User retention has become a critical factor in determining success in the highly competitive streaming industry.

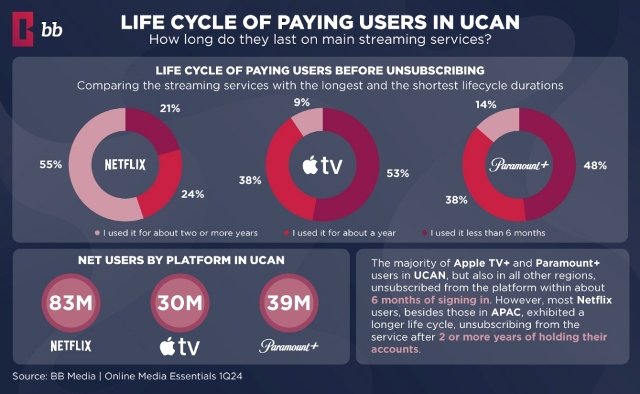

Among major players, Netflix has consistently outperforms rivals like Apple TV+ and Paramount+ in retaining subscribers. While many Apple TV+ and Paramount+ users cancel their subscriptions within six months, Netflix users — except in the APAC region — tend to stay subscribed for over two years, according to BB Media.

Why APAC is an Exception to Netflix’s Retention Success

The APAC region presents a unique challenge for Netflix. Unlike its global dominance, Netflix’s retention rate in APAC lags due to several factors. For one, APAC was the last region Netflix entered, only launching there in 2016. Furthermore, Netflix remains unavailable in China, one of the largest markets in the region, which limits its growth and retention potential.

What Drives Netflix’s Global User Retention?

Early Market Entry:

Netflix’s early expansion has been key to its success. Launching in the U.S. in 2007 and expanding globally by 2016 gave Netflix a head start in the streaming market. In comparison, Apple TV+ (2019) and Paramount+ (2021-2022) entered during a much more competitive era, giving Netflix a significant advantage in retaining customers.

Extensive Content Library:

Netflix boasts a vast and diverse content library, which plays a pivotal role in keeping subscribers engaged. The platform’s global catalog is 302 percent larger than Paramount+ and an incredible 8,087 percent larger than Apple TV+. With 10 times more original titles than Apple TV+ and 45 times more than Paramount+, Netflix ensures that its users have constant access to fresh and varied content, which contributes to its superior retention rates.

Genre Preferences and Appeal:

Netflix’s genre variety also helps retain users. While Apple TV+ only features two of the top five globally preferred genres — Drama and Comedy — Paramount+ offers better regional variety, especially in APAC and LATAM, with popular genres like Comedy, Drama, Action, and Adventure. Although Netflix’s genre appeal is strongest in North America (UCAN), its wide-ranging library helps it appeal to a global audience despite regional content preferences.

The Role of Pricing in User Retention

Pricing strategies are also essential in determining user retention. Paramount+ is the most affordable streaming service across most regions, except in EMEA, where Netflix offers cheaper standard plans. Netflix’s ad-supported plan — available in EMEA and LATAM at an average price of $4.72 USD in LATAM — offers users a more affordable option, helping retain cost-sensitive customers. By comparison, Apple TV+ and Paramount+ standard plans are priced higher in certain regions, with Apple TV+ at $6.74 USD and Paramount+ at $4.53 USD.

While Netflix’s ad-supported plans in EMEA are $3 USD cheaper than its competitors’ standard plans, Paramount+ provides similar ad-supported plans in select markets like Australia and Canada.

Why Netflix Continues to Lead

Several factors contribute to Netflix’s leading position in global user retention. Its vast content library, broad genre offerings, and competitive pricing help the platform stay ahead in a crowded market. Netflix’s ability to adapt to regional preferences and continually innovate in content delivery has made it a top choice for millions of subscribers worldwide.

As the streaming industry continues to evolve, Netflix’s balanced approach — offering diverse content and competitive pricing — will be crucial to its continued success in retaining users. Although Apple TV+ and Paramount+ have made inroads in some regions, Netflix’s well-rounded strategy ensures it remains the leader in global streaming.

Netflix achievements

Netflix has added 5.1 million new streaming subscribers in the third quarter of 2024, as the streaming giant continues to expand its global audience. The subscriber boost comes ahead of the highly anticipated release of the second season of the hit Korean drama Squid Game, set for late December, which is expected to drive further growth during the holiday season.

While Netflix outpaced expectations with its new subscribers, the 5.1 million additions were lower than the 8.76 million added in the same quarter last year. This signals a slowdown in Netflix’s pace of subscriber growth, particularly in its largest market, the U.S, Reuters news report said.

“A steep decline in net new subscribers is concerning,” said Forrester analyst Mike Proulx. “While there’s room for international growth, in the U.S., things are getting tapped out.” Still, Netflix expects a strong holiday season, bolstered by new releases, to drive higher subscriber numbers in the final quarter.

Ad-Supported Plans Drive New Signups

Netflix’s ad-supported service played a significant role in its Q3 growth, accounting for over 50 percent of new signups in regions where the tier is available. This aligns with the company’s strategy to increase revenue through ad-supported subscriptions, although the company doesn’t expect advertising to become a major revenue driver until 2026.

Netflix reported 15 percent rise in revenue for the quarter to $9.825 billion. The video company’s operating margin hit 30 percent, up from 22 percent a year earlier, reflecting its improved profitability amid slowing subscriber growth.

Programming and Live Events to Boost Engagement

Netflix’s content production has ramped up following the end of last year’s Hollywood strikes, with user engagement averaging two hours of daily viewing per member. The company is exploring live events, including a high-profile fight between YouTube star Jake Paul and Mike Tyson in November, and two National Football League games on Christmas Day, as a way to attract advertisers and drive viewership.

Price Increases in Key Markets

Netflix will raise prices in Spain and Italy, following recent increases in several European markets and Japan. Despite these hikes, Co-CEO Ted Sarandos emphasized that Netflix will not bundle its service with other platforms, like Disney+ or Warner Bros. Discovery, preferring to maintain its standalone value proposition.

As Netflix continues to lead the global streaming market, its ability to adapt — through ad-supported plans, strategic pricing, and live events — will be critical in maintaining its position amid growing competition.

Baburajan Kizhakedath