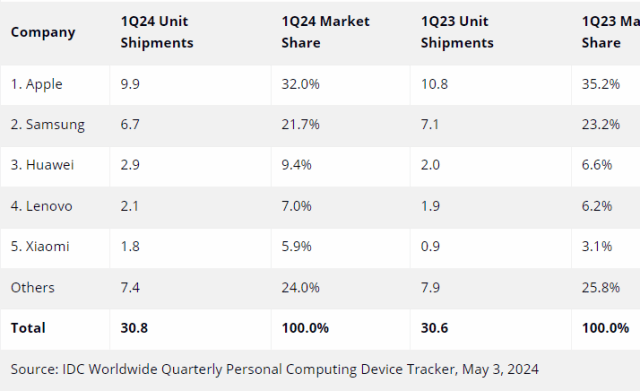

The global tablet market experienced year-over-year growth of 0.5 percent to 30.8 million units during the first quarter of 2024. The marginal growth marks the end of a two-year decline, IDC report said.

This growth comes after a prolonged period of stagnation caused by market saturation. The resurgence in tablet shipments during this quarter can be attributed to the initiation of a refresh cycle, although long-term volumes are not expected to reach the peak levels observed during the pandemic, IDC said in its Worldwide Quarterly Personal Computing Device Tracker said.

This growth comes after a prolonged period of stagnation caused by market saturation. The resurgence in tablet shipments during this quarter can be attributed to the initiation of a refresh cycle, although long-term volumes are not expected to reach the peak levels observed during the pandemic, IDC said in its Worldwide Quarterly Personal Computing Device Tracker said.

A notable trend driving this growth is the increasing preference for premium tablets among consumers seeking productivity-oriented devices.

Apple, despite facing lack of new models in the past year, witnessed an 8.5 percent decline in shipments year over year. The company remains at the forefront of the market, shipping 9.9 million units in 1Q24, as it prepares for the launch of new models expected in the second quarter.

Samsung, securing the second position, experienced a 5.8 percent decline in shipments compared to the previous year, with 6.7 million units shipped in 1Q24. Factors such as competitive promotions in Europe and Asia/Pacific and a dearth of new products hindered Samsung’s growth. However, Samsung aims to enhance user experience through AI integration in its latest offerings and is concentrating on premium products to leverage the anticipated replacement cycle.

Huawei maintained its third-place position with a growth of 43.6 percent, shipping 2.9 million units in 1Q24. Huawei’s resurgence in the smartphone sector likely contributed to its growth in the tablet market, increasing its market share by 2.8 basis points compared to 1Q23.

Lenovo, ranking fourth, achieved a growth of 13.2 percent in 1Q24. Lenovo’s Tab P series models drove shipments, particularly in the detachable portfolio, although slate tablets still comprise a significant portion of its shipments.

Xiaomi, retaining its position in the top 5, demonstrated exceptional growth of 92.6 percent, shipping 1.8 million units in 1Q24. The company experienced triple-digit growth outside its largest market, China, across most regions where it operates.

“Real growth opportunities will arise from the impending refresh cycle and increased adoption in commercial sectors, such as education and the gig economy,” Anuroopa Nataraj, senior research analyst with IDC’s Mobility and Consumer Device Trackers, said.

“However, competition from PCs and smartphones will continue to pose challenges, dampening the market outlook. Nevertheless, the integration of AI capabilities presents potential growth avenues, akin to other device categories,” Anuroopa Nataraj said.