In 2023, Latin America saw an unprecedented surge in optical fiber deployment, covering 231 million homes and surpassing HFC networks, — powered by investment in network. However, the rapid expansion led to an oversupply, with more fiber than occupied homes, prompting strategic shifts and infrastructure sharing across the region.

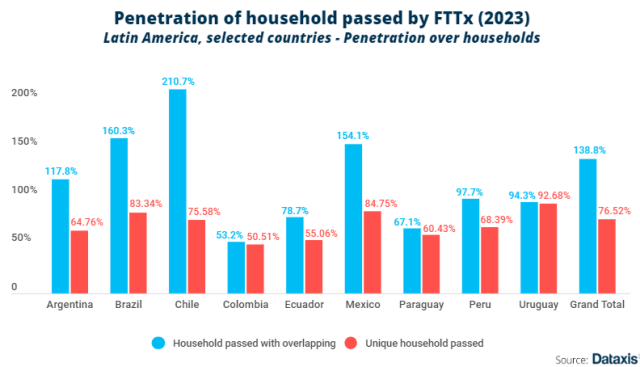

The proliferation of optical fiber in Latin America has reached 139 percent penetration, outpacing the actual number of homes. This surplus is attributed to overlapping network layouts in major urban areas, leaving a substantial portion of connections unutilized, according to Dataxis analysis report.

The proliferation of optical fiber in Latin America has reached 139 percent penetration, outpacing the actual number of homes. This surplus is attributed to overlapping network layouts in major urban areas, leaving a substantial portion of connections unutilized, according to Dataxis analysis report.

Adjusting for overlaps, approximately 76.5 percent of households now fall within the optical footprint, marking a significant increase since 2019. The industry’s investment, totaling around $41.9 billion, covered network deployment and customer connections.

Forecasts by Dataxis suggest that by 2028, an additional $30 billion investment would be needed to wire 87 percent of homes with fiber.

Since 2021, fiber has emerged as the primary broadband network in Latin America region, overtaking HFC networks driven by cable operators. This transition was catalyzed by the delays and higher costs associated with DOCSIS 4.0, coupled with technological advancements in historical HFC lines.

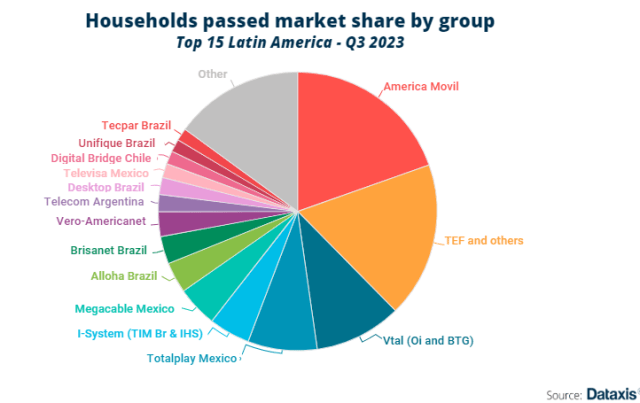

In 2023, fiber coverage surpassed HFC networks by fourfold, varying across countries in Latin America. Major cable operators like Claro Brazil and Mexico’s Megacable spearheaded this shift by deploying substantial fiber networks, reaching millions of homes.

The surplus capacity within these networks prompted a reconsideration of strategies and opportunities among top broadband operators. By 2023, only 31 percent of deployed fiber had been occupied, leading to discussions on network idleness. Eliminating duplicate footprints revealed that 56.3 percent of homes within the optical footprint were subscribed to a provider, leaving a surplus of resources.

The surplus capacity within these networks prompted a reconsideration of strategies and opportunities among top broadband operators. By 2023, only 31 percent of deployed fiber had been occupied, leading to discussions on network idleness. Eliminating duplicate footprints revealed that 56.3 percent of homes within the optical footprint were subscribed to a provider, leaving a surplus of resources.

To address this, some operators slowed down new network deployments to focus solely on user connections. Examples include Totalplay in Mexico and Alares, Alloha Fibra, and Desktop in Brazil. Additionally, industry consolidation occurred, such as the merger between Vero Internet and Americanet in Brazil, while others, like Entel Chile, considered selling their fiber units to redirect focus toward clients.

A potential avenue for this surplus bandwidth lies in supporting emerging 5G networks, viewed not just as a mobile development but as an ecosystem requiring robust terrestrial support. Operators spun off wholesale fiber optic units and partnered with investment funds to meet this demand.

Telefonica, through its subsidiaries in various Latin American countries, made strategic moves with investment funds like CDPQ, KKR, and BTG Pactual. However, concerns arose in 2023 regarding the escalating operational expenses in renting resources amidst inflation and devaluation.

Furthermore, the oversupply spurred infrastructure-sharing models. Telefónica (Argentina) exemplified this by forming alliances with iPlan Networks, Metrotel, and Sion to enhance network efficiency, challenging the traditional ‘one network, one operator’ paradigm. Similarly, Vrio, owner of DirecTV Latin America, pursued regional reach through a product (DFibra) developed entirely over third-party networks, Carlos Blanco, Senior Analyst at Dataxis, said.

America Movil and Telefonica achieved extensive fiber optic coverage, each passing around 40 million homes across multiple markets in Latin America. While America Movil expanded organically, Telefonica’s reach resulted from various models, including organic growth and partnerships with investment funds.

The proliferation of optical fiber, though a remarkable advancement, has triggered industry-wide adaptations and strategic realignments to optimize resources and address the challenge of surplus capacity in Latin America’s broadband landscape.