The latest report by Omdia has revealed the business trends and consumer buying patterns in the music industry.

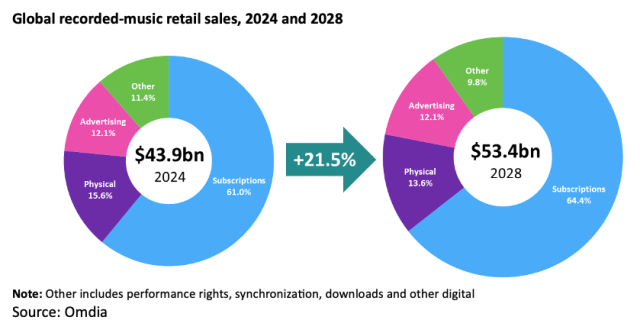

Revenue from music sales is projected to reach $43.9 billion in 2024 and surpass the $50 billion mark by 2027, reaching $53.4 billion by 2028. These figures encompass consumer spending on physical and digital formats, services, and trade revenue from advertising, performance rights, and synchronization.

Subscription services, including major digital music platforms like Spotify, Apple Music, and YouTube Music, are anticipated to be the primary growth drivers, with a 10.4 percent increase this year to $26.8 billion, up from $24.3 billion in 2023.

Subscription revenue of music industry is forecasted to exceed $34.4 billion by 2028, with a compound annual growth rate (CAGR) of 7.2 percent over the period.

Advertising revenue for music industry is predicted to grow faster than physical sales over the next five years, with a 5.7 percent CAGR compared to 2 percent for physical sales. Despite this, physical sales will remain the second-largest source of recorded music revenue.

Spotify Technology’s annual revenue for 2023 was $14.337 billion, a 16.04 percent increase from 2022. Spotify had 236 million premium subscribers worldwide last year.

It is estimated that Apple Music has 93 million subscribers in 2023. Apple Music has generated $9.2 billion in revenue in 2023, according to estimates.

Revenue of YouTube Music was $1.07 billion in 2023, according to research reports. YouTube Music has reached 100 million subscribers in 2023.

Though growth in music industry is expected over the next five years, the annual growth rate will slow to just 0.2 percent by 2028, when physical sales will be valued at $7.3 billion. Combined audio and video advertising is set to increase by 8.1 percent this year to $5.3 billion from $4.9 billion in 2023, reaching $6.5 billion by 2028.

China is poised to ascend in the global rankings in the music industry over the next five years, driven by a significantly higher CAGR compared to Europe’s leading markets, the UK and Germany. China is expected to surpass Germany by 2026 and the UK by 2027. Although Japan will remain Asia’s leader and the world’s second-largest recorded music market by the end of 2028, it is projected to be overtaken by China as early as 2029.

Omdia forecasts that China’s retail music sales will exceed $2 billion this year, marking a 22.1 percent increase to $2.4 billion from $1.97 billion in 2023. Music sales in China are expected to reach $3 billion in 2026 and $4 billion in 2028.

“Retail music sales will have risen for 14 consecutive years by the end of 2028. Each year will mark a new record with previously piracy-affected countries now contributing significantly to recorded music revenue. China is the one to watch as sales in the country are expected to more than double in just five years,” said Simon Dyson, Senior Principal Analyst at Omdia.

Baburajan Kizhakedath