The Global mobile Suppliers Association (GSA) has released its latest update on fixed wireless access (FWA) broadband services, highlighting significant growth in 5G adoption worldwide. According to the report, 526 operators in 183 countries and territories have announced FWA service offers using LTE or 5G, with 487 operators in 176 countries having launched services.

5G FWA Surpasses LTE in Adoption

The update added nearly 70 new FWA offerings, most of which rely on 5G technology, reflecting the global trend toward next-generation networks. While LTE-based FWA remains widely available, 462 operators in 179 countries continue to sell or invest in LTE FWA services, its adoption is gradually declining compared to 5G. LTE struggles to compete against fiber broadband, whereas 5G FWA services attract operators investing in newer, faster technology, GSA report said.

As of November 2025, 248 operators have launched 5G FWA services, up from 215 in June 2025. This represents just over 65 percent of the 384 operators who had announced 5G FWA launches or soft launches at the end of October 2025. The figures reflect net growth, masking removals due to company failures, mergers, spectrum expiries, or replacement of FWA products with MiFi devices and hotspots.

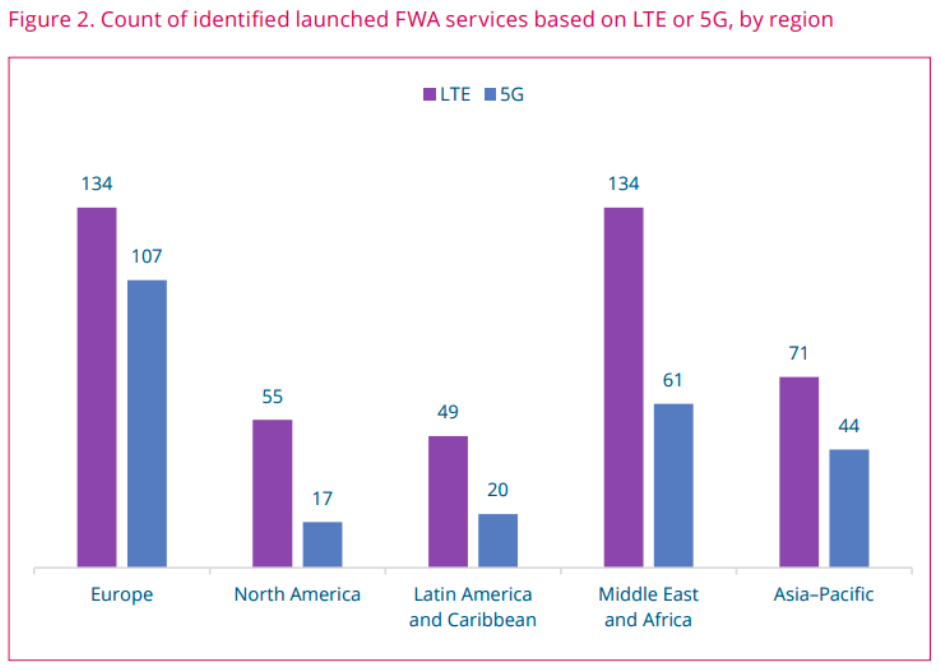

Regional FWA Deployments

Europe leads in FWA deployments, particularly across the 27 EU countries, with 107 commercially launched 5G FWA networks. The Middle East and Africa follow closely with 61 launched 5G FWA networks. Interestingly, Europe and the Middle East and Africa now have the same number of operators offering LTE FWA services.

An operator’s decision to introduce FWA services depends on several factors:

The availability and coverage of fixed-line broadband in the country or region.

Presence of underserved or remote areas with limited broadband access.

The operator’s own fixed network capabilities and technological readiness.

Competition, as rivals often launch FWA services in response to each other.

Country-Specific FWA Trends

United States: Leads the world in LTE FWA services, with 45 operators offering national or regional coverage, and more than 10 operators providing 5G FWA.

Slovakia: Second in LTE FWA offerings with 14 operators, and between six and 10 operators providing 5G FWA.

Nigeria: Nine operators actively marketing LTE-based FWA services.

