Enterprise wireless is set to become a key growth driver for telecom operators in 2026, as consumer market margins continue to shrink, according to Omdia’s latest report, 2026 Trends to Watch: Enterprise Wireless. The research report highlights drones, non-terrestrial networks (NTNs), network slicing, and private 5G campus networks as critical areas shaping B2B wireless opportunities.

5G-Enabled Drones Transform Enterprise Applications

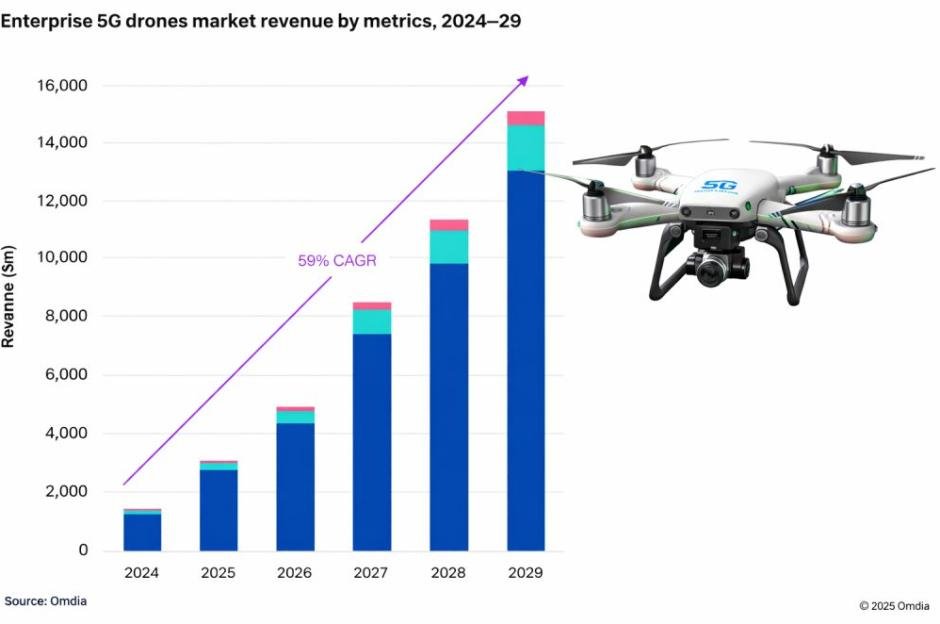

Drones integrated with 5G connectivity are expected to move beyond experimental deployments, unlocking new use cases in agriculture, logistics, utilities, public safety, and construction. Omdia projects the global B2B drone market will reach $15 billion by 2029, growing at a compound annual growth rate of 59 percent. By 2029, drones themselves will account for 86 percent of total market revenue, with software and connectivity services contributing 10 percent and 3 percent, respectively.

To capitalize on this growth, telcos are advised to form dedicated teams, boost R&D, and collaborate with drone manufacturers and software platforms. Partnerships can enable commercial offerings that integrate connectivity, analytics, and cloud services. Drone manufacturers are encouraged to embed 5G modules in next-generation devices and collaborate on certification, interoperability, and vertical-specific solutions.

Non-Terrestrial Networks Gain Momentum

2026 will be a pivotal year for NTNs, with Amazon LEO and AST SpaceMobile launching commercial services. These low Earth orbit (LEO) networks are expected to focus on enterprise, government, defense, and mission-critical segments rather than mass consumer markets. Amazon’s Ultra antenna promises download speeds of up to 1 Gbps and upload speeds of 400 Mbps in enterprise preview mode, while AST SpaceMobile plans D2D deployments in partnership with major communications service providers.

Telcos are expected to expand enterprise D2D offerings, with T-Mobile USA, AT&T, and Verizon likely competing to integrate NTN services into their portfolios. Omdia forecasts that enterprise 5G mobile revenue of $102 billion could be strategically enhanced by D2D capabilities.

Network Slicing Moves to Maturity

Network slicing is set to become a core pillar of 5G monetization in 2026, moving beyond fragmented pilots to standardized, automated offerings aligned with real enterprise demand. Omdia forecasts network slicing revenue to grow at a compound annual growth rate of 164 percent from 2025. Mobile SIM slicing will dominate, while campus slicing and fixed wireless access slicing emerge as additional revenue sources.

Telcos are advised to focus on a limited set of market-ready slice offerings, automate provisioning, and work closely with enterprises in logistics, retail, transportation, and public safety. Vendors should provide integrated slicing platforms covering core, RAN, orchestration, and assurance, while building vertical-specific partnerships to accelerate monetization.

Private 5G Campus Networks Evolve

Private 5G campus networks face a turning point following Nokia’s decision to review its enterprise campus business. Omdia expects the market to split into two paths: one integrating campus networks with public networks and shared infrastructure, led by telcos and vendors such as Ericsson; the other focusing on verticalized industrial networks, driven by system integrators and industrial OEMs like Siemens.

Telcos targeting enterprise segments must now redefine private 5G strategies, balancing the complexity of deployment with the long-term growth potential. Vendors can seize opportunities to challenge existing players and deliver vertical-specific solutions that cater to specialized enterprise needs.

Strategic Recommendations for 2026

Omdia’s Olivier Loridan (Senior Analyst, Telco B2B Solutions) and Pablo Tomasi (Principal Analyst, Telco B2B Solutions) urge service providers to sharpen enterprise wireless strategies, prioritize high-value NTNs, co-develop drone solutions, and standardize network slicing offers. Vendors are encouraged to deliver unified slicing platforms, bridge the gap between satellite providers and telcos, and address private 5G campus gaps with vertical-specific solutions.

As enterprise wireless technologies mature, telcos and vendors that strategically invest in drones, NTNs, network slicing, and private 5G will be well-positioned to capture emerging B2B growth opportunities in 2026 and beyond.

BABURAJAN KIZHAKEDATH