Spotify has revealed how it achieved a 20 percent increase in revenue for the second quarter of 2024, reaching €3.81 billion.

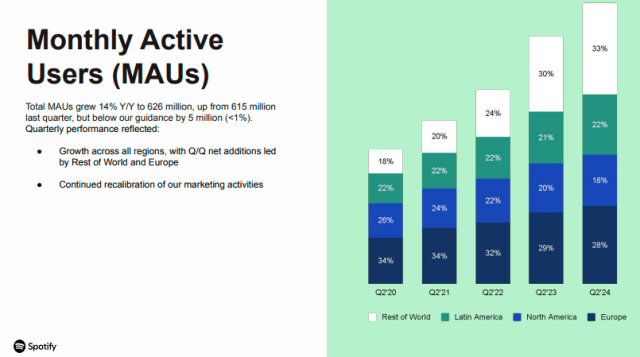

Despite this financial growth, Spotify fell short of its target for monthly active users (MAUs), achieving 626 million instead of the projected 631 million.

Spotify has revealed new experiences and offerings for users and advertisers have positively impacted its revenue growth:

# Expanded video podcast catalog to more than 250,000 shows

# Incorporated over 250,000 audiobook titles into Premium offering in Canada, Ireland and New Zealand Introduced Basic plan in Australia, the United Kingdom and the United States to give eligible users the option for ad-free music listening without audiobook listening time

# Introduced Creative Lab, a new in-house ad creative agency and Quick Audio, a generative AI tool for advertisers

Key Financial Highlights:

Revenue: Rose by 20 percent to €3.81 billion.

Profit: Increased by 45 percent year-over-year to €1.11 billion ($1.21 billion), marking a record quarterly profit.

Gross Profit Margin: Expanded to 29.2 percent from 27.6 percent in the previous quarter.

User and Subscription Metrics:

Monthly Active Users (MAUs): Reached 626 million (up 14 percent), slightly below the target of 631 million.

Paying Subscribers: Increased to 246 million (up 12 percent)

Premium Revenue grew 21% to €3,351 million, reflecting subscriber growth of 12% and a Premium ARPU increase of 8% to €4.62.

ARPU performance was driven by price increase benefits, partially offset by product/market mix.

Ad-Supported revenue grew 13%, reflecting double digit growth across all regions.

Music advertising growth was driven by gains in impressions sold and increased pricing.

Podcast advertising revenue growth was driven by growth in impressions sold across Original and Licensed podcasts and the Spotify Audience Network, partially offset by softer pricing.

The Spotify Audience Network saw Q/Q growth in participating publishers and advertisers.

CEO Remarks:

CEO Daniel Ek highlighted the company’s diversified subscription offerings, contributing to the growth in paying subscribers. “We’re moving from one-size-fits-all to having something for everyone,” Daniel Ek told Reuters, mentioning various plans tailored for students and shared households.

Cost-Reduction and Marketing Strategy:

Spotify’s record profit can be attributed to significant cost reductions, including layoffs and cuts to its marketing budget implemented last year. The company also focused on growing its user base through promotions and new investments in podcasts.

Despite the missed MAU target, Spotify experienced user growth across all regions. Ek addressed the shortfall, attributing it to the “continued recalibration” of marketing activities. “It’s definitely something we take very seriously, if we miss our own forecasts,” he said. “For me, it’s a question of when, not if. We will return to strong MAU growth, I feel good about it.”

Overall, Spotify’s second-quarter results reflect its strategic focus on cost management and subscription diversification, even as it works to regain momentum in user growth.

Baburajan Kizhakedath