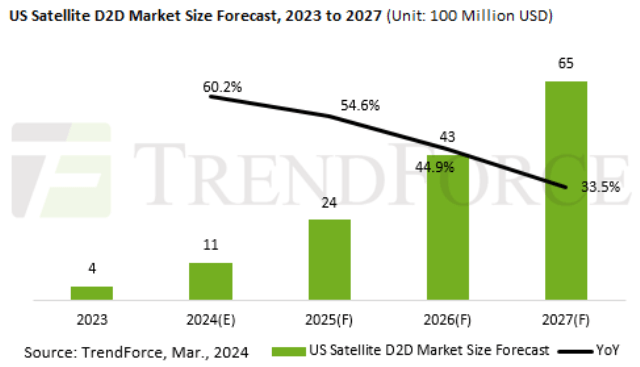

TrendForce, a market research firm, has forecasted substantial growth in the US satellite direct-to-device (D2D) market, projecting an increase from $430 million in 2023 to $6.5 billion by 2027, with a CAGR of 36 percent.

This surge in growth is attributed to the adoption of satellite D2D services, potentially paving the way for telecom operators to diversify into satellite communications beyond conventional mobile services.

This surge in growth is attributed to the adoption of satellite D2D services, potentially paving the way for telecom operators to diversify into satellite communications beyond conventional mobile services.

Starlink, a prominent US satellite operator, has been at the forefront of deploying residential satellite communication services across the United States and the Philippines. In a bid to enhance user penetration, Starlink has announced a strategic partnership with telecom giant T-Mobile to offer satellite D2D services.

With temporary certification from the Federal Communications Commission (FCC), Starlink is poised to roll out its direct-to-cell services in 2024. Initially, the service will be available to regional users in the US, enabling them to exchange basic text messages via the satellite’s integrated eNodeB modem using 4G signals in the 1.9 GHz frequency band.

Furthermore, following voice communication trials between the Blue Walker 3 satellite prototype and 5G smartphones, AST SpaceMobile has secured approximately $207 million in investments from major players like AT&T and Google.

AST SpaceMobile is gearing up to launch the Bluebird satellite — equipped with D2D services—aboard a Falcon 9 rocket in the first quarter of 2024. This joint venture with AT&T aims to introduce the service into the US market, positioning the US as a pivotal region for telecom operators seeking to expand satellite D2D offerings in collaboration with satellite operators.

Taiwanese PCB and antenna manufacturers are poised to capitalize on the burgeoning satellite D2D supply chain, notes TrendForce. As more satellite operators embark on deploying D2D services, Taiwanese suppliers of critical components are extending their manufacturing capabilities from ground stations to satellite component production, thereby entering the satellite D2D service supply chain.

For instance, COMPEQ exclusively supplies HDI products to Starlink satellites, including those for direct-to-cell services. Meanwhile, Auden Techno is investing in the development of phase array antennas for C-band and L-band applications, targeting narrowband scenarios for Starlink’s D2D services.

Taiwanese manufacturers are aiding satellite operators in producing vital components for satellite D2D services. They are also actively collaborating with these operators to conduct rigorous testing of critical satellite components under various conditions.