Charter Communications has released its financial and operational outcomes for the fourth quarter and full year ending December 31, 2023.

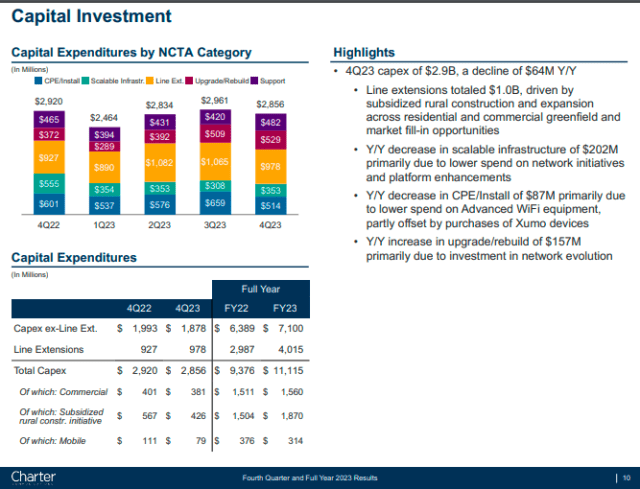

Charter Communications reported capital expenditure (Capex) of $2.9 billion in Q4 2023, marking a $64 million decrease from the same period in 2022. The reduction was primarily attributed to lower spending on scalable infrastructure and customer premises equipment (CPE), offset by increased expenditure on upgrade / rebuild initiatives.

Charter Communications reported capital expenditure (Capex) of $2.9 billion in Q4 2023, marking a $64 million decrease from the same period in 2022. The reduction was primarily attributed to lower spending on scalable infrastructure and customer premises equipment (CPE), offset by increased expenditure on upgrade / rebuild initiatives.

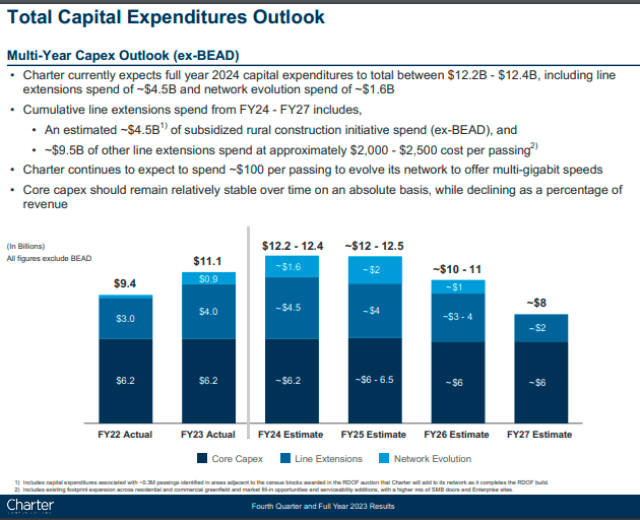

For the entire year 2023, Charter’s capital expenditures amounted to $11.1 billion, showing an increase from $9.4 billion in 2022. The surge was driven by elevated spending on line extensions, totaling $4 billion, and higher investment in upgrade / rebuild projects, aligning with the company’s network evolution.

Charter anticipates capital expenditures for 2024 to range between $12.2 billion and $12.4 billion, including line extensions spend of ~$4.5 billion and network evolution spend of ~$1.6 billion.

Cumulative line extensions spend from FY24 – FY27 includes an estimated ~$4.5 billion of subsidized rural construction initiative spend (ex-BEAD), and ~$9.5 billion of other line extensions spend at approximately $2,000 – $2,500 cost per passing.

Cumulative line extensions spend from FY24 – FY27 includes an estimated ~$4.5 billion of subsidized rural construction initiative spend (ex-BEAD), and ~$9.5 billion of other line extensions spend at approximately $2,000 – $2,500 cost per passing.

Charter continues to expect to spend ~$100 per passing to evolve its network to offer multi-gigabit speeds. Core Capex should remain relatively stable over time on an absolute basis, while declining as a percentage of revenue.

Customers

Charter experienced a decrease of 61,000 total residential and small to medium-sized business (SMB) internet customers in Q4 2023. However, the company added 546,000 mobile lines during the same period. As of December 31, 2023, Charter served a total of 30.6 million residential and SMB internet customers and 7.8 million mobile lines.

The reported revenue for Q4 2023 was $13.7 billion, reflecting a 0.3 percent year-over-year growth. Notably, residential internet revenue exhibited a 3.0 percent increase, while residential mobile service revenue surged by 35.7 percent. Charter’s net income attributable to shareholders totaled $1.1 billion for the fourth quarter and $4.6 billion for the full year 2023.

Adjusted EBITDA for Q4 2023 reached $5.6 billion, demonstrating a 1.6 percent year-over-year growth. The total revenue for the year ending December 31, 2023, was $54.6 billion, showcasing a 1.1 percent increase. Full-year Adjusted EBITDA amounted to $21.9 billion, a 1.3 percent rise compared to 2022.

Charter’s CEO, Chris Winfrey, emphasized the company’s successful rural expansion and the positive impact of investments in network evolution. He expressed satisfaction with the progress of Charter’s strategy to provide top-notch products and services while ensuring cost savings for consumers.

As of December 31, 2023, Charter boasted 29.9 million residential customer relationships, excluding mobile-only connections. Despite a decrease of 62,000 residential internet customers in Q4 2023, Charter remains committed to its network evolution initiatives, aiming to offer symmetrical and multigigabit speeds across its entire footprint. The company continues to work towards providing an enhanced customer experience through its Advanced WiFi service.

Charter’s financial report also highlighted the decline in residential video and wireline voice customers in Q4 2023. The addition of 532,000 residential mobile lines during the same period reflects the success of Charter’s Spectrum Mobile offering. The company’s converged network strategy, Spectrum One, and Spectrum Mobile play a pivotal role in delivering a competitive connectivity experience to consumers.

Lastly, Charter reiterated its commitment to collaborating with government entities to extend Spectrum Internet access to underserved communities. In Q4 2023, Charter activated 105,000 subsidized rural passings, resulting in a positive impact on customer relationships within the subsidized rural footprint. The company remains focused on its mission to connect communities and enhance digital inclusion.