Latin America is emerging as one of the fastest-growing media and entertainment markets globally, with total revenues forecast to reach $65 billion in 2026, marking a 10.7 percent year-on-year increase, according to new data from Omdia. The findings were presented by Maria Rua Aguete, Head of Media and Entertainment at Omdia, during Content Americas.

This growth rate significantly outpaces that of the United States, where media revenues are expected to rise by 6.9 percent to $453 billion over the same period. Omdia attributes Latin America’s rapid expansion to accelerating adoption of online video, the dominance of advertising-led business models, and the emergence of innovative content formats such as microdramas.

Brazil and Mexico Lead LATAM Media Expansion

Brazil and Mexico are at the center of Latin America’s media growth. Brazil has become the third-largest FAST market worldwide by revenue, generating $152 million, behind only the United States and the United Kingdom. FAST adoption is also strong in terms of usage, with Mexico and Brazil ranking among the heaviest users globally. Omdia data shows that 53 percent of consumers in Mexico and 40 percent in Brazil use FAST services regularly.

Maria Rua Aguete said the region is demonstrating how innovation can translate directly into engagement and monetization. She highlighted the rise of FAST platforms and the integration of microdramas into services such as TelevisaUnivision’s ViX as clear indicators of how Latin America is reshaping the global media landscape.

Streaming Dominance and Mobile-First Discovery

Netflix continues to dominate the Latin American streaming market, accounting for nearly 50 percent of total streaming revenues in the region. Its leadership is supported by the rollout of an ad-supported tier and effective bundling strategies that appeal to price-sensitive consumers.

Content discovery in Latin America is increasingly mobile-first. Platforms such as YouTube and Instagram Reels now reach 97 percent of adults aged 18 to 64 in Brazil, underlining the importance of short-form and mobile-native video in shaping viewing habits.

Microdramas Emerge as a Major Growth Driver

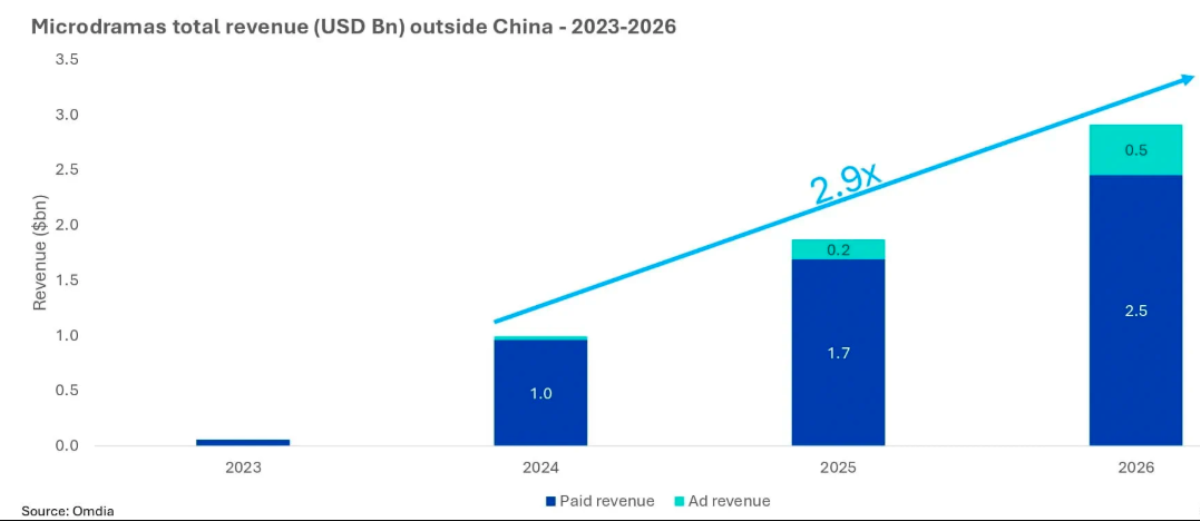

Microdramas are rapidly transforming the media ecosystem in Latin America and beyond. Omdia forecasts global microdrama revenues to reach $14 billion by the end of 2026, with $3 billion generated outside China. These vertically formatted, mobile-first stories are gaining traction due to low production costs and exceptionally high engagement levels.

Rua Aguete said microdramas are no longer a niche format but a core driver of mobile video consumption. She noted that on mobile devices, microdrama apps are generating more daily viewing time than some of the world’s largest traditional streaming platforms.

TelevisaUnivision’s ViX platform illustrates how microdramas can be integrated into AVOD and freemium models to expand reach, boost engagement, and increase total time spent. At the same time, global platforms such as Amazon Prime Video and Disney+ face the risk of losing further mobile engagement to dedicated microdrama apps like DramaBox and ReelShort, which are gaining momentum across the region.

Advertising Becomes the Primary Growth Engine

Advertising has become the central driver of media growth in Latin America. In 2025 alone, $42 billion of global online video revenue expansion came from ad-driven models, reflecting a clear shift away from traditional television and purely subscription-based strategies.

This trend highlights the growing importance of AVOD, FAST, and hybrid monetization models in Latin America, where strong advertising demand aligns well with mobile-first consumption patterns.

Strategic Implications for Global Media Players

As global media and entertainment revenues approach $1.2 trillion in 2026, major streamers including Netflix, Amazon Prime Video, and Disney+ face mounting pressure to narrow the mobile engagement gap with social platforms such as YouTube and TikTok, where users spend more than an hour per day.

Mobile-native formats like microdramas offer a strategic opportunity to capture this engagement without undermining premium long-form content. With online video revenues in Latin America projected to reach $34 billion in 2026, the region is not only keeping pace with global trends but is increasingly setting the benchmark for the future of media growth.

BABURAJAN KIZHAKEDATH