The streaming services market in the United States continues to grow and transform, but not all business models are thriving equally. A new industry report from Fabric Data Company reveals a sharp contrast between the performance of subscription-based streaming services and transactional platforms — where users pay individually to buy or rent content.

Transactional vs. Subscription Streaming: Diverging Trends

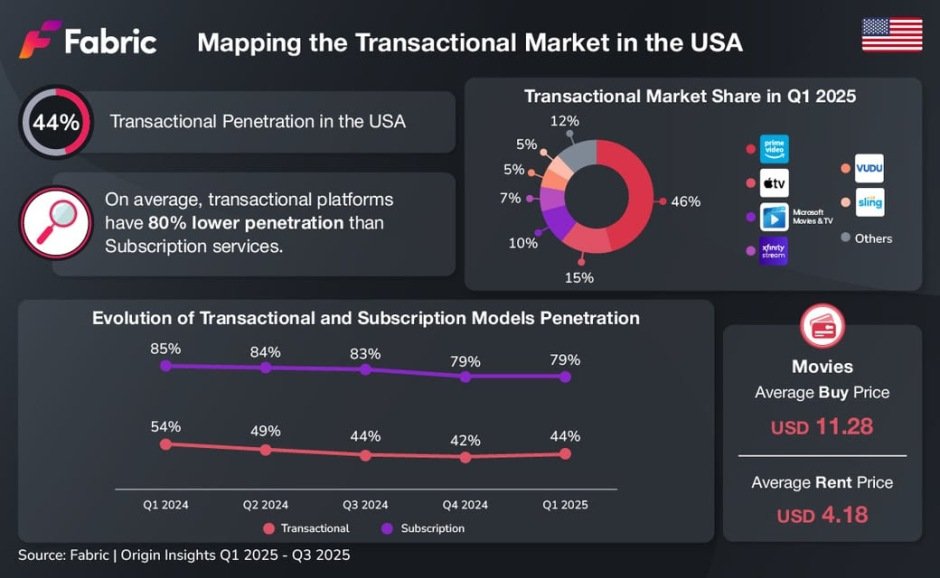

In 2025, about 44 percent of U.S. households engaged with transactional services. While this is a significant audience, it falls well short of the 79 percent penetration for subscription platforms such as Netflix, Disney+, and Amazon Prime Video. Transactional models experienced a 19 percent year-over-year decline in penetration, the steepest drop of any segment in the industry. By comparison, subscriptions declined by just 7 percent over the same period, underscoring the stronger consumer preference for unlimited, flat-rate viewing.

This downward trend comes despite a brief rebound in early 2025, signaling that the transactional model is under sustained pressure as audiences seek more cost-effective and convenient streaming options.

Market Leaders and Competitive Landscape

Within the U.S. transactional streaming market, Amazon Prime Video leads decisively, capturing a 46 percent share in Q1 2025. Apple TV follows at 15 percent. Microsoft Movies & TV, which launched in 2012 and served as Microsoft’s flagship entertainment marketplace, held the third position with a 10 percent share at the start of 2025.

Content library of Microsoft Movies & TV was significant: over 42,700 titles globally and more than 36,000 available in the United States at the time of its closure. This included more than 29,000 movies and 7,000 series. However, growth had slowed markedly. Between 2021 and 2023, the catalog expanded steadily, but 2024 saw only about 100 new assets added. By mid-2025, the catalog actually contracted by nearly 1,000 titles, signaling waning investment and shrinking relevance.

Pricing Pressures Undermined Microsoft’s Position

One of the clearest factors behind Microsoft Movies & TV’s decline was pricing. Data from Fabric’s Origin Insights for Q2 2025 showed that the platform’s average movie purchase price was $14.54 —about 58 percent higher than the $9.18 average on Amazon Prime Video and Apple TV. Rental pricing was also higher, averaging $4.34 compared to competitors’ $3.70.

In a crowded field of more than 90 transactional platforms in the U.S., such price gaps are critical. Consumers faced little reason to pay more when comparable content was readily available elsewhere at lower prices. In fact, Microsoft’s content overlapped heavily with the market leaders: 83 percent of its catalog matched titles of Amazon Prime Video, and 79 percent overlapped with Apple TV’s.

Global Discontinuation and Customer Impact

In July 2025, Microsoft announced the global discontinuation of Microsoft Movies & TV. Users can no longer buy or rent new titles, though previously purchased or rented content remains accessible. The closure ended a 13-year run for a service that once aimed to make Microsoft a key player in digital entertainment.

The decision reflects a strategic pivot away from direct-to-consumer video sales and rentals. With limited content differentiation, high prices, and shrinking market share, maintaining the service was no longer competitive against major players that bundle transactional options with expansive subscription ecosystems.

Lessons for the Streaming Industry

Microsoft’s exit underscores critical lessons for all transactional streaming platforms:

Competitive Pricing Is Essential: Even a strong brand cannot sustain a premium if audiences can find the same content cheaper elsewhere.

Content Differentiation Drives Loyalty: High catalog overlap means little incentive for consumers to choose a more expensive service.

Market Dynamics Require Agility: Rapid shifts in consumer behavior — such as the growing preference for subscriptions — demand flexible strategies.

As the U.S. streaming market continues to expand, platforms that thrive will be those that balance affordability with exclusive, high-quality content. The closure of Microsoft Movies & TV is a clear signal that without these advantages, even long-standing services risk losing relevance in an increasingly competitive landscape.

Baburajan Kizhakedath