The streaming market in The Netherlands is entering a new phase of maturity and consolidation, with audiences showing high levels of engagement but increasingly selective viewing habits. According to recent market data from The Fabric, 87 percent of Dutch households access online video platforms, with young adults aged 16–24 leading the way at a 96 percent engagement rate.

Subscription Models Outpace Ad-Supported Streaming

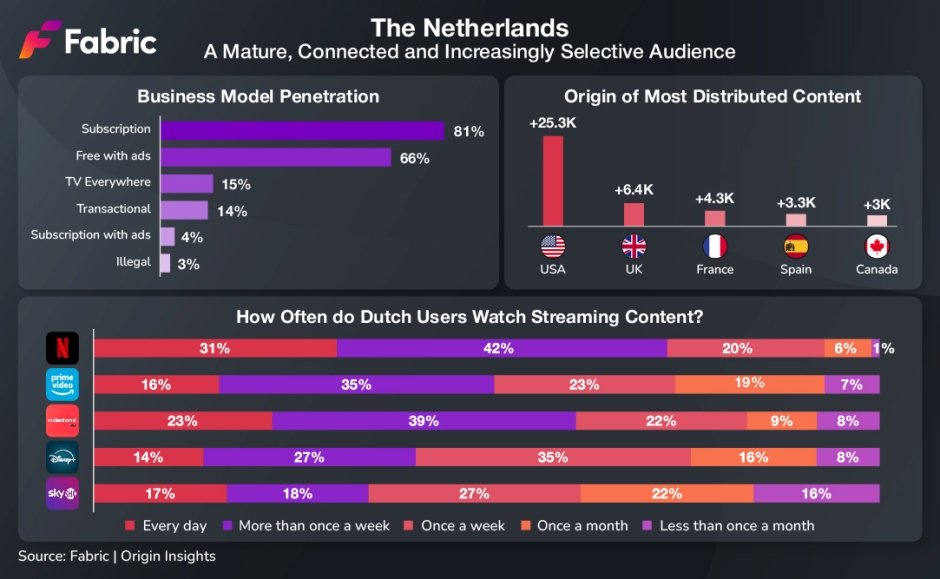

Unlike the broader EMEA region, where free-with-ads models dominate with 69 percent share, Dutch viewers strongly prefer subscription-based streaming. Around 81 percent of households choose paid platforms, spending an average of 10 hours per week watching subscription content as of Q4 2024. Notably, 56 percent of households say they are willing to pay higher fees to avoid advertising interruptions, making the Netherlands one of Europe’s most subscription-driven streaming markets.

Global Content Dominates Over Local Offerings

International content continues to shape the streaming landscape. Around 90 percent of titles available in The Netherlands are sourced from abroad, with the United States leading with over 25,000 titles, followed by the U.K. (6,000+) and France (4,000+). Local Dutch productions make up just 5 percent of available catalogs on global platforms such as Netflix, Apple TV+, and Prime Video.

Despite its smaller library of 2,700 titles, Dutch-owned Videoland stands out as the only local platform in the top five, achieving 26 percent household penetration. Its success is fueled by popular localized genres, particularly reality TV, even though its subscription price (USD 12.90) is about 22 percent higher than Netflix (USD 10.56).

Viewing Preferences Differ by Age and Device

Generational differences strongly influence platform and device preferences. Users aged 25–34 typically subscribe to six platforms, compared to just three among those over 55. Younger viewers aged 16–24 favor Prime Video, while Netflix dominates among 25–34 and 44+ audiences. YouTube is most popular with the 35–44 age group.

Device usage shows similar divides: while 70 percent of households stream primarily on Smart TVs, 58 percent of 16–24-year-olds prefer smartphones as their main viewing device.

Genres and Upcoming Releases Drive Audience Engagement

Drama and comedy remain dominant genres across platforms, but crime leads as the most-watched category, with 56 percent of Dutch viewers favoring it. Prime Video and Apple TV+ have the largest crime catalogs, with 2,400 and 2,000 titles, respectively. Recent hits include Dope Thief (Apple TV+), Patience (Prime Video), and Netflix’s The Breakthrough.

Looking ahead, 181 new titles are set to launch across Dutch streaming platforms before the end of 2025. Netflix leads with 51 percent of these upcoming releases, followed by Disney+ (18 percent), Prime Video (16 percent), Apple TV+ (12 percent), and HBO Max (3 percent). Highly anticipated shows include Wednesday Season 2 (Netflix), Gen V Season 2 (Prime Video), and Lilo & Stitch (Disney+).

The Dutch Streaming Market: Mature but Selective

The Netherlands stands out as a highly connected and subscription-driven market, with viewers showing a clear willingness to pay for premium experiences. While global content dominates, the success of Videoland proves there is still room for localized platforms that cater to unique audience tastes. As platform competition intensifies and new titles arrive, Dutch audiences are likely to continue shaping one of Europe’s most distinctive streaming landscapes.

Baburajan Kizhakedath