US fixed wireless access (FWA) services are showing early signs of performance pressure, with new data from Ookla highlighting a broad decline in download and upload speeds across all three major providers during the middle of 2025. The slowdown comes even as FWA adoption continues to surge, raising questions about whether seasonal factors alone explain the trend or if network congestion is beginning to emerge.

FWA speeds fall across all major US providers

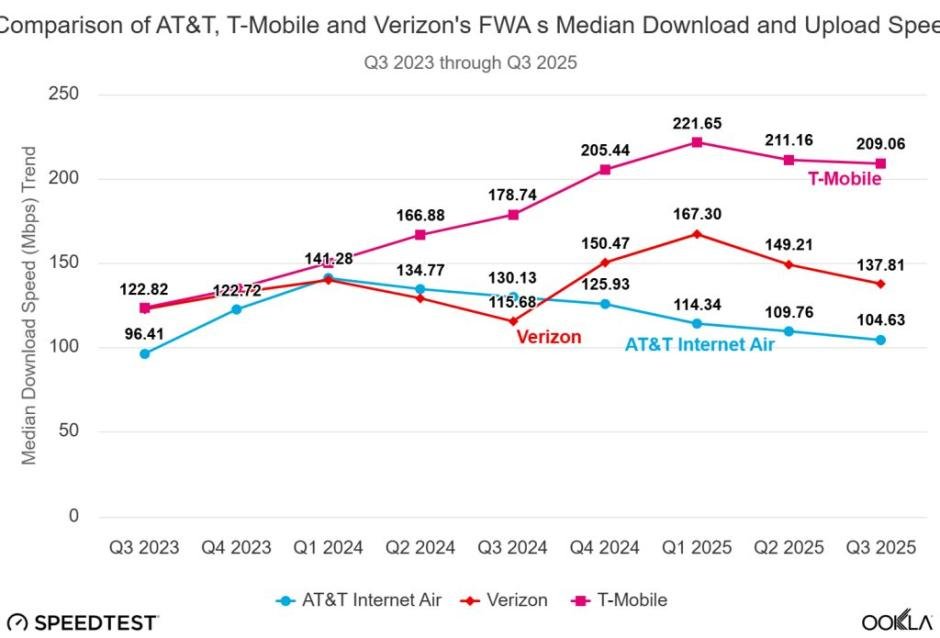

Ookla data shows a noticeable decline in download and upload speeds of FWA services from T-Mobile, Verizon, and AT&T during Q2 2025 and Q3 2025. This mirrors a similar pattern seen in Q2 and Q3 2024, when seasonal effects contributed to weaker performance.

However, the scale and consistency of the latest slowdown have renewed concerns that rapid FWA subscriber growth may be starting to impact network quality, Ookla report said.

T-Mobile, which continues to lead the US FWA market in overall performance, saw its download speed fall from 221.65 Mbps in Q1 2025 to 209.06 Mbps in Q3 2025. Verizon experienced a sharper decline, with download speeds dropping from 167.30 Mbps to 137.81 Mbps over the same period. AT&T’s FWA service also weakened, falling from 114.34 Mbps in Q1 2025 to around 104.36 Mbps in Q3 2025.

Upload speeds followed a similar downward trajectory. T-Mobile’s upload speed declined from 24.03 Mbps in Q1 2025 to 15.49 Mbps in Q3 2025. Verizon’s fell from 15.23 Mbps to 11.40 Mbps, while AT&T’s dropped from 13.13 Mbps to 9.25 Mbps.

Strong FWA growth raises congestion concerns

Despite the slowdown in speeds, demand for FWA remains strong. The top three providers added 1.04 million new FWA subscribers in Q3 2025 alone, taking the total US FWA customer base to 14.7 million. This means FWA now serves slightly more than twelve point five percent of the 117.4 million US households with broadband, according to US Census Bureau data.

This rapid uptake has long raised concerns among investors and network analysts. FWA services rely on the same 5G spectrum used for mobile connectivity, increasing the risk that heavy home broadband usage could affect both fixed and mobile performance, particularly during peak hours.

Seasonal factors still play a role

Seasonality remains a key factor in interpreting the data. RF engineers have long noted that FWA performance can degrade during spring and summer months due to foliage. Dense leaves on deciduous trees can weaken radio signals, especially in suburban and urban areas with tree-lined streets.

While this effect is most pronounced in higher frequency spectrum such as millimeter wave, it can also impact mid-band 5G, which is widely used for FWA coverage. This helps explain why similar declines were observed in Q2 and Q3 2024.

AT&T’s longer-term decline stands out

Data shows that Verizon and AT&T both experienced speed declines in mid-2024, but Verizon’s performance rebounded in Q4 2024. AT&T’s did not. AT&T Internet Air users have seen a steady downward trend from a median download speed of 141.28 Mbps in Q1 2024 to 104.63 Mbps in Q3 2025.