Australia: Six to 10 operators providing 5G FWA services.

While LTE FWA sees broad availability across multiple operators in many countries, 5G FWA adoption remains concentrated, with fewer operators per country but higher performance and advanced network capabilities.

Global FWA Tariffs and Performance 2025: LTE vs 5G Trends and Insights

GSA’s analysis on fixed wireless access (FWA) tariffs and performance highlights evolving trends in LTE and 5G FWA services. The study reveals insights on pricing structures, speed expectations, portability, and device types, providing a comprehensive picture of the global FWA market in 2025.

FWA Tariff Structures: Volume vs Speed

FWA tariffs continue to evolve, with data volume remaining the primary differentiator for many operators.

LTE FWA: Over 40 percent of LTE operators offer volume-based plans, while just over 22 percent focus on speed-based tariffs. Only 12 percent of operators combine both volume and speed-based pricing.

5G FWA: Adoption is more balanced, with 24.1 percent of operators promoting speed-based tariffs and 23.3 percent volume-based. Plans combining both are offered by 12 percent of 5G operators.

The market has shifted from early speed-based tariffs for 5G toward increasingly popular volume-based plans, often including optional extras like roaming or additional voice calls. Despite “unlimited” claims, many offers are restricted by fair use policies or speed limits once data thresholds are exceeded.

GSA identified 105 LTE operators and 59 5G operators promoting unlimited FWA data, though small print details were often unclear. This represents 23.7 percent of both LTE and 5G operators, slightly down from previous surveys in June 2025.

Portability of FWA Devices

FWA services typically use mains-connected devices, excluding MiFi and battery-powered hotspots. Some devices allow nomadic usage, while others require fixed installation:

5G FWA: 34 offers marketed as portable, 80 tied to a fixed location, 141 unspecified.

LTE FWA: 117 portable, 167 fixed, and 174 unspecified.

Some operators provide both fixed and portable options, with separate tariffs for each, giving users flexibility depending on their needs.

FWA Service Speeds: LTE vs 5G

Operators are often opaque about real-world speeds, due to factors like distance from towers, interference, network load, and indoor obstacles. Nonetheless, GSA collected maximum and average speed data from operators globally:

LTE FWA:

Maximum download speeds: 1 Mbps to 2.5 Gbps

Average maximum speed: 152.1 Mbps, slightly up from 150.8 Mbps in June 2025

Average typical speed marketed: 37.3 Mbps

5G FWA:

Maximum download speeds: 50 Mbps to 5.4 Gbps, with 74 percent between 200 Mbps and 2.7 Gbps

Average maximum speed: 851.3 Mbps, up from 768.6 Mbps in June 2025

Average typical speed marketed: 140 Mbps, slightly lower than June 2025 but higher than November 2024

These figures highlight 5G’s significant performance advantage over LTE for FWA services, making it more attractive for consumers seeking high-speed broadband.

Device Types: Indoor vs Outdoor CPE

FWA services overwhelmingly use indoor customer premises equipment (CPE) for convenience and ease of installation:

Indoor CPE: 76 percent of services; 69.2 percent are internal only

Outdoor CPE: 18.4 percent of networks include outdoor support; 6.3 percent LTE-only, 4.1 percent 5G-only

Why 5G FWA is Gaining Momentum

Higher Speeds & Lower Latency: 5G FWA delivers faster broadband speeds and lower latency compared to LTE, making it suitable for homes and small businesses.

Expansion to Underserved Areas: Enables operators to provide broadband in regions lacking fiber connectivity.

Competitive Advantage: Launching 5G FWA can help operators differentiate themselves and respond quickly to rivals’ offerings.

Future-Proof Networks: 5G FWA supports advanced applications, including smart home services, remote work, and IoT solutions.

Conclusion

The global FWA market continues to grow, with 5G steadily outpacing LTE, particularly in regions like Europe, the Middle East, Africa, and select countries in North America and Asia-Pacific. While LTE-based services remain widely available, 5G FWA offers superior speed, reliability, and future-ready capabilities, driving operators to expand deployments despite fewer overall operators per territory.

Baburajan Kizhakedath