AT&T Inc. is gearing up to spend $86 billion for buying media giant Time Warner Inc. in a merger deal, which will be announced by Monday.

AT&T Inc. is gearing up to spend $86 billion for buying media giant Time Warner Inc. in a merger deal, which will be announced by Monday.

Last year, AT&T acquired payTV giant DirectTV for $48.9 billion.

There will be some question marks on the evaluation of Time Warner business because the annual revenues of the media company is nearly $28 billion. Media reports also indicate that getting approval from FCC and other departments will be a tough process for AT&T. Usually, such approvals will come if AT&T is ready to give up dominance on certain markets.

Why Time Warner?

The strategy of AT&T is to become a leading telecom company with significant media assets that can be offered to its US-based wireless subscribers. Verizon bought AOL and Yahoo with the same objective.

The merger deal between Time Warner and AT&T is reflecting the wireless major’s decision to adapt to the latest technological shifts: video streaming on mobile devices including smartphones and tablets on high-speed telecom networks.

More consumers are getting their entertainment online from Netflix Inc. and watching on iPhones instead of TVs. That’s putting pressure on traditional entertainment companies and pay-TV providers, reports Bloomberg.

AT&T plans to unveil a new web-streaming TV service, DirecTV Now that will carry dozens of cable channels over the internet. Time Warner’s HBO last year introduced an online version of its network for people who don’t want cable TV.

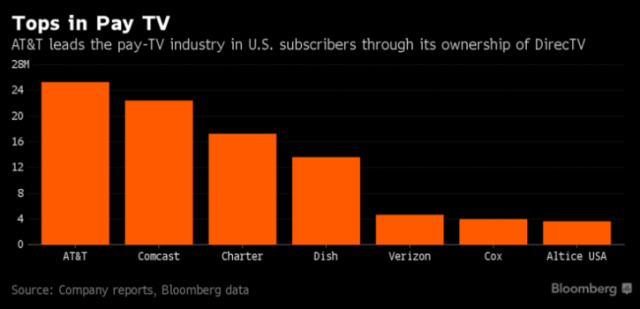

With Time Warner, AT&T would combine distribution and production on a scale unparalleled in traditional media, potentially creating new options. The phone giant already owns the second-biggest U.S. wireless network and the largest U.S. pay-TV footprint.

Telecoms want media lifeline

Analyst firm TBR released the following inputs in 2016 analyzing the US wireless market:

Verizon is transitioning from serving solely as a telecom carrier and is venturing to compete as a heavyweight within the digital media market. The carrier acquired assets to complement its AOL and go90 businesses, which is equipping Verizon to contend with competitors in the media space such as social media companies and OTT video providers.

Verizon has made acquisitions to expand its ad tech capabilities and content library, though the carrier’s central media platform, go90, will take at least two years to become a profitable business. Continued investments will be needed to grow go90 into a viable alternative to prominent services such as YouTube, forcing Verizon to limit its investment in wireless and wireline networks.

The Verizon-AOL-Yahoo Hydra combination will be a rival to Facebook and Google, as well as adjacent players vying for digital advertising (e.g., SAP) or data to drive advertising (e.g., Oracle).

AT&T will capitalize on the rapid growth of OTT and streaming video services through its June acquisition of QuickPlay Media.

Digitization of TV represents the next key driver for vendors operating in the $40 billion ad tech market, fueling growth to $100 billion by 2020. Comcast acquired ad management platform FreeWheel for an estimated $360 million in 2014.

The above chart prepared by Bloomberg indicates that the latest media deals.

Insufficient revenue from other biz areas

Verizon generated $713 million in revenue from AOL in 2Q16 and the carrier is pursuing additional acquisitions to build its media segment to offset revenue declines. The addition of Yahoo’s platform means Verizon will reach an estimated average of 1 billion consumers each month.

AT&T is expanding its portfolio to help developers create new IoT solutions easier through offerings such as the IoT Starter Kit as well as enabling solutions to be created on additional cloud platforms such as Microsoft Azure and IBM Cloud.

AT&T will be in a transitional phase in 2H16 as the carrier will no longer be able to rely on DirecTV to sustain revenue growth. Revenue from AT&T’s traditional businesses will remain pressured, which will cause the carrier to rely on growth initiatives in NFV and SDN, IoT and media to ensure revenue growth.

Sprint will continue to trail competitors in total wireless subscriber growth until it establishes more distinctive service offerings to stand out from its rivals.

T-Mobile US will be under pressure to meet growing demand for video content.

Pay-TV market

Pay-TV distributors like AT&T, the parent of DirecTV, are trying to prevent subscribers from dropping their services for cheaper online alternatives. They aim to own content they can offer wherever consumers want, whether it’s streamed to mobile phones or broadcast on TV.

Verizon has acquired companies like AOL and Yahoo to become a player in the mobile advertising market.

New York-based Time Warner, which also owns CNN and HBO, is a rich target for AT&T. The media company has a vast library of movies and television. Its annual revenue totals $28 billion.

More deals

Time Warner two years ago rejected a buyout offer from 21st Century Fox Inc. Time Warner, Walt Disney Co. and competitors like Viacom Inc. are all confronting similar threats: falling TV ratings as consumers drop or pare their cable-TV subscriptions for online alternatives.

AT&T bought DirecTV last year for $48 billion, while Charter Communications Inc. acquired Time Warner Cable Inc. for $56 billion.

CBS Corp. and Viacom Inc. are considering recombining the business after more than a decade as separate companies. In June, Lions Gate Entertainment Corp., the studio behind “Mad Men” and “The Hunger Games,” agreed to buy the premium cable network Starz, beating out a rival bidder — AT&T.

When it bought NBCUniversal, Comcast Corp. had to accept conditions so it wouldn’t be too powerful in the burgeoning web TV landscape. NBC was required to make all of its channels available to all new online TV entrants, weakening its negotiating leverage.

The entertainment division also was barred from exerting influence on the streaming service Hulu, which it partly owns. Hulu will unveil an online TV offering that competes with Comcast’s conventional cable service.

Baburajan K

editor@telecomlead.com