AT&T does not guarantee specific speeds for its FWA service, stating that users can generally expect download speeds between 90 Mbps and 300 Mbps and upload speeds between 8 Mbps and 30 Mbps. Even so, the sustained decline contrasts with the more cyclical patterns seen at its rivals.

Early warning sign for the US FWA market

Ookla’s earlier analysis showed that overall US FWA speeds were on an upward trajectory from Q1 2023 through Q4 2024, with T-Mobile consistently outperforming its peers. The downturn in 2025 may mark a turning point as FWA transitions from an early growth phase to a mass market broadband alternative.

It remains unclear whether the slowdown is primarily seasonal or an early indicator of congestion driven by rising usage. What is clear is that maintaining performance will be critical as FWA becomes a more significant part of the US broadband landscape. Network optimization, spectrum strategy, and capacity management will increasingly determine whether FWA can sustain growth without sacrificing user experience in the years ahead.

AT&T Internet Air’s overall download speeds have declined from about 135 Mbps in Q2 2024 to around 105 Mbps, but top-tier users continue to see strong gains. Speedtest data shows that AT&T’s 90th percentile download speeds increased from roughly 352 Mbps in Q2 2024 to more than 411 Mbps in Q3 2025, indicating that users in well-served areas are benefiting from improved network performance.

Gains are expected as AT&T prepares to add new spectrum through its planned $23 billion acquisition of EchoStar assets, including 600 MHz and 3.45 GHz licenses covering 400 US markets. While the deal is not expected to close until mid-2026, AT&T has already upgraded 23,000 cell sites to support the 3.45 GHz band, which should benefit both 5G mobile and Internet Air customers.

AT&T is expected to expand its FWA footprint more aggressively once the new spectrum is in place, though management continues to position FWA as a complementary broadband option for areas not yet served by fiber.

Similar trends are visible at T-Mobile, where 90th percentile download speeds rose sharply from about 402 Mbps in Q1 2024 to over 482 Mbps in Q3 2025.

Verizon, by contrast, continues to enforce download and upload speed caps of 300 Mbps and 20 Mbps, resulting in more controlled peak performance.

Peak-hour analysis shows that AT&T and T-Mobile users at the lower end of the experience curve face noticeable speed declines in the late afternoon and evening, with the slowest speeds occurring between 8 pm and 9 pm. Verizon’s lower-tier users do not see the same fluctuations, likely due to its speed caps, which help allocate network resources more evenly. While AT&T and T-Mobile do not impose explicit speed caps, both disclose that speeds may be temporarily reduced during periods of congestion, suggesting that active traffic management during peak hours is contributing to the observed performance dips.

AT&T recorded the highest FWA latency in Q3 at 67 milliseconds, compared with 54 milliseconds for Verizon and 50 milliseconds for T-Mobile, though AT&T’s latency has steadily improved from 78 milliseconds in Q3 2024. Latency remains a critical metric for FWA users, particularly for real-time applications such as gaming and video conferencing. As a later entrant to the FWA market, AT&T says it limits Internet Air deployments to areas with sufficient network capacity to avoid degrading mobile performance.

Performance continues to vary significantly between urban and rural users. Across all three operators, a much higher share of urban FWA customers meet the FCC’s minimum broadband benchmark of 100 Mbps download and 20 Mbps upload.

In Q3 2025, 42 percent of T-Mobile’s urban FWA users met this standard compared with 26.9 percent of rural users.

Verizon showed a similar gap, with 25.7 percent of urban users meeting the benchmark versus 14.7 percent in rural areas.

AT&T recorded 21 percent for urban users and 16.7 percent for rural users. The shortfall is largely driven by weaker upload speeds, as median uploads for all providers remain below the 20 Mbps threshold.

The urban advantage reflects closer proximity to cell sites, which are more densely deployed in cities than in rural areas where signals must travel farther and degrade more quickly. Meanwhile, FWA subscriber growth remains strong but is expected to slow slightly.

The big three added 1.04 million FWA subscribers in Q3 2025, up from Q2, but New Street Research forecasts additions of around 3.6 million in 2026 as fiber deployments accelerate and the broadband market approaches saturation. Verizon and T-Mobile are expected to see slower growth, while AT&T’s additions are likely to remain steady given its newer market position.

Longer term, both Verizon and T-Mobile have raised their FWA targets through 2028, and potential access to additional upper C-band spectrum could support millions more subscribers later in the decade. Strategic moves such as Verizon’s planned acquisition of fixed wireless ISP Starry and AT&T’s recent spectrum deals with EchoStar and UScellular underscore that US operators remain committed to expanding FWA, even as performance, capacity, and customer experience remain under close scrutiny.

Baburajan Kizhakedath