A report from CARE Ratings indicated that both Vodafone Idea and Airtel will not be keen to bid for 5G spectrum in 2019.

Vodafone Idea CEO Bales Sharma last week said the merged entity of Vodafone and Idea will be focusing on the 4G expansion with a Capex of Rs 27,000 crore. The Capex of Vodafone Idea surged 30.7 percent to INR 32,956 million in Q2 fiscal 2018-19 focusing on 4G coverage expansion.

Vodafone Idea CEO Bales Sharma last week said the merged entity of Vodafone and Idea will be focusing on the 4G expansion with a Capex of Rs 27,000 crore. The Capex of Vodafone Idea surged 30.7 percent to INR 32,956 million in Q2 fiscal 2018-19 focusing on 4G coverage expansion.

Airtel India CEO Gopal Vittal during an analyst call indicated that the telecom operator does not to wish to spend on 5G spectrum in 2019.

The main concern for two of the top Indian telecom operators is the lack of availability of 5G devices in 2019 and preparedness of the eco-system to opt for a Capex-less roll out of 5G mobile network across India.

India’s telecom regulator TRAI has already prepared by the reserve price for 5G spectrum and other spectrum. However, the government is yet to announce the timing of the spectrum auction.

CARE Ratings predicts that India’s broadband wireless subscriber base is likely to reach 515-530 million by March 2019, achieving 30-35 percent growth.

The wireless broadband subscriber base grew 93.7 percent from 154 million in August 2016 to 298.4 million subscribers in August 2017. Indian mobile broadband subscriber base rose 49.4 percent to 445.6 million in August 2018.

The wireless broadband subscriber base grew 93.7 percent from 154 million in August 2016 to 298.4 million subscribers in August 2017. Indian mobile broadband subscriber base rose 49.4 percent to 445.6 million in August 2018.

The pressure on Indian telecom operator ARPU is expected to continue though ARPU may improve on a sequential basis in the second half of FY19 on the back of minimum recharge packs announced.

The recent plans announced by Indian telcos aim to generate revenue from low-revenue customers, while reduction in the number of inactive users will be the yet another benefit, Madan Sabnavis, chief economist and Bhagyashree C Bhati, research analyst at CARE Ratings, said.

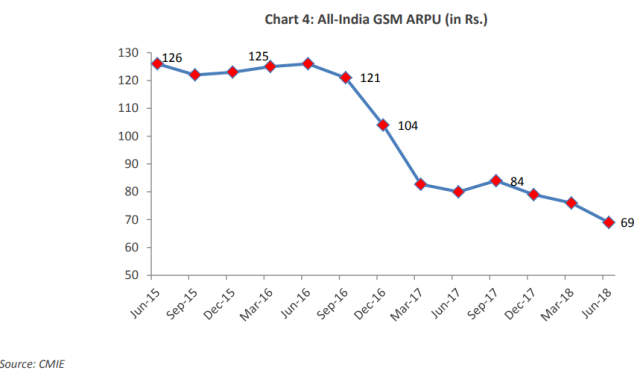

During FY16 and the first two quarters of FY17, the all-India GSM ARPU remained in the range of Rs 121 to Rs 126. In the December 2016 quarter, the ARPU declined to Rs 104 a sequential fall of 14 percent with the introduction of cheap data services by Reliance Jio on 5 September 2018.

Post this quarter, the ARPU was on a free fall. ARPU increased 5 percent q-o-q to Rs 84 in the September 2017. In the June 2018 quarter, the ARPU reached Rs 69 for the first time.

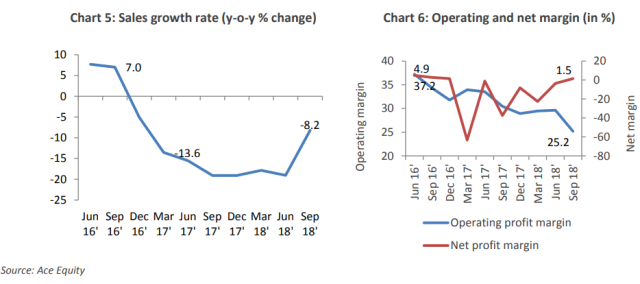

Indian telecom industry reported decline in sales on a y-o-y basis for the eighth consecutive quarter ended September 2018 where aggregate sales of the nine telecom service providers fell by 8.2 percent.

The operating profit margin of the telecom industry deteriorated in the range of 284 basis points to 527 basis points y-o-y in each of the quarters during the period January 2017 to September 2018.

The industry’ operating profit margin fell by 527 basis points y-o-y to reach 25.17 percent in the September 2018 quarter.

The net profit margin of the industry was at 1.48 percent in the September 2018 quarter. The cut in Interconnection Usage Charges (IUC) to 6 paisa per minute from 14 paisa per minute in September 2017 and the cut in International Termination Charges (ITC) to 30 paisa per minute from 53 paisa per minute in January 2018 impacted the industry’s performance.