The latest Canalys report has details about smartphone market growth in China for 2024 and projections for 2025.

China’s smartphone market grew 4 percent – shipping 285 million units in 2024. This is remarkable for vendors because China smartphone market had experienced decline in the last two years.

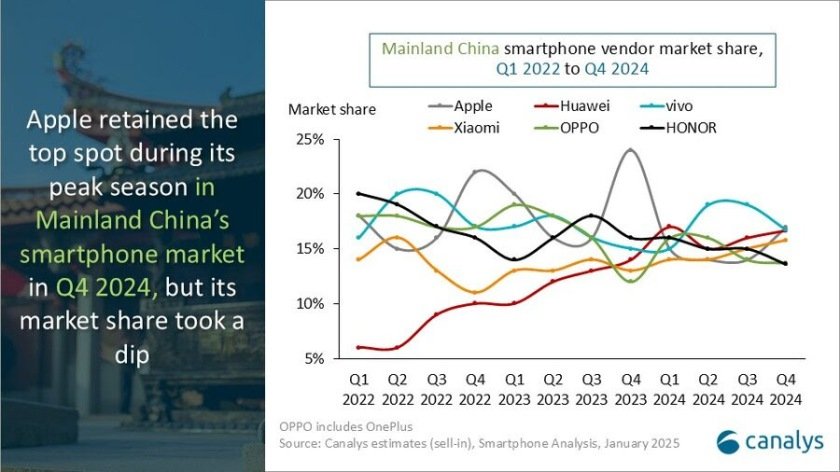

Vivo led the market with a 17 percent share, shipping 49.3 million units, while Huawei ranked second with 46 million units, marking a 37 percent growth.

Apple, OPPO, and HONOR each held 15 percent market share, indicating strong competition.

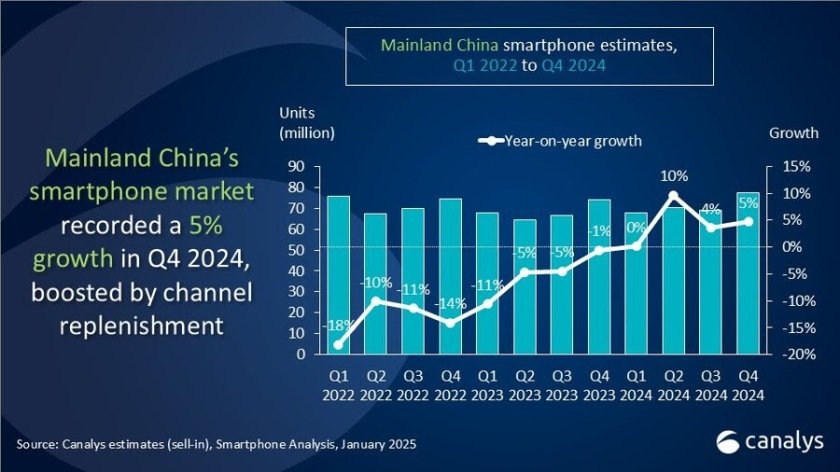

In Q4 2024, smartphone shipments grew by 5 percent to 77.4 million units, driven by high-end peak season demand, government subsidies, and year-end promotions.

Apple led Q4 with 13.1 million units shipped but saw a 25 percent year-on-year decline due to domestic competition.

Vivo and Huawei each held 17 percent market share, ranking second and third.

Xiaomi achieved 12.2 million units in Q4, with the highest annual growth of 29 percent among top vendors.

OPPO followed with 10.6 million units, growing 18 percent year-on-year in Q4.

Steady recovery across all quarters in 2024 was supported by strategic investments, technological innovations, and structural market improvements. Affordable premium designs and robust durability boosted mass-market demand, while advancements in GenAI, HarmonyOS NEXT, Xiaomi’s HyperOS, in-house chips, and foldable devices drove high-end upgrades.

Vivo leveraged online and offline channels, partnerships with operators, and marketing strategies to strengthen its position.

Xiaomi stabilized shipments, built user trust, and grew its ecosystem through synergies with EV products and home appliances, achieving four consecutive quarters of market share growth.

Apple maintained its Q4 leadership but faced increasing competition from domestic flagships, improving its high-end competitiveness through enhanced retail experiences, trade-in programs, and installment plans.

Canalys predicts over 290 million smartphone shipments in China for 2025, supported by steady demand recovery, a stable macroeconomic environment, healthy channel operations, and government subsidies announced in January.

Smartphone vendors are preparing for supply and channel expansion, while product innovations such as longer battery life, slimmer designs, advanced form factors, and enhanced AI-powered operating systems are expected to attract consumers across all segments.

Baburajan Kizhakedath