The streaming ecosystem in Turkey is undergoing a major transformation in 2025. While international platforms continue to dominate in terms of penetration and content variety, the rapid growth of local services, increasing digital adoption, and evolving pricing models highlight a market that is consolidating toward maturity, according to the latest data from Fabric.

Digital Viewership on the Rise

In Q1 2025, 73 percent of Turkish households consumed online content, marking a 4 percent year-over-year increase. Despite this growth, penetration remains below the EMEA average of 81 percent. Within the region, Norway leads at 89 percent, while South Africa reports the lowest at 69 percent. Turkey’s figures reflect strong momentum but also underscore untapped potential in digital viewership.

Global Platforms Lead, Local Players Expand

As of Q1 2025, the top three subscription platforms in Turkey are dominated by global leaders:

Netflix: 42 percent penetration

YouTube Premium: 32 percent penetration

Prime Video: 29 percent penetration

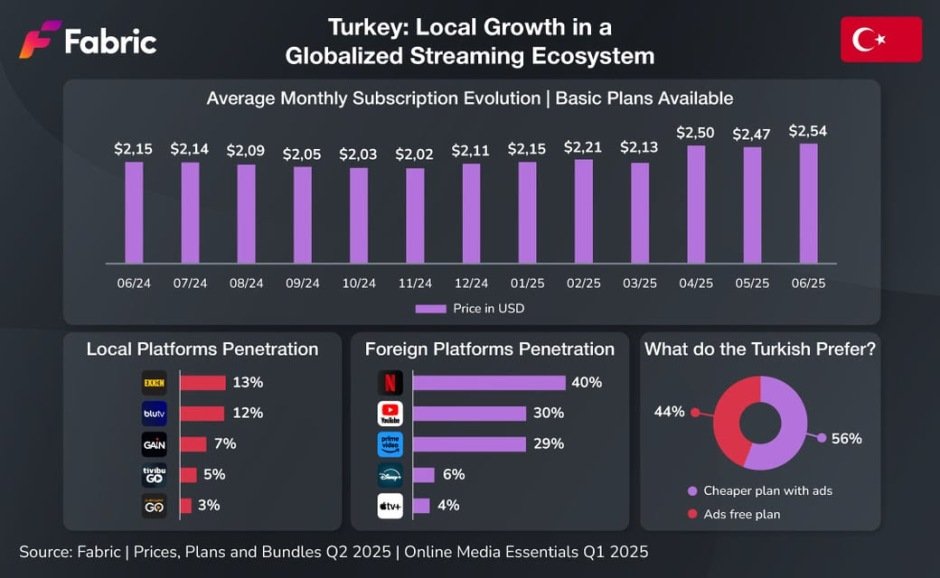

Local platforms, however, are making inroads. Four of the top ten services are Turkish: Exxen (13 percent), BluTV (12 percent), Tivibu GO (5 percent), and D-Smart GO (3 percent).

A milestone development is the BluTV–HBO Max merger, finalized in April 2025. This marks HBO Max’s official entry into Turkey, leveraging BluTV’s strong user base and original catalog. Warner Bros. Discovery also announced three Turkish local originals—Anatomy of Chaos, Jasmin, and Feride—highlighting a growing focus on domestic production.

Pricing and Flexibility in a Cost-Sensitive Market

The Free with Ads model remains the most popular, with 67 percent household penetration in Q1 2025, up 8 percent year-over-year. Subscription models, however, are gaining traction—rising from 46 percent in 2024 to 58 percent in 2025, despite an 18 percent average price increase.

Turkey still boasts some of the lowest subscription rates globally:

Prime Video: $0.98 (85 percent below EMEA average)

Crunchyroll: $1.25 (78 percent below average)

Netflix: $4.77 (23 percent below average)

HBO Max: $5.75 (36 percent below average)

Platforms are adapting to Turkish consumers’ price sensitivity by offering hybrid plans. Both Disney+ and Tivibu GO introduced ad-supported subscriptions in 2025, responding to demand from the 56 percent of households that prefer cheaper, ad-backed options.

Original Content: Limited but Growing

Netflix remains the leader in original programming, with 4.5K+ global originals and 60+ Turkish productions available in Turkey. In Q2 2025, all five of the most-watched original titles in the country came from Netflix, including When Life Gives You Tangerines (South Korea) and The Eternaut (Argentina).

Local platforms, while smaller in scale, are investing in originals:

Gain: 103 original titles

Puhutv: 15 original titles

Turkish productions are resonating strongly with audiences. Two of the top five most-watched series in Q2 2025 were national originals:

Kral Kaybederse (2025), available on Netflix, Puhutv, and D-Smart GO

Resistence (2025), a Disney+ original

A Market in Transition

Turkey’s streaming market is evolving into a hybrid ecosystem of global giants and emerging local players. The HBO Max–BluTV merger, stronger adoption of subscription models, and rising demand for domestic content suggest a market moving toward maturity.

To remain competitive, local platforms will need to scale up original production, embrace hybrid pricing models, and deepen consumer engagement. The coming years will define whether Turkey becomes a regional streaming powerhouse or remains dominated by global leaders.

Baburajan Kizhakedath