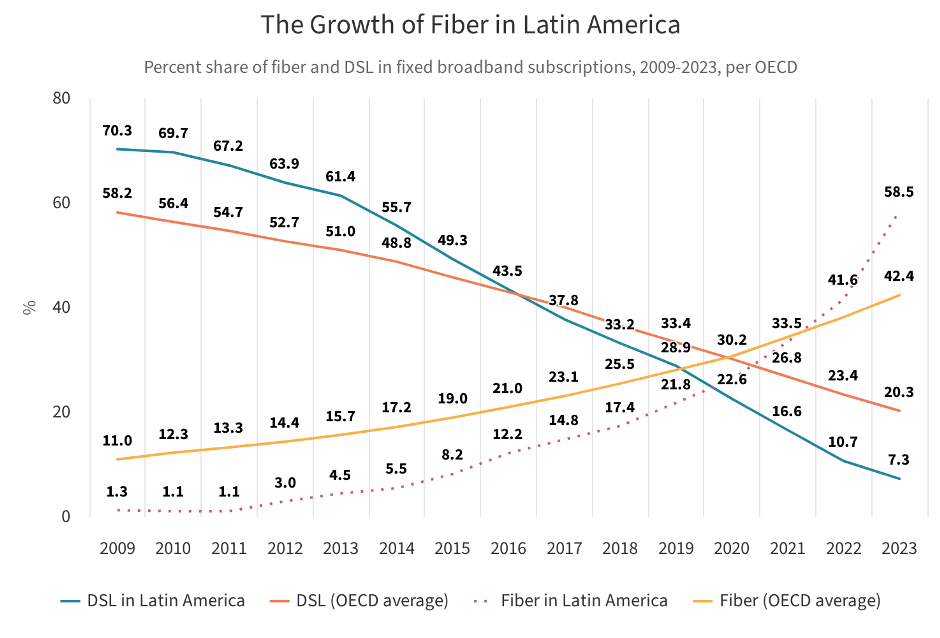

Fiber networks are expanding rapidly across Latin America, offering residents faster internet and serving as a backbone for Wi-Fi access points. However, the growth of fiber faces challenges, particularly outdated Wi-Fi standards, which require upgrades to fully leverage higher-speed connections, according to Ookla report.

Between 2020 and 2024, fiber subscriptions in Mexico, Chile, Colombia, and Costa Rica increased by 258 percent, while Brazil ranked fifth globally in year-over-year growth of fixed broadband subscriptions per 100 inhabitants from June 2023 to June 2024, according to OECD data.

Latin America is seeing significant growth in fiber-based internet, reflected in rising fixed broadband speeds across its most populous countries.

In Brazil, 77.2 percent of fixed connections were fiber as of November 2024, up 8.8 percent from the previous year, with smaller regional ISPs collectively providing 67 percent of these connections, often outpacing larger incumbents like Telefónica’s Vivo and América Móvil’s Claro.

In Mexico, major international players such as Claro have driven the fiber transition, migrating 85 percent of their broadband customers to fiber, which has more than tripled median download speeds over five years.

Meanwhile, countries like Colombia, Chile, and Brazil are also adopting neutral host network models, where a shared fiber network is leased to multiple service providers. Despite these regional differences, the overall outcome is clear: fiber adoption is rapidly expanding, leading to faster internet speeds across Latin America.

The growth of fiber in Latin America allows ISPs to offer faster, more reliable service plans, but Wi-Fi networks often limit the actual speeds customers experience.

Speedtest Intelligence data shows that fiber users connected via Ethernet can nearly double their download speeds compared to Wi-Fi, yet Wi-Fi remains about 20 times more popular. As a result, the Wi-Fi standard a customer uses is crucial for realizing fiber’s full potential.

For example, Chile’s Mundo offers plans up to 50 Gbps, but only the latest Wi-Fi standards — Wi-Fi 6 or Wi-Fi 7 — can support these speeds. Using older Wi-Fi, such as Wi-Fi 4, severely restricts performance, meaning users can’t fully benefit from ultra-fast fiber connections.

Wi-Fi adoption in Latin America shows clear progress but also highlights persistent gaps. Chile and Uruguay lead in Wi-Fi 6 deployment, while Wi-Fi 4 still accounts for at least 20 percent of connections in many markets, and over 40 percent in parts of Central and South America.

Speedtest data confirms that Wi-Fi 6 delivers the fastest speeds, often supported by fiber networks, whereas slower technologies like xDSL may underpin many Wi-Fi 4 connections.

Some operators, including América Móvil, show early Wi-Fi 7 usage, but adoption is minimal. Wi-Fi 6 in the 6 GHz band (6E) is also scarce, with regulatory debates ongoing over allocation for Wi-Fi versus licensed cellular use. Many operators still have a significant share of Wi-Fi 4 users, particularly with routers from Huawei and TP-Link, and upgrading these could significantly enhance user experience. Customer satisfaction reflects this trend: in Mexico, Wi-Fi 4 users rated their experience 2.9/5, Wi-Fi 5 users 4.2, and Wi-Fi 6 users 4.7/5, underscoring the benefits of newer Wi-Fi standards.

The global adoption of Wi-Fi 7 is still in its early stages but growing, with the U.S. reaching under 2 percent of fixed samples in Q1 2025 and countries like France, Switzerland, and Denmark leading Europe by the end of 2024.

Despite fiber availability, many countries — including Spain, Portugal, and Ireland —have large numbers of older Wi-Fi 4 and Wi-Fi 5 connections. In Latin America, the benefits of fiber networks can only be fully realized if Wi-Fi technology advances alongside them.

By upgrading outdated Wi-Fi 4 connections and promoting newer standards like Wi-Fi 6 and Wi-Fi 7, operators can deliver faster, more reliable service, offer competitive tiered plans, and strengthen customer loyalty.

Baburajan Kizhakedath