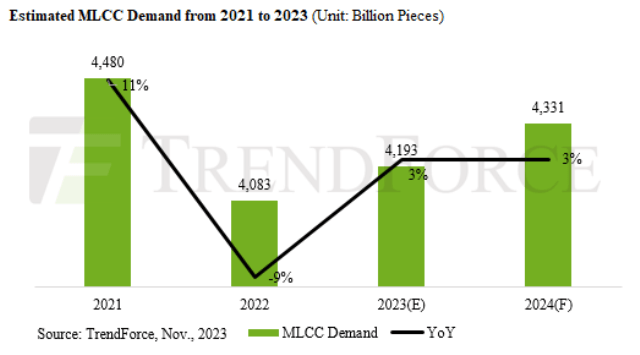

TrendForce’s recent report on Multilayer Ceramic Capacitors (MLCCs) anticipates a period of subdued growth spanning from 2023 to 2024, influenced by global economic uncertainties.

Projections indicate a modest 3 percent annual growth rate, estimating the demand for MLCCs at approximately 4.193 trillion units in 2023, with a slight uptick to 4.331 trillion units in 2024.

Factors Influencing Growth

The growth trajectory is primarily linked to MLCC applications in smartphones, automotive electronics, and PCs. Despite this, cautiousness prevails among Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs), leading to restrained expansion plans and a conservative outlook due to uncertain political and economic conditions.

Industry Response and Market Trends

OEMs, after a surge in third-quarter orders, have adopted a more cautious stance, impacting orders for ODMs as they prepare for the upcoming holiday season. Price negotiations for the first quarter of 2024 are underway, while suppliers are enforcing strict controls on production capacity and inventory levels due to lower-than-expected demand during the peak season and concerns over global economic weakness.

Although demand for smartphones, PCs, and notebooks is showing signs of improvement, overall consumer confidence remains fragile, hindering substantial industry growth.

Market Dynamics and Competing Strategies

MLCC shipments peaked at approximately 434 billion units in September, supported by increased demand from new smartphone models and related components. However, the gradual recovery lacks robust support from broader social and economic stability, resulting in a slower increase in consumer demand. November forecasts suggest a dip in MLCC demand to 405 billion units.

In response to market conditions, suppliers like Murata and Taiyo Yuden showcased strong performances in their third-quarter reports. Their strategic adjustments, coupled with Japan’s eased monetary policies, led to improved revenues and profits. Murata, in particular, plans aggressive pricing strategies for high-capacity and resistant products from 1Q24 onwards, aiming for substantial order acquisitions in 2024.

Competitors like Samsung and Yageo have slashed prices for high-end MLCC products, signaling intensified competition within the industry.

Future Prospects and Challenges

Given the expected slow growth, suppliers’ adaptability across various product applications and their financial resilience will be critical in navigating the challenges of 2024. The competitive landscape is evolving, with strategic pricing and product positioning expected to define success amidst moderate market expansion.