The growth of 5G Fixed Wireless Access (FWA) has significantly transformed the U.S. broadband market, presenting both opportunities and challenges for mobile operators and consumers, according to a report from Opensignal.

Key insights into this evolution include the following:

Market Impact and Growth

Rapid Expansion: Since mid-2022, 5G FWA has absorbed all broadband subscriber growth in the U.S., adding more than 600,000 to 700,000 net subscribers per quarter. This is notable in a mature market with 97 percent broadband adoption.

Network Efficiency: U.S. mobile operators, particularly T-Mobile US and Verizon, have managed to expand their broadband services without significant incremental network investments. Their ability to maintain and even improve 5G speeds despite the increased FWA subscriber base highlights their effective network management strategies.

Factors Contributing to Success

Lower Costs: FWA offers a cost advantage over traditional wireline broadband, making it an attractive option for consumers.

Existing Infrastructure: Mobile operators leverage their existing retail channels and subscriber base to market FWA, simplifying the process of reaching potential customers.

Spectrum Availability: Plentiful mid-band spectrum and efficient load management have allowed U.S. operators to handle the additional traffic from FWA without degrading mobile service quality.

Competitive Landscape

Verizon and T-Mobile: Leading the market, Verizon introduced 5G Home Internet in 2018 and expanded significantly in 2022, reaching over three million customers. T-Mobile launched its 5G Home Internet service in 2021, now serving over five million subscribers.

Strategic Moves: T-Mobile’s acquisition of Lumos aims to enhance its fiber infrastructure, whereas Verizon’s fiber network is concentrated in the Northeast. AT&T, although a newer entrant to the FWA market, is concurrently investing heavily in fiber upgrades.

Broader Market Trends

Increased Competition: The percentage of housing units passed by two or more high-speed broadband providers rose from 50 percent in Q1 2022 to 78 percent in Q4 2023. This translates to nearly 40 million more homes with multiple broadband options, intensifying market competition.

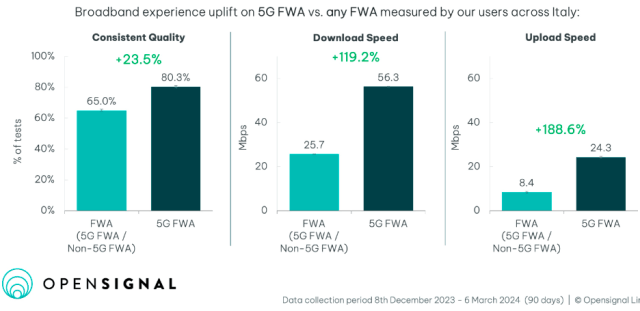

Mixed International Outcomes: The impact of FWA on mobile network performance varies globally. For example, India’s Reliance Jio experiences minimal impact from FWA, while Saudi Arabia’s Zain sees more pronounced effects depending on FWA penetration and usage patterns.

Zain used FWA as a strategic tool to disrupt the fixed broadband market. Zain’s 5G FWA customer base grew eight-fold in the first three years. Zain’s 5G traffic ratio to total mobile traffic reached 38 percent in January 2022. Zain recorded 30 percent increase in ARPU for wireless home customers in comparison of 4G to 5G.

Reliance Jio has used a dedicated network slice to provide 5G FWA services — which helps with managing the network congestion. Jio recently launched a streaming plan that includes 15 streaming apps with fixed broadband packages, highlighting its ability to handle the additional load coming from video streaming.

Baburajan Kizhakedath