CARE Ratings has revealed the financial status of Indian telecom industry in the third quarter of fiscal 2017 – after the entry of Reliance Jio.

CARE Ratings has revealed the financial status of Indian telecom industry in the third quarter of fiscal 2017 – after the entry of Reliance Jio.

The Mukesh Ambani promoted Reliance Jio entered the telecom market in September 2016 with its free voice and data services and negatively affected the telecom industry’s sales and profits in the December 2016 quarter.

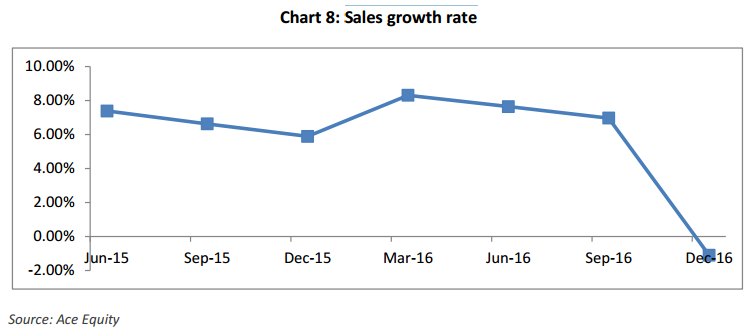

The aggregate sales of the nine telecom operators that grew in single-digit in each of the quarters during June 2015 quarter to September 2016 quarter declined by 1.1 percent in the December 2016 quarter, said CARE Ratings.

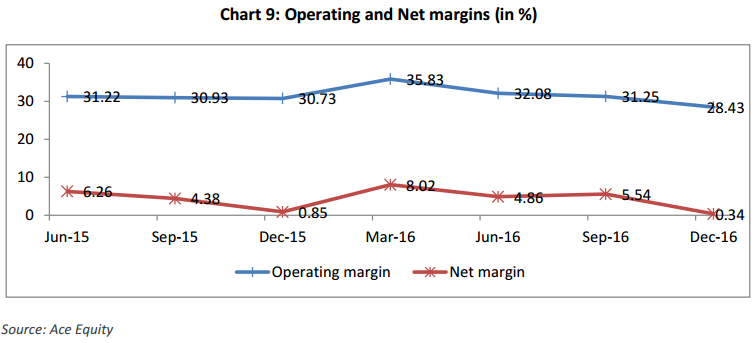

The telecom industry’s operating margin stood at 28.43 percent and net margin stood at 0.34 percent in the December 2016 quarter. The profitability reported by the industry was weakest compared to each of the past six quarters.

The telecom industry’s operating margin stood at 28.43 percent and net margin stood at 0.34 percent in the December 2016 quarter. The profitability reported by the industry was weakest compared to each of the past six quarters.

Bharti Airtel’s voice call services accounted for 71.6 percent of total revenue. Idea Cellular’s voice business formed 72.8 percent of the total revenues in the December quarter of 2016. Bharti Airtel and Idea Cellular have a market share of 40.5 percent in terms of subscribers.

Data services of Airtel accounted for around 22.8 percent. Idea Cellular’s data services accounted for 20.2 percent of revenue. SMS and other VAS services account for the balance revenues.

Data services of Airtel accounted for around 22.8 percent. Idea Cellular’s data services accounted for 20.2 percent of revenue. SMS and other VAS services account for the balance revenues.

ARPU of Bharti Airtel declined 10.4 percent to Rs 172 in the December 2016 quarter. Idea’s ARPU fell by 10.8 percent to Rs 157 due to Reliance Jio that will extend free services to Prime members till June 2017.

In the financial year 2017-18, some de-growth is expected in number of subscribers as the dual SIM users that subscribed to Reliance Jio may surrender one of the connections.

In the financial year 2017-18, some de-growth is expected in number of subscribers as the dual SIM users that subscribed to Reliance Jio may surrender one of the connections.

As of December 2016, the broadband subscriber base of mobile device users (phones and dongles) surged by 62.8 percent to 217.36 million compared to 133.49 million user base in April 2016.

As per market view in February 2017, the tariff for 1 GB of data in India is 3.5 USD whereas it is 10 USD in USA and 15 USD in China.

The rise in data usage is expected to increase the share of non-voice call revenues in total revenues of the telecom companies. This will be mainly on account of devices that are available at cheaper prices, rapid growth in social media, and increase in use of internet-based applications and change in user profile.

In the coming years, the ARPU of telecom companies is expected to improve backed by an increase in usage of data services and the new norm of bundled voice and data packages.

The consolidation in telecom industry is expected to support the financials of the industry and will also aid the companies to share their spectrum assets.

The Digital India program promoted by the government, increase in usage of e-wallets and banking applications are expected to increase the usage of mobile data consumption in the coming years.

Bharti Airtel leads the wireless subscriber base with a share of 23.58 percent, followed by Vodafone with 18.16 percent and Idea Cellular with 16.9 percent.

The other leading telecom players are BSNL with 8.59 percent, Aircel with 8.06 percent and Reliance Communications with 7.68 percent. Reliance Jio managed to gain subscriber share of 6.4 percent and the share for Telenor and Tata stood at 4.83 percent and 4.7 percent.

Baburajan K

editor@telecomlead.com