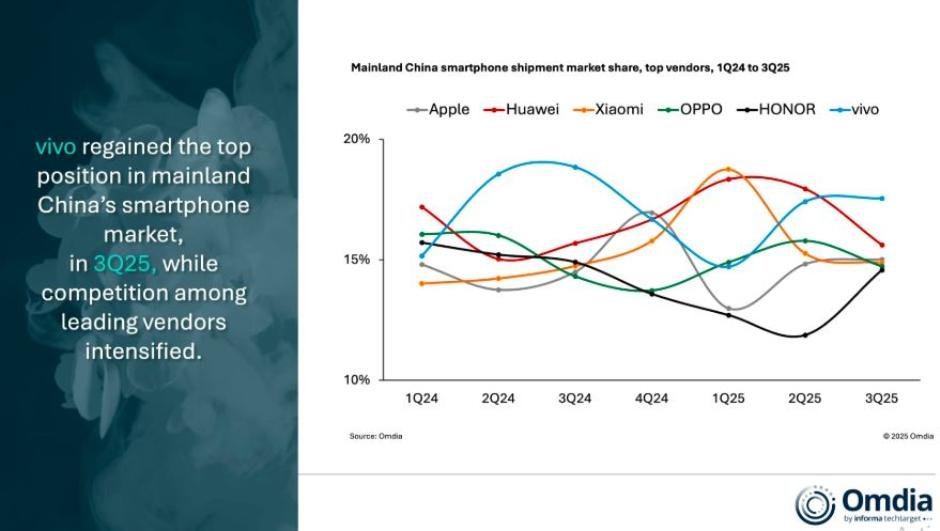

China’s smartphone market in terms of shipments fell 3 percent year-on-year to 67.2 million during the third quarter of 2025, according to the latest report from Omdia. The smartphone market in China is in an adjustment phase, with intense competition among leading vendors narrowing the shipment gaps between top players.

Vivo reclaimed the top spot in the China smartphone market, Huawei and Apple following closely, and Xiaomi and OPPO maintaining strong positions, Omdia report indicated.

Vivo Leads the Market

Vivo emerged as the leading smartphone vendor in China in 3Q25, shipping 11.8 million units and capturing 18 percent of the market share. Although Vivo’s shipments slightly decreased from 13.0 million units in 3Q24, it still managed to overtake Huawei, demonstrating resilience amid market fluctuations.

Huawei Maintains Strong Position

Huawei shipped 10.5 million units in 3Q25, holding a 16 percent market share, the same as in 3Q24. The company remains a strong contender in China, with stable performance despite the challenges in the domestic market and supply chain constraints.

Apple and Xiaomi Compete Closely

Apple recorded 10.1 million shipments in 3Q25, up from 10.0 million in 3Q24, increasing its market share to 15 percent from 14 percent. Xiaomi’s shipments slightly decreased to 10.0 million units, maintaining a 15 percent market share, consistent with the previous year. The close numbers highlight intense competition between Apple and Xiaomi for the third spot in China.

OPPO Holds Steady

OPPO shipped 9.9 million units, unchanged from 3Q24, increasing its market share slightly to 15 percent from 14 percent. The stable performance shows OPPO’s steady demand among Chinese consumers despite the overall market slowdown.

Other Vendors

The collective category of other smartphone vendors shipped 14.9 million units, representing 22 percent of the market, slightly lower than the 15.1 million units in 3Q24. This segment continues to reflect the fragmented and competitive nature of China’s smartphone market.

Market Insights

Total shipments among top five vendors slightly declined compared to last year, signaling a cautious market environment.

Vivo’s resurgence highlights its effective marketing and product strategy.

Apple’s slight gain in market share indicates strong consumer demand for premium devices.

Huawei remains resilient despite external challenges.

Xiaomi and OPPO maintain consistent performance, emphasizing the strong mid-range segment in China.

China’s smartphone market in Q3 2025 continues to be highly competitive, with minor shifts in market share reflecting evolving consumer preferences and the strategic moves of leading vendors.

Market Stabilizing After Early-Year Volatility

“Although the market has contracted for two consecutive quarters, the narrowing decline indicates that the shipment fluctuations triggered by the government subsidy program at the beginning of the year are coming to an end, with the market gradually returning to normal,” said Lucas Zhong, Analyst at Omdia.

A more cautious shipment pace has allowed vendors to maintain healthier inventory levels, setting the stage for an active fourth quarter driven by flagship launches, the Double 11 shopping festival, and the possibility of a new round of subsidies.

Huawei’s strategy to preinstall HarmonyOS 5.0 on all major new models since the launch of the Pura X is seen as a bold long-term move. While the transition presents short-term challenges in software optimization and user experience, Omdia believes it will strengthen Huawei’s ecosystem moat in an increasingly saturated market.

Focus Shifts to Durability and Battery Life

In the entry-level and mid-range segments, major vendors refreshed their product lines with practical enhancements. Models such as the HONOR X70, Redmi Note 15 Pro, vivo Y500, and OPPO A6 feature 7000mAh+ batteries and improved water, dust, and drop resistance—responding to mass-market consumers’ key concerns about durability and battery life.

Modest Growth Expected in 2025

Despite the recent slowdown, Omdia forecasts modest growth for mainland China’s smartphone shipments in 2025, supported by ongoing government subsidy programs and renewed consumer demand.

Hayden Hou, Principal Analyst at Omdia, said local phone vendors are differentiating through design innovation, larger battery capacities, and advanced camera systems, while integrating AI-driven features to enhance the user experience. Chinese consumers remain among the most receptive globally to AI-capable smartphones.

Baburajan Kizhakedath