TCL Electronics Holdings and Sony have signed a memorandum of understanding on January 20 to explore strategic cooperation in the global home entertainment sector, signaling a major realignment in the TV industry.

According to TrendForce, the partnership includes plans to establish a joint venture that would manage Sony’s home entertainment business worldwide, combining TCL’s scale and supply chain strengths with Sony’s brand equity and technology expertise.

Under the proposed structure, TCL will hold a 51 percent stake in the joint venture, while Sony will own the remaining 49 percent. The venture will focus on televisions and home audio products across global markets. Both companies aim to finalize the agreement by the end of March this year, with operations expected to begin after regulatory approval in April 2027.

Sony to Leverage TCL’s Mini-LED and OLED Capabilities

TrendForce notes that in the short to medium term, Sony is likely to take advantage of TCL Group’s strong mini-LED supply chain. This could result in Sony’s premium TV portfolio shifting more decisively toward mini-LED models, helping the brand remain competitive in the high-end segment.

Over the longer term, Sony may also emerge as an important international sales channel for TCL CSOT’s OLED TV panel capacity. This would support TCL’s ambitions in OLED while allowing Sony continued access to advanced display technologies without heavy capital investment.

TCL Strengthens Global Position as Sony Faces Shipment Decline

TCL’s rise in the global TV market has been driven by vertical integration and cost efficiency. TrendForce data shows that TCL shipped more than 20 million TVs in 2019 and continued to expand its market share in subsequent years. By 2024, TCL became the world’s second-largest TV brand. Shipments are forecast to reach nearly 31 million units in 2025, representing a 15.7 percent share of the global market.

Sony, by contrast, peaked in 2010 with shipments of 21.5 million TVs and an 11.4 percent global market share, ranking third worldwide at the time. Intense price competition from Chinese brands has steadily eroded Sony’s volume. As a result, the company has shifted its focus toward mid- and high-end TVs. TrendForce predicts that by 2025, Sony’s TV shipments will fall below 4 million units, with market share dropping to just 1.9 percent, significantly reducing its global competitiveness.

Panel Procurement and Manufacturing Shift Toward TCL Ecosystem

Sony primarily sources mid- to high-end TV panels. Following the formation of the joint venture, procurement processes are expected to become more centralized and streamlined, with TCL CSOT likely playing a dominant role. TrendForce expects TCL CSOT’s panel supply share to rise meaningfully. AUO, which has strengthened its collaboration with TCL in recent years, may also benefit from increased demand for premium panels and see a recovery in shipment volumes.

On the manufacturing side, around 45 percent of Sony’s TVs are produced in-house, while roughly 55 percent are outsourced. Historically, Foxconn handled about 80 percent of Sony’s outsourced TV production, but it has recently reduced its involvement in TV OEM operations. At the same time, MOKA, a subsidiary of TCL Group, has been expanding its manufacturing capacity and targeting global brands. This positions MOKA as a likely primary OEM partner for Sony’s future TV lineup, further deepening Sony’s reliance on the TCL ecosystem.

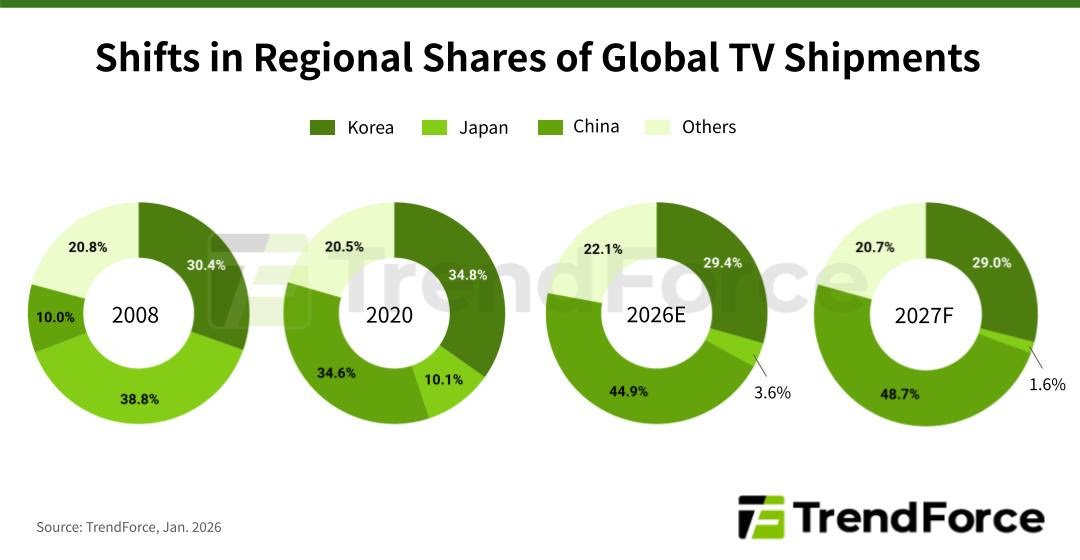

Chinese Brands Near 50 Percent Global TV Market Share

Japanese brands once accounted for nearly 40 percent of the global TV market. However, rapid expansion by Chinese manufacturers and sustained price competition have forced companies such as Toshiba, Funai, and Panasonic to license or divest their TV businesses. TrendForce forecasts that by the time the TCL-Sony joint venture becomes operational in 2027, Chinese brands will collectively approach a 50 percent share of the global TV market.

BABURAJAN KIZHAKEDATH