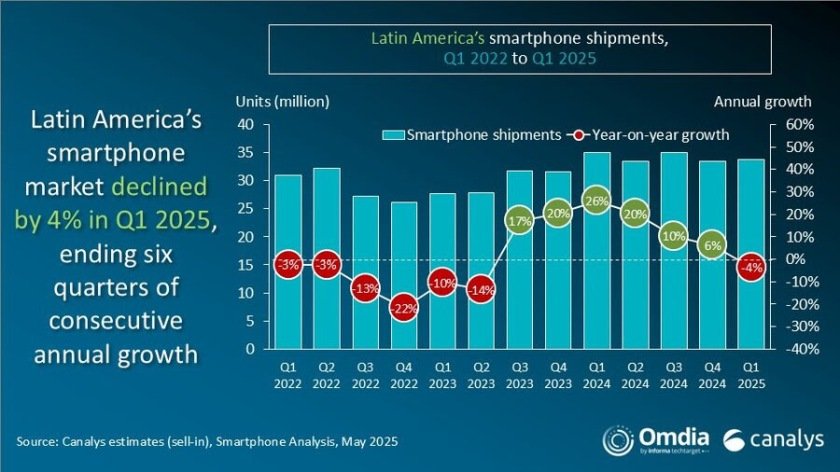

Latin America’s smartphone market shrank 4 percent year-on-year in Q1-2025, halting a six-quarter growth streak, according to the latest Canalys (now part of Omdia) data.

Smartphone shipments in Latin America dropped to 33.7 million units amid economic headwinds, tariff concerns, and vendor pullbacks on aggressive strategies. However, country-level data reveals stark contrasts in performance, highlighting varied consumer demand and smartphone vendor strategies across the region.

Entry-level demand remains resilient, with brands pushing sub-US$100 models to cater to cost-sensitive buyers. Premium models like Samsung’s S25 and Apple’s iPhone 16 saw strong uptake. However, it’s the mid-range segment — representing nearly 80 percent of total shipments — where the fiercest competition will play out through 2025, as vendors pursue profitability amid tighter margins and longer replacement cycles.

Brazil Emerges as a Bright Spot

Brazil defied the regional trend, growing 3 percent year-on-year to 9.5 million units and accounting for 28 percent of Latin America’s total smartphone shipments. This growth was fueled by aggressive expansion from Chinese brands like HONOR, Xiaomi, and Realme, which intensified their investments and product launches to tap into Brazil’s large, increasingly price-conscious consumer base.

In Brazil, Samsung led with a dominant 43 percent, followed by Motorola at 23 percent, Xiaomi at 15 percent, realme at 7 percent, and Apple at 5 percent.

Mexico Faces Inventory Pressures

Mexico, the region’s second-largest market with a 22 percent share, saw a sharp 18 percent decline in shipments. The drop followed a surge in device renewals in 2024, especially in the entry to mid-range segments. As a result, inventory build-up has stifled demand for new models in early 2025, with retailers hesitant to restock aggressively until existing stock clears.

In Mexico, Samsung also topped the market with 25 percent, with Xiaomi at 17 percent, Motorola at 14 percent, OPPO at 12 percent, and Apple at 8 percent.

Central America’s Growth Stalls

Central America, which rose in importance during 2024, saw its first shipment decline in nearly two years — down 7 percent in Q1-2025. The slowdown stemmed from excess inventory, especially among new entrants like TRANSSION, ZTE, and OPPO, which had ramped up volumes aggressively last year. A cooling in demand and more cautious retail activity has now forced a correction.

In Central America, Samsung held the highest share at 37 percent, trailed by HONOR at 20 percent, Xiaomi at 15 percent, TRANSSION at 14 percent, and Motorola at 7 percent.

Colombia and Peru Show Mixed Signals

Colombia and Peru, the fourth and fifth largest smartphone markets in Latin America, experienced modest declines in Q1-2025. Despite their economies beginning the year with positive growth, consumer spending on smartphones remained cautious. Analysts expect demand to rebound in upcoming quarters as economic confidence strengthens.

In Colombia, Xiaomi led with 29 percent, followed by Samsung at 18 percent, TRANSSION at 12 percent, Motorola at 11 percent, and HONOR at 9 percent.

In Peru, Xiaomi again secured the top spot with 25 percent, closely followed by Samsung at 24 percent, HONOR at 22 percent, ZTE at 11 percent, and Motorola at 10 percent.

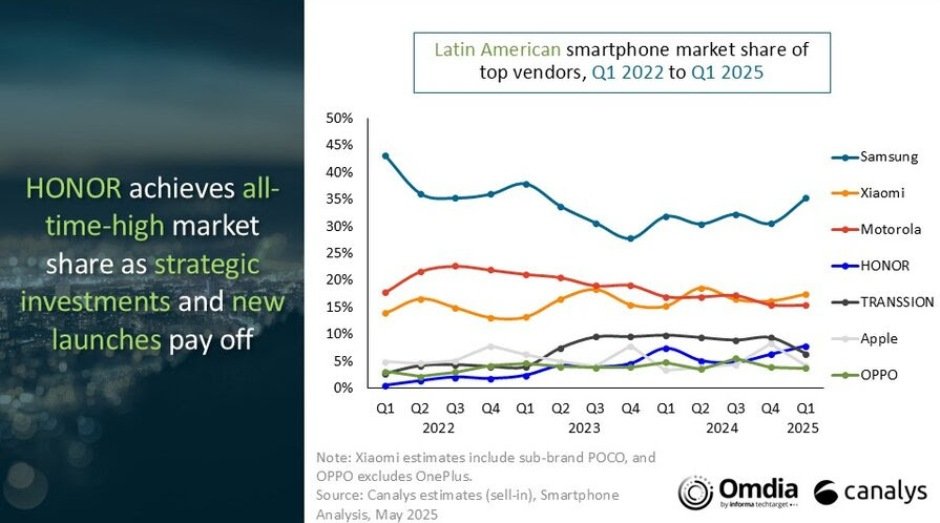

These figures reflect Xiaomi’s growing strength in markets like Colombia and Peru, while Samsung maintained leadership in Brazil, Mexico, and Central America. Motorola remained consistently present but showed stronger performance in Brazil. Emerging brands like HONOR, TRANSSION, and ZTE gained meaningful traction in several markets.

Main vendors

Samsung led the market with 11.9 million units shipped, up from 11.1 million, increasing its market share to 35 percent from 32 percent.

Xiaomi shipped 5.9 million units, up from 5.3 million, raising its market share to 17 percent from 15 percent.

Motorola’s shipments dropped to 5.2 million from 5.9 million, with its share slipping to 15 percent from 17 percent.

HONOR maintained flat shipments at 2.6 million but grew its share from 7 percent to 8 percent.

TRANSSION saw a decline in shipments to 2.1 million from 3.4 million, reducing its share to 6 percent from 10 percent.

Shipments from other vendors also fell, from 6.5 million to 6.0 million, with a slight drop in market share from 19 percent to 18 percent.

Forecast

Canalys forecasts a 1 percent contraction in the Latin American smartphone market for 2025, citing the region’s vulnerability to global challenges such as US-China tensions, inflation, currency fluctuations, and the potential impact of new US tariffs. These factors, along with local socioeconomic instability, are expected to dampen consumer spending, particularly in the entry-level segment that dominates the market.

In Q1 2025, noticeable behavioral shifts signal deeper structural changes that vendors must address. Success in this environment will depend on agile inventory management, strengthened value propositions, and operational discipline. Manufacturers that prioritize portfolio optimization, focused marketing, and improved consumer experiences will be better positioned to stay competitive amid ongoing volatility.

Baburajan Kizhakedath