Europe is witnessing a surge in the adoption of the 5G, with 178 mobile operators across 51 countries — accounting for 28.5 percent of the global total — investing in public 5G networks, according to the latest data from the Global mobile Suppliers Association (GSA).

Europe represents 35.5 percent of all globally launched 5G networks, with 135 operators across 43 countries. While this proportion has slightly declined year-on-year, reflecting faster growth in other regions, the trajectory for 5G deployment in Europe remains strong. A total of 43 operators in 25 countries are currently soft-launching, trialing, or deploying 5G networks, signaling ongoing expansion, GSA report said.

5G Standalone Driving the Next Phase of Network Evolution

The adoption of 5G standalone (SA) networks — powered by a dedicated 5G core — marks the next evolution in mobile connectivity. Unlike early non-standalone (NSA) 5G networks that rely on LTE cores, 5G SA delivers benefits such as lower latency, improved reliability, enhanced coverage, stronger indoor signals, and advanced security. Despite these advantages, NSA networks remain more widespread, as they still provide faster speeds than LTE.

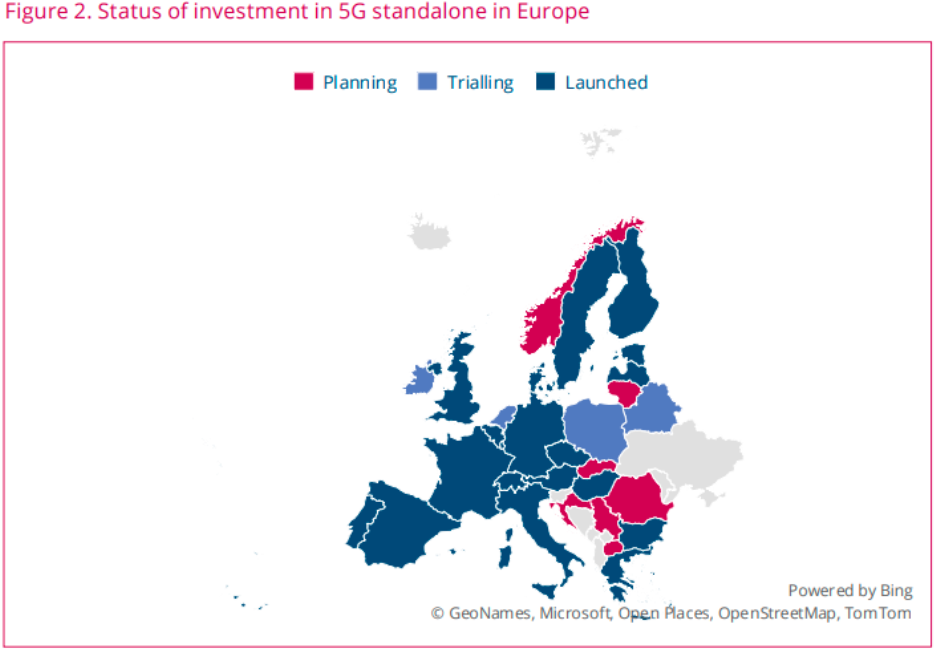

Globally, the number of telecom operators investing in 5G standalone grew by 30 from November 2024 to November 2025, totaling 181 operators in 73 countries. Europe stands out with particularly strong adoption: 79 operators across 32 countries are investing in 5G standalone, representing 43.6 percent of the global figure. Operators in 20 European countries have already launched the technology, with Germany, the United Kingdom, and France leading the way, each hosting three operators with live 5G SA networks. Vodafone Germany was the first to launch 5G standalone in Europe.

In 2025, several European operators rolled out 5G standalone, including Sunrise in Switzerland, Telia in Latvia, JT in Jersey, Elisa in Estonia, and O2 in Czechia.

Sunrise – Switzerland

Sunrise has committed to deploying 5G Standalone (SA) across its nationwide network in Switzerland in 2025. This deployment transitions the network away from legacy non‑standalone (NSA) 5G (which uses a 4G core) toward a fully dedicated 5G core, unlocking network slicing, ultra‑low latency, and enhanced coverage, including indoors. Ultra‑fast speeds are expected with broad SA coverage once the rollout completes.

Sunrise links 5G SA access to compatible subscriptions and devices. Many existing plans across consumer and business segments already support the technology automatically once the device and SIM are SA‑capable. Specific standalone 5G‑exclusive tariffs have not been widely marketed yet; instead, SA is integrated into premium plans that emphasize data throughput and enterprise use cases.

Sunrise’s strategy is to become the first Swiss carrier with nationwide SA coverage, enhancing its general 5G proposition with improved latency, security and energy efficiency. The operator is preparing for 3G network shutdowns to repurpose spectrum for 5G SA deployment, boosting long‑term spectrum efficiency.

Telia – Latvia & Baltic Footprint

Telia is building SA core networks across its Nordic and Baltic footprint, including Estonia and Lithuania, with infrastructure upgrades also impacting Latvia by association with group strategy and network modernization. The operator is deploying cloud‑native SA core architectures to enable advanced services.

Telia has trialed and deployed private 5G SA networks — for example at the Port of Klaipeda in Lithuania — demonstrating capabilities like sub‑10ms latency and industrial automation use cases, which can form the foundation for broader public SA launches across markets.

Telia’s pricing for 5G services in the Baltics is typically based on premium mobile and converged plans that include enhanced 5G data and value‑add bundles. Exact SA‑specific price premiums are usually tied to high‑end plans or enterprise packages rather than standalone consumer tariffs.

JT – Jersey (Channel Islands)

JT (Jersey Telecom) is deploying a new 5G SA network across Jersey in a phased rollout expected to complete by late 2025. Early phases have focused on areas like St Ouen, with migration from older infrastructure to a modern SA stack ensuring stronger signals and higher speeds island‑wide.

JT’s consumer pricing for mobile plans supports 5G as part of regular mobile data tiers. Typical monthly plans range from smaller data buckets (e.g., 2‑10GB) to unlimited options, with pricing reflecting capacity tiers rather than specific SA fees. Example plans are around £26‑£46 per month depending on data allowances.

Elisa – Estonia

Elisa has launched 5G SA in Estonia and selected Ericsson’s cloud‑native dual‑mode 5G core to power the rollout, ensuring ultra‑reliable low latency, high security, and strong performance for both consumers and enterprise users.

Elisa’s SA services typically sit in premium plan tiers that emphasize high throughput and quality connectivity. By integrating SA into existing mobile subscriptions and adding 5G home broadband where applicable, Elisa positions SA as part of its broader next‑generation service lineup.

O2 – Czechia

O2 Czech Republic deployed a cloud‑native 5G SA core with technology from Nokia, becoming the first operator in the country to launch standalone 5G. This core enables advanced service delivery, including network slicing and better latency performance.

O2 integrates 5G SA into existing data plans rather than monetizing it as a separate paid feature, aiming to boost overall customer experience with faster speeds and more reliable coverage without specific SA price premiums.

Future Outlook for 5G in Europe

GSA anticipates further investment and launches of 5G standalone networks across Europe in 2026. This expansion is expected to accelerate the roll-out of 5G devices and enable larger operators to begin trialing next-generation 5G-Advanced networks, driving the region closer to fully realizing the benefits of 5G.

LTE is now universal across Europe and most markets also have LTE fixed wireless access, but fresh LTE deployments are flattening as focus shifts to 5G. Europe accounts for a large share of global 5G activity, with dozens of operators trialling or launching services, and further 5G growth is projected. Investment in 5G standalone is solid and progressing better in Europe than elsewhere, although rollout will be slower than non-standalone 5G as operators seek stronger returns.

In the near term, 5G spectrum auctions are expected to slow, while satellite networks — especially direct-to-device — will increasingly influence spectrum use. At the same time, operators are accelerating 2G and 3G shutdowns to cut energy use and costs, though 3G is likely to be retired faster than 2G because migrating the remaining 2G base is more challenging.

Baburajan Kizhakedath