demand resurgence, leading to a passive stance in Q2 negotiations. Manufacturers, aiming to bolster profitability, have set ambitious targets for Q2 mobile DRAM contract price increases, but TrendForce anticipates a more moderate increase of 3–8 percent due to buyers’ passive negotiating stance.

In the graphics DRAM sector, strong price increases continue to drive purchasing activity, particularly for mainstream GDDR6 16 Gb specification. Manufacturers’ shift towards the high-bandwidth memory (HBM) domain has led to a conservative production plan for GDDR, contributing to the expected rise in graphics DRAM contract prices by 3–8 percent in 2Q24.

Consumer DRAM demand remains stable, primarily in AI-related sectors, with selective inventory restocking in TV and networking. While major global manufacturers capitalize on the AI boom by reducing inventories and adopting firm pricing stances, Taiwanese firms face inventory pressures, resulting in a more gradual approach to price increases. As a result, consumer DRAM contract prices for the second quarter are expected to grow by an estimated 3–8 percent.