Artificial intelligence (AI) is emerging as the primary force behind a new wave of semiconductor industry investment, according to SEMI’s latest 300mm Fab Outlook report. As generative AI applications surge in complexity and adoption, global front-end semiconductor suppliers are accelerating capacity expansion to meet unprecedented computing demands.

The industry is poised for robust growth, with total 300mm wafer capacity projected to reach 11.1 million wafers per month (wpm) by 2028, growing at a 7 percent CAGR from the end of 2024.

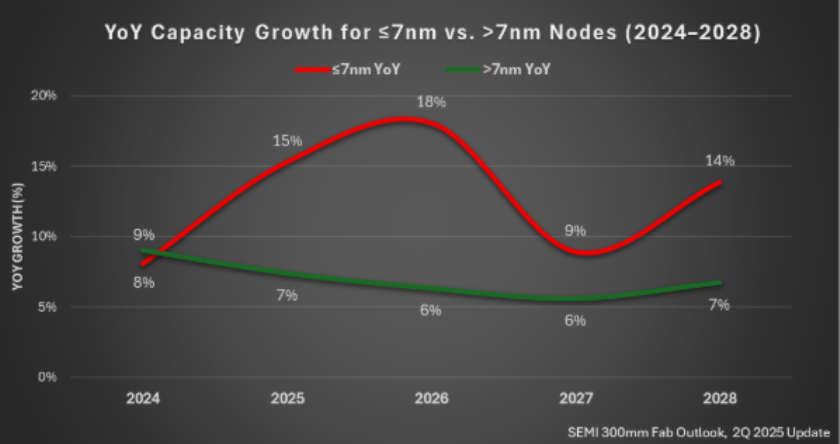

The expansion is being driven particularly by advanced process technologies — 7nm and below — whose capacity is set to grow by 69 percent, from 850,000 wpm in 2024 to 1.4 million wpm by 2028.

SEMI President and CEO Ajit Manocha said: “The rapid proliferation of AI applications is stimulating robust investment across the semiconductor ecosystem.”

AI’s impact is two-fold: fueling demand for powerful chips to train large models and increasing the need for AI inference in everyday applications. From personal assistants to augmented reality and humanoid robotics, AI’s growing integration across consumer and industrial systems is catalyzing demand for high-performance semiconductors.

In response, chipmakers are ramping up investment in advanced manufacturing technologies. Capacity for 2nm and below nodes is expected to skyrocket, growing from under 200,000 wpm in 2025 to over 500,000 wpm by 2028.

Capital spending on advanced wafer equipment is set to rise dramatically — more than doubling from US$19 billion in 2024 to US$43 billion in 2028, representing a 120 percent jump.

This aggressive investment pattern underscores the strategic importance of AI as both a market driver and innovation enabler. With 2nm chips entering mass production in 2026 and 1.4nm chips slated for deployment in 2028, AI is not only redefining the future of technology — it is reshaping the entire semiconductor manufacturing landscape